Governors siphoning mortgage settlement money: It’s disgusting

- Share via

As a news junkie and student of the human condition, it takes a lot to make my blood come to a full boil. It takes even more to make me sympathize with wealthy corporations. Hand it to Gov. Jerry Brown — he managed to pull off both feats with the news that he diverted more than $350 million from California’s share of the 2012 national mortgage settlement with the banking industry to reduce the state’s 2013 budget deficit.

Now that California is enjoying a budget surplus, a coalition of homeownership advocates and religious organizations has filed suit against the state to force Brown to restore the money.

Back in 2008-09, the real estate bubble burst, taking the global economy with it. By many measures, especially real unemployment and median wages, we still haven’t recovered.

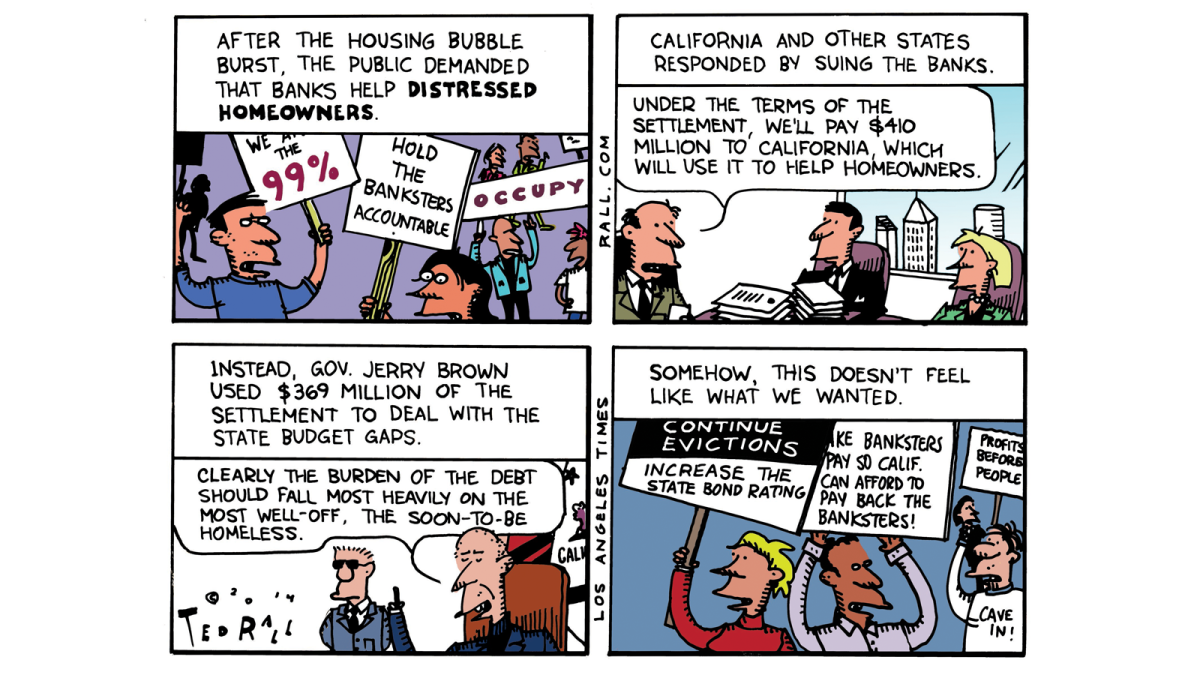

PHOTO GALLERY: Ted Rall cartoons

By 2010, a political consensus had formed. Though politicians were partly to blame, the worst offenders were the giant “too big to fail” banks that had knowingly approved loans to home-buyers who couldn’t afford to pay them back, sold bundles of junk mortgage derivatives to unsuspecting investors and secretly hedged their bets against their clients. After the house of cards came down, the banks played the other side. They cashed in their chips, refusing to refinance mortgages even though interest rates had fallen. They deployed “robo-signers” to illegally evict hundreds of thousands of homeowners — including people who had never missed a payment — and to ding them with outrageous late fees, while the banks profited from the subsequent foreclosures.

On the left, anger at the banks coalesced around the Occupy Wall Street movement. Though less widely reported, anti-bank sentiment also found a home in the tea party.

Politics ultimately play out in the courts. Lawsuits filed by state attorneys general forced the banks to the bargaining table. In 2012, they agreed to cough up $25 billion as penance.

The money was supposed to help people who had lost their homes, as well as helping those who were hanging on by a thread to avoid eviction, either by refinancing at lower rates or writing down principal to reflect lower real estate prices.

Enter the governors.

Brown wasn’t unique. Cash-hungry states siphoned off half of their share of the mortgage settlement to plug holes in their budgets.

We will never know how many families became homeless as a result.

The more you think about it, the more disgusting it is. Obviously it’s important for the state to get its fiscal house in order. But not at the expense of those least able to bear the burden. Desperate families lost — and are still losing — their homes so that holders of California’s state debt, much of it held by the same banks that caused the mortgage crisis, can be repaid.

This outrage is not without precedent.

Years earlier, states siphoned off 47% of the $7.9 billion they received from the 1998 tobacco settlement for general budget purposes instead of using it for anti-smoking and health campaigns they were supposed to launch.

How many kids might have been reached by tobacco education programs that never got off the ground? How many will die of lung cancer? “Fifteen years after the tobacco settlement, our latest report finds that states are continuing to spend only a minuscule portion of their tobacco revenues to fight tobacco use,” the Campaign for Tobacco-Free Kids said in 2014. “In Fiscal Year 2014, the states will collect $25 billion in revenue from the tobacco settlement and tobacco taxes, but will spend only 1.9% of it — $481.2 million — on programs to prevent kids from smoking and help smokers quit. This means the states are spending less than two cents of every dollar in tobacco revenue to fight tobacco use.”

This is the kind of behavior that prompts conservatives to characterize such settlements as government shakedowns of big business. It’s hard to disagree. As slimy as the banksters were and are — they’re sabotaging political solutions to the foreclosure crisis — they’re just the greedyheads doing what the greedyheads do. Public officials, on the other hand, are supposed to be on our side.

What Brown and his fellow governors have done with the mortgage settlement money is even more nauseating.

ALSO:

Is downtown L.A.’s Figueroa Corridor the next Silicon Valley?

March Madness: NCAA should stop exploiting student-athletes, pass a Bill of Rights

Ted Rall, who draws a weekly editorial cartoon cartoonist for The Times, is also a nationally syndicated opinion columnist and author. His new book is “Silk Road to Ruin: Why Central Asia is the New Middle East.” Follow Ted Rall on Twitter @TedRall.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.