Welcome to Essential Politics, our in-the-moment look at California political and government news.

Sign up for our free newsletter for analysis and more, and subscribe to the California Politics Podcast. Don’t miss our Essential Politics page in Sunday’s California section.

- Share via

L.A. billionaire Eli Broad donates $1.5 million to pro-charter school group supporting Villaraigosa for governor

Los Angeles billionaire and philanthropist Eli Broad donated $1.5 million on Thursday to a pro-charter school group supporting Antonio Villaraigosa’s candidacy for governor.

The contribution came one day after Netflix chief Reed Hastings donated $7 million to the same group, Families & Teachers for Antonio Villaraigosa for Governor 2018, which is sponsored by the California Charter Schools Assn. Advocates, according to the California secretary of state’s office.

Broad and Hastings are wealthy backers of the education-reform movement. Villaraigosa is the most prominent California Democrat to back the effort to reform traditional protections for teachers that are a key priority for teachers’ unions. His stance has made him a target of those unions and many other labor groups, in part because of his roots as a labor organizer.

It’s unclear what the independent expenditure group plans to do with the millions of dollars in donations, but it could boost Villaraigosa’s chances against Lt. Gov. Gavin Newsom, who leads in the polls and fundraising. Newsom is backed by the powerful California Teachers Assn. and other education unions.

The charter school association has previously been successful in local elections, notably last year when its efforts led to the first Los Angeles Unified School District board majority of elected officials with major pro-charter financial support.

- Share via

Petition drive to repeal California gas tax increase temporarily slows down

Paid signature-gatherers for a ballot measure that would repeal gas tax increases may be hard to find on the streets of California this week.

Organizers say it’s not a money issue, adding that they needed to briefly halt paid signature-gathering to catch up on collecting petitions from volunteers.

The petition drive has so far collected more than 327,800 verified signatures of the 587,407 needed to qualify the measure for the November ballot, according to Dave Gilliard, the political strategist behind the drive.

“We knew it was popular but the incredible pace is even faster than we expected so we outran the capacity of our verification operation over the Christmas holiday and told our crew managers to slow down so we could catch up,” Gilliard said. “We will be back up to speed by the end of this week.”

The gas tax and vehicle fee increases signed by Gov. Jerry Brown are expected to raise $5.2 billion annually for road and bridge repairs and expanded mass transit. The gas tax jumped from 18 cents to 30 cents per gallon on Nov. 1, and vehicle fees of at least $25 kicked in Jan. 1.

“The gas tax repeal petition is breaking records for both paid and volunteer signatures and we’re using the next two weeks to catch up on validation of signatures already received,” said Carl DeMaio, a former San Diego City Councilman and conservative radio talk-show host. “As a grass-roots-funded effort we are also continuously raising funds and volunteer support. We are highly confident we’ll qualify this Initiative for the November 2018 ballot.”

- Share via

State pot bureau ready to enforce California’s new marijuana laws as license applications flood in

The state has issued 104 licenses for retail stores to sell marijuana for recreational use in California and 239 other applications for those permits are pending, officials said Tuesday.

An official with the state Bureau of Cannabis Control added that the agency is prepared to begin taking enforcement action against pot shops that are not properly licensed.

“The bureau’s enforcement team is ready to respond to any complaints it receives and start doing compliance checks and site visits at any time,” said Alex Traverso, a spokesman for the bureau.

Selling marijuana without a license is a crime punishable by up to six months in county jail and a fine of up to $500. Those convicted of engaging in any marijuana business activity without a license will also be subject to a civil penalty of up to three times the amount of the license fee for each violation.

A new report issued Tuesday indicated the bureau has issued 478 temporary licenses to firms to test, distribute and sell medical and recreational marijuana, which began Jan. 1 after voters approved a legalization initiative, Proposition 64, in 2016. Businesses have received 153 licenses to sell marijuana for medical use.

Another 1,458 firms have applied for licenses that are still being processed.

The state Department of Food and Agriculture has separately issued 207 licenses to marijuana growers.

- Share via

Two possible instances of discrimination reported after California issues driver’s licenses to immigrants here illegally

The California Research Bureau on Tuesday released its first report on incidents of discrimination under a 2015 state law that has provided driver’s licenses for hundreds of thousands of immigrants here illegally.

Researchers found no complaints have been made against government agencies tasked with enforcing anti-discrimination laws. But two possible instances of discrimination were reported in focus group interviews conducted by Drive California, a coalition of advocates studying the impact of the new law.

In one case, a woman in Fresno was told her license was not a valid form of identification at a retail store, though it was unclear “whether the incident reflected intentional discrimination or simple ignorance of the license marking,” the report states.

A MoneyGram clerk in another case denied a license holder the ability to cash a check. The same person was later rejected again at a bank.

The state Department of Motor Vehicles has issued 960,000 AB 60 driver’s licenses as of Nov. 30. The state research bureau produced the report for the Legislature as part of the new law, which declares discrimination against an AB 60 license holder a violation of the Unruh Civil Rights Act.

- Share via

California lawmaker proposes requiring panic buttons for hotel workers in response to widespread sexual harassment

Alarmed by a survey indicating sexual harassment of hotel housekeepers is widespread, a California state lawmaker on Tuesday proposed requiring employers to provide “panic button” devices to their employees so they can summon help if abused by a guest.

The bill to be introduced Wednesday by Assemblyman Al Muratsuchi (D-Torrance) would also require individual hotels to impose a three-year ban on guests who engage in harassment on the property.

“We want to protect our most vulnerable women workers, hotel maids who are going into rooms alone, from sexual harassment,” said Muratsuchi, who co-authored the bill with Assemblyman Bill Quirk (D-Hayward).

The legislation signals that concerns over sexual harassment that dominated the state Legislature last year will continue to be an issue for lawmakers as they begin the new legislative year Wednesday.

Harassment allegations against Hollywood producer Harvey Weinstein, comedian Louis C.K. and other high-profile men have involved sexual misconduct in hotel rooms.

A survey in July by Unite Here Local 1 found that 49% of female hotel workers in Chicago had experienced a guest answering the door naked or exposing himself. The report titled “Hands Off, Pants On,” found 58% of hotel workers said they had been sexually harassed by a guest.

California’s Unite Here Local 11 has been calling for the action proposed in the legislation.

“It is the intent of this measure to protect hotel employees from violent assault, including sexual assault, and sexual harassment, and to enable those employees to speak out when they experience harassment on the job,” said the introduction to the legislation introduced by Muratsuchi.

In addition to requiring hotels to provide panic buttons to employees who work alone in rooms, the bill requires hotels to take written complaints from employees and keep them for five years. Any complaint backed by evidence including a statement given under penalty of perjury would result in a guest being banned from a hotel for three years.

Hotels would also be required to post a notice on the inside of hotel room doors warning guests about the consequences of sexual harassment.

Updated at 4:10 pm to include comment from Assemblyman Muratsuchi.

- Share via

Money, Republican malaise and Tom Steyer: These are the things to watch for in California’s 2018 statewide elections

Get ready, California. What had been a behind-the-scenes dash for cash closely watched by few other than political observers is about to burst into public view.

Voters this year will decide who will succeed Democrat Jerry Brown as the next governor and whether they will send Sen. Dianne Feinstein back to Washington.

Before the June 5 primary, candidates will ramp up their campaigns with messages on television and stuffed into mailboxes. Here’s a primer on the state’s two marquee races.

- Share via

This dispute over candidate endorsements is dividing the California Democratic Party

It’s up to a few thousand California Democratic Party delegates to decide whether the state party endorses candidates at its February convention in San Diego — a nod that could come with millions of dollars of support.

But this month, California Democratic Party Chairman Eric Bauman sent a letter to statewide candidates urging them not to seek the state party endorsement in February, prompting allegations that he was trying to silence dissenting voices. Bauman said his letter was simply meant to stave off disunity at the convention.

The dispute over endorsements is the latest battle between Bauman and those who backed his rival, Kimberly Ellis, in a bitter leadership contest in the spring that was decided by a handful of votes and resulted in a recount. Party delegates split into establishment and grass-roots factions, aligning themselves with Bauman and Ellis respectively, mirroring the divide among Democrats in deciding between Hillary Clinton and Bernie Sanders in the 2016 presidential primary.

- Share via

Fickle L.A. County is pivotal in the race for California governor

Home to a quarter of California’s 5.2 million registered voters, Los Angeles County is the biggest prize in California’s 2018 race for governor.

For two hometown Democratic candidates especially — former Los Angeles Mayor Antonio Villaraigosa and state Treasurer John Chiang of Torrance — doing well in L.A. County is essential if they hope to best the front-runner, Lt. Gov. Gavin Newsom.

Yet this overwhelmingly Democratic stronghold continually bedevils even the most adept campaigns.

- Share via

A renewed brawl over single-payer healthcare in California is on deck for 2018

California officials are bracing for healthcare battles in Washington to have a major impact on the state’s budget and programs. Activists and politicians are planning a showdown over whether or not to establish a single-payer healthcare system in the state. And prescription drug manufacturers are the target of a number of bills meant to target the rising costs of medication.

Sound familiar? Turns out the brewing healthcare battles in California in 2018 aren’t all that different from those from 2017.

Here’s a primer on the upcoming healthcare agenda in California:

- Share via

A guide to figuring out whether California will flip the House for Democrats this fall

Now that the year of the midterm election has arrived, the battles will start to pick up speed as Democrats try to reclaim control of the House.

The path to the 24 seats Democrats need passes through California — and that means they need to win at least a handful of the Republican seats they hope to flip.

As the contests take shape, we’re watching a few things to get a sense of what the 2018 election might bring.

- Share via

How California lawmakers plan to protect the online privacy of consumers in 2018

With federal regulation rollbacks and a rise in data breaches, California lawmakers this year are looking for ways to protect consumers and their personal information.

Some legislation under consideration could give people more notice and control over what data is collected, without having to pay for privacy or better services. Other bills could provide free credit freezes for consumers and require new privacy features for products that connect to the internet.

- Share via

2018 will see California motorists pay more to the state to repair roads and bridges

The new year brings with it new vehicle fees in California ranging from $25 to $175 depending on the value of your car, but Republican lawmakers are hoping to qualify a ballot measure in November to repeal the higher charges.

The fees and a 12-cent increase in California’s gas tax last year are part of a plan by Democrats to raise more than $5.2 billion annually to deal with a backlog of road and bridge repairs.

Petitions to qualify a repeal initiative are circulating now.

- Share via

A rent control battle tops the list of California housing issues to watch in 2018

California lawmakers aren’t wasting any time in tackling one of the most contentious issues in state housing politics this year.

On Jan. 11, the Assembly Housing and Community Development Committee is set to hold a hearing on legislation that could lead to a dramatic expansion of rent control policies across the state.

The debate over rent control could spill over onto the 2018 ballot, where Californians also could see proposals to expand or curtail the property tax restrictions ushered in 40 years ago by Proposition 13.

Lawmakers will have to wrestle with how to follow up a package of housing bills that passed last year. The measures provided new funding and regulations designed to encourage homebuilding, but are unlikely to make an appreciable difference in housing costs.

- Share via

6 things you probably didn’t know about the Californians in Congress

California’s 55 members of Congress make up the largest and most diverse delegation in the country.

From favorite movies to military commendations, check out our list of six things you may not know about them:

- Share via

Assemblyman Sebastian Ridley-Thomas is resigning

Assemblyman Sebastian Ridley-Thomas abruptly announced his resignation from the California Legislature on Wednesday, citing health reasons.

Ridley-Thomas, a Democrat from Los Angeles, informed Speaker Anthony Rendon (D-Paramount) Tuesday night.

“The reason for this difficult decision is that I am facing persistent health issues,” Ridley-Thomas, 30, said in a written statement on Wednesday. “On December 18th, I underwent surgery for the fifth time this year. Although I expect a full recovery, my physicians advise that I will need an extended period of time to recuperate.”

Earlier this year, Ridley-Thomas was absent from work for more than two weeks. Staff members initially said the absence was a personal leave, then said the time off was due to unspecified medical reasons. His resignation letter on Wednesday offered no additional details.

“When I resume public life, I intend to remain active in civic affairs, where my passion lies,” he said in the statement released by his office.

Ridley-Thomas was first elected to the Assembly in a 2013 special election. He is the son of Los Angeles County Supervisor Mark Ridley-Thomas. Before winning elected office at age 26, the younger Ridley-Thomas worked as an aide for Los Angeles City Councilman Curren Price and managed a 2012 Assembly campaign in San Bernardino County.

In a statement about his son’s decision, Mark Ridley-Thomas said he and his wife “more than anyone, have seen him struggle with health challenges this year, and we fully support his decision to step down from the state Legislature so that he can recuperate with complete rest, in accordance with his doctor’s orders.”

His solidly Democratic district includes the west Los Angeles neighborhoods of Westwood, Culver City, Crenshaw and Baldwin Hills. He is chairman of the influential Assembly Revenue and Taxation Committee, which oversees all tax-related legislation. Ridley-Thomas is a proponent of changes in the operation of the state Board of Equalization, though his plan would have allowed the agency to ultimately retain many of its duties. A more substantial shake-up was signed into law by Gov. Jerry Brown in June.

Ridley-Thomas was the author of a bill signed into law in October giving the Los Angeles Unified School District the power to preserve some of its existing single-gender schools. He was unsuccessful, though, in an effort to stop local governments from imposing taxes on streaming video services like Netflix and Hulu.

Ridley-Thomas’ departure will require a special election in 2018. He is the fourth Southern California legislator to leave office this year. The election of Rep. Jimmy Gomez (D-Los Angeles) to Congress also required a special election. The other two lawmakers— Assemblymen Raul Bocanegra (D-Pacoima) and Matt Dababneh (D-Woodland Hills) — stepped down in the wake of allegations of sexual misconduct, which both men have denied. A special election to fill Bocanegra’s seat will be held on April 3, with a potential runoff on June 5. A special election date has not yet been set for Dababneh’s seat.

“My colleagues and I wish Assemblymember Sebastian Ridley-Thomas all the best going forward as he deals with his health challenges,” Rendon said in a statement. “The Assembly will continue to assist the residents of the 54th Assembly District until a new assemblymember is seated.”

This post was updated with comment from Assembly Speaker Anthony Rendon and Los Angeles County Supervisor Mark Ridley-Thomas, as well as more information about special elections. It was originally published at 11:10 a.m.

- Share via

Former California Secretary of State March Fong Eu to be honored in Sacramento

- Share via

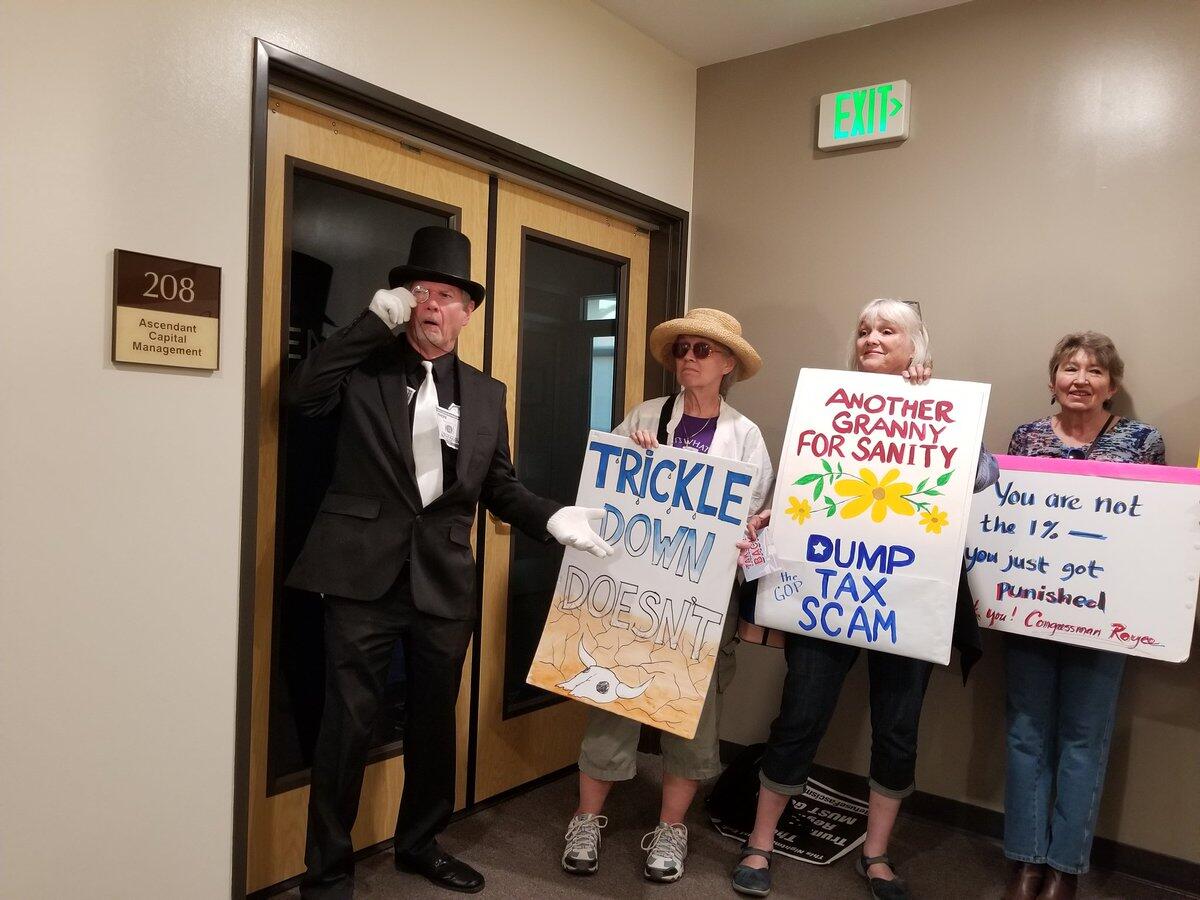

California Senate Democrats are considering some ideas to counter the GOP tax plan

Democrats in the California Senate are planning to write legislation to lessen the effects of the elimination of popular tax breaks in the GOP’s overhaul of the federal tax system.

To finance broad-based corporate tax cuts and reductions in individual tax rates, the GOP plan caps the deductibility of state and local income and property taxes — a benefit used often in suburban areas of California.

“The Republican tax scam disproportionately harms California taxpayers,” Senate President Pro Tem Kevin de León (D-Los Angeles) said in a statement. “Our hard-earned tax dollars should not be subject to double-taxation, especially not to line the pockets of the Trump family, hedge fund managers and private jet owners.”

De León, who also is running for U.S. Senate, said the state Senate is working with law professors at UCLA, UC Davis and the University of Chicago to develop the legislation.

Ideas being considered, according to a de León spokesman, include:

- Reducing state personal income taxes through a tax credit program and offsetting that amount through payroll taxes.

- Allowing individuals to make voluntary gifts to the state of California, which would be deductible as a charitable donation under federal law. The deduction for the donated amount would replace the state and local tax deduction.

Lawmakers return to Sacramento in January.

- Share via

L.A. Mayor Eric Garcetti admits considering a 2020 bid: ‘I am thinking about this’

It’s no secret Los Angeles Mayor Eric Garcetti is interested in running for president.

When reporters ask about his intentions, he has used all sorts of ways to deflect, typically by saying he’s focused on his day job — for the moment.

But speaking in Spanish to a Univision reporter this week, Garcetti edged ever closer to the telltale admission he’s actually considering it.

“I am thinking about this,” said Garcetti, who is partly of Mexican heritage but learned Spanish attending private school. “The majority of time goes to my work as mayor of Los Angeles, but every [citizen] should think about what our role is in these difficult times, in these dangerous times.”

Garcetti added that he expects many mayors to run for president, and noted New York City Mayor Bill de Blasio recently visited Iowa, which holds the first presidential nominating contest.

Garcetti has long been rumored to be flirting with a White House bid, and he has fueled such speculation by traveling out of state to places such as the early presidential primary state of New Hampshire to campaign for a mayoral candidate.

- Share via

Gov. Brown makes judicial appointments, including attorney who helps train Legislature on anti-sexual-harassment policies

- Share via

The California Housing Crisis Podcast’s predictions for 2018

After a big year in 2017, California’s housing affordability crisis is going to be another major topic in state politics.

On the 2018 docket, lawmakers will tackle rent control and voters statewide could see many housing-related ballot measures, including a $4-billion bond primarily to fund new low-income developments and potential major changes to Proposition 13’s property tax restrictions.

On this week’s Gimme Shelter: The California Housing Crisis Podcast, we debate all those topics, highlight the effects of the GOP federal tax plan on California housing and interview Amy Thoma Tan, who works in public affairs, about what it’s like to purchase a new home in Sacramento’s hot real estate market.

Gimme Shelter, a podcast covering why it’s so expensive to live in California and what the state can do about it, is recorded every two weeks and features Liam Dillon, who covers housing affordability issues out of the Los Angeles Times’ Sacramento bureau, and Matt Levin, data reporter for CalMatters.

- Share via

California’s former top cop forms marijuana distribution firm in new age of legalization

Former California Atty. Gen. Bill Lockyer is going from enforcing laws against marijuana to legally distributing the drug under the state’s new rules that allow the sale and possession of pot for recreational use.

With state-licensed sales of marijuana starting Jan. 1, Lockyer has co-founded a firm, C4 Distro, that will distribute packaged marijuana concentrates and edibles to stores in Los Angeles.

He says California’s new regulated system has a chance to be a model for the rest of the country.

“For me as somebody who was on the law enforcement side for so many years, I saw the inadequacies of the effort to regulate something just by calling it illegal,” Lockyer said. “I think legalizing will help stabilize and help legitimize this industry and result in better consumer protection and other public benefits.”

Lockyer, a Democrat who served in the state Assembly and was leader of the state Senate, has co-founded the firm with Eric Spitz, who was chairman and president of the former parent company of the Orange County Register.

The businessmen aim to get their products to pot shops in L.A. in late January or early February, Spitz said.

Asked if he uses marijuana himself, Lockyer, 76, said, “Not in any recent times, but there were college years.”

He said he sees his involvement in the marijuana industry as a mixture of helping to pay for his kids’ college tuition and public service to help the new regulations work. “This whole industry has to come from the dark side to the light,” he said.

By focusing on delivery to as many as 700 stores that might open in Los Angeles, C4 Distro hopes to capture a targeted market while other firms distribute statewide. The business has a warehouse in southeast Los Angeles County and is close to applying for a distributor’s license from the state, Lockyer said.

Lockyer served a quarter century in the state Legislature before he was elected as state attorney general in 1999. He left that office in 2007 when he was elected as state treasurer, serving until his retirement from politics in 2015.

Before co-leading a group that bought the Register newspaper in 2012, Spitz served as chief financial officer at Narragansett Brewing Company. Spitz left the Register’s Freedom Communications in 2016.

2 p.m.: An earlier version of this article mistakenly said Spitz left Freedom Communications in 2015.

- Share via

House passes disaster aid bill with wildfire funding, 18 Californians vote no

Eighteen of California’s 53 House members voted no on an $81-billion disaster aid package Thursday, which includes funds for California’s recent wildfires.

The 17 Democrats and one Republican voted no on the bill, which passed the House by a 251 to 169 vote.

The Senate is not expected to take up the bill until January, when Congress returns from its holiday break.

The entire California delegation had recently signed onto a letter asking for the disaster aid.

In a speech on the House floor before the vote, House Majority Leader Kevin McCarthy (R-Bakersfield) pleaded with colleagues not to take a political stance on a disaster aid bill.

“Don’t play politics on a vote to give aid to the people of Texas, to the people of Puerto Rico and to the Virgin Islands, to the people of Florida, and to the people of California that are still fighting the fires. Don’t play politics on a bill where you hope to maybe stop another. That would be the worst of any politics I’ve seen played here,” McCarthy said. “Here and now, right before Christmas, don’t vote against aid for Americans who just lost everything.”

Several of the Democrats who voted no also voted against the spending bill Thursday, and said that they felt they could not support either because the bills did not include Democratic priorities for the end of the year, including protections for people brought to the country illegally as children.

Others said the aid bill doesn’t provide enough money for California and doesn’t treat Puerto Rico and the Virgin Islands fairly in terms of competing for the funds.

The 18 representatives voting no were:

- Nanette Barragán (D-San Pedro)

- Karen Bass (D-Los Angeles)

- Tony Cardenas (D-Los Angeles)

- Judy Chu (D-Monterey Park)

- Lou Correa (D-Santa Ana)

- Anna Eshoo (D-Menlo Park)

- Jimmy Gomez (D-Los Angeles)

- Ro Khanna (D-Fremont)

- Barbara Lee (D-Oakland)

- Zoe Lofgren (D-San Jose)

- Tom McClintock (R-Elk Grove)

- Nancy Pelosi (D-San Francisco)

- Lucille Roybal-Allard (D-Downey)

- Linda Sanchez (D-Whittier)

- Jackie Speier (D-Hillsborough)

- Eric Swalwell (D-Dublin)

- Norma Torres (D-Pomona)

- Juan Vargas (D-San Diego)

- Share via

Three California House members cross party lines on spending bill to keep government open

Three California House members crossed party lines Thursday on a vote to pass a spending bill that will keep the government open until mid-January.

Democratic Reps. Jim Costa of Fresno and Raul Ruiz of Palm Desert joined the majority of Republicans to vote for the bill. Republican Rep. Duncan Hunter of Alpine joined Democrats to vote against it.

The bill, which funds the government through Jan. 19, passed the House 231 to 188, right before representatives left for the holidays.

Costa said in a statement that he voted yes because keeping the government open is Congress’ job, but he called the vote “a continuation of the dysfunction in Washington.”

“It further illustrates the damage that results from partisan politics and irresponsible leadership. It is unacceptable that we have to resort to funding the government for weeks at a time because we cannot sit down together — Democrats and Republicans — and negotiate a real budget bill,” Costa said.

Hunter’s staff said the congressman was concerned that military spending in the bill was extended for only a short period. He had wanted the spending to be extended until September.

- Share via

Poll points to all-Democrat runoffs in California races for governor and senator

Californians could see two Democrat-on-Democrat contests in the state’s premier races in 2018, according to a new poll released Thursday.

In the gubernatorial race, Lt. Gov. Gavin Newsom remains the front-runner with the support of 26% of likely voters in a Berkeley IGS poll. Former Los Angeles Mayor Antonio Villaraigosa came in second with the backing of 17%.

The poll found notable demographic differences in the two men’s bases of support. Newsom had strong leads in the Bay Area, where he once served as the mayor of San Francisco, as well as among white voters, liberals and the wealthy. Villaraigosa saw strong backing in Los Angeles County, among Latino voters and among those who earned less than $40,000.

Republicans splintered in the race, placing businessman John Cox and Assemblyman Travis Allen in a tie for third place with 9% each. Two other Democrats, state Treasurer John Chiang and former state schools chief Delaine Eastin, each won the support of 5% of likely voters.

If Republicans fail to consolidate behind a candidate in the June primary, voters will for the first time see no GOP candidate on the November ballot for governor.

It’s a repeat of what occurred in the 2016 U.S. Senate race, and what is likely to occur again in the 2018 U.S. Senate race if the field does not grow.

Sen. Dianne Feinstein has the support of 41% of likely voters in her reelection bid, but her rival, fellow Democrat Kevin de León, won the support of 27%, according to the poll. There is no GOP candidate in the race.

Feinstein, who has served in the Senate for a quarter-century, has enormous advantages in fundraising, name recognition and support among powerful political groups.

However, the poll found that nearly one-third of likely voters said they are undecided or would like to support another candidate.

- Share via

Sen. Dianne Feinstein says she will not back must-pass spending bill without fixes for ‘Dreamers’ and children’s healthcare

In a surprising reversal, California Sen. Dianne Feinstein announced Thursday that she will not vote for an end-of-year spending bill that does not include protections for people brought to the country illegally as children as well as funding for a children’s health insurance program.

“It’s absolutely unconscionable that Republicans are leaving these items out of their bill to fund the government,” she said in a statement Thursday.

Earlier this week, the Democrat said she would vote for the bill, which must be passed in order to keep the government open past Friday.

Feinstein’s reversal is largely symbolic because the Senate likely still has enough Democratic votes to pass a temporary spending bill and push off a deal for so-called Dreamers until the new year.

Feinstein had been facing pressure from advocates and one of her 2018 opponents for refusing to block the bill if it didn’t include protections for Dreamers, who had benefited from the Deferred Action for Childhood Arrivals program that President Trump ended in September. About a quarter of the nearly 800,000 so-called Dreamers live in California, and almost 2 million California children and pregnant women use the Children’s Health Insurance Program, which the state government says is expected to run out of money next month.

“I’ve talked with them, I’ve met with them, I understand their plight and it breaks my heart. In California, 200,000 DACA youth are living in fear. The government knows where they live, where they study and where they work, and unless Congress acts, they know the government can show up at any moment and deport them,” Feinstein said.

Protesters had flooded Feinstein’s California and Washington offices in recent days.

Some on the left in California have questioned whether Feinstein is too moderate for a state that feels it’s under attack by the new administration. Her most prominent 2018 opponent, Democratic state Senate leader Kevin de León, has tried to capitalize on her reluctance to block the spending bill.

An Institute of Governmental Studies at UC Berkeley poll released Thursday found Feinstein leading De León 41% to 27% among likely voters, with 32% of respondents saying they were undecided or would support another candidate. House Democrats who have pushed to block the spending bill in order to get a deal for Dreamers by the end of the year praised Feinstein.

Rep. Nanette Barragán of San Pedro, whose cousin is among the Dreamers anxiously waiting a resolution, said she spoke twice with Feinstein on Thursday morning.

“It was a really good conversation, and to see her take a stand and say “I’m with you guys’… is great to see,” Barragán said.

Congressional Asian Pacific American Caucus Chairwoman Judy Chu (D-Monterey Park) said she’s glad Feinstein took a stand.

“It sends a powerful message, and it shows that we can be even more unified on holding the line on Dreamers and the [spending bill],” she said.

Read MoreFOR THE RECORD

12:49 p.m. The poll was of likely voters, this post initially stated it was of registered voters.

UPDATE

11:26 a.m.: This post has been updated with reaction from the California congressional delegation.

This post was originally published at 10:07 a.m.

- Share via

California legislator wants to curb sexual harassment in Hollywood and eating disorders for models

A new proposal by a California assemblyman is taking aim at two of the more criticized phenomena in the entertainment industry: sexual harassment and unhealthy body standards for fashion models.

The legislation, by Assemblyman Marc Levine (D-San Rafael), would require the state’s Occupational Safety and Health Standards to adopt guidelines for fashion models in an attempt to combat the prevalence of eating disorders and excessive thinness in the industry.

This is the second time Levine has tried to take on the fashion industry. His similar bill to impose standards on models sputtered in 2016.

This time, Levine also is trying to address the prevalence of sexual harassment in the entertainment industry by requiring that talent agencies — which represent actors, performers and other artists — provide training on sexual harassment and how to identify and prevent inappropriate behavior.

“I believed women who told me their stories of abuse when I introduced legislation to provide workplace protections in the fashion industry in 2016 just like I believe them now,” Levine said in a statement. “It’s time that law reflects society’s rejection of sexual harassment in all workplaces, including Hollywood. My bill aims to address the problem before it starts, but also empowers survivors with the tools to report these cases.”

- Share via

Local Indivisible group picks Democrat to endorse against Rep. Duncan Hunter

With an already crowded field of contenders hoping to unseat Rep. Duncan Hunter and months to go before the candidate filing deadline, one local activist group has made an early endorsement in the race.

Indivisible CA50, made up of activists mostly in San Diego County, announced Thursday that it’s endorsing Ammar Campa-Najjar, a Democrat and public affairs consultant who’s challenging Hunter.

The endorsement comes as liberal activists and interest groups all over the state are grappling with whether — and how — to winnow down the dozens of candidates vying for 10 GOP-held seats in California.

The group held more than half a dozen endorsement meetings to allow members throughout Hunter’s district to vote on their preferred candidate. One of the candidates, Pierre Beauregard, dropped out of the race recently and endorsed Campa-Najjar.

In a statement Campa-Najjar said in a statement that the nod “represents the enthusiasm of hundreds of progressive grassroots activists.”

Indivisible’s national political director Maria Urbina said the endorsement was the first made by any California chapter in the 2018 midterms.

Aside from Campa-Najjar, two other Democrats are running for Hunter’s seat: Josh Butner, a school board trustee and former Navy SEAL, and realtor Patrick Malloy, who ran last year and lost to Hunter by nearly 27 percentage points.

Hunter will also face at least two GOP challengers: Shamus Sayed and Andrew Zelt. Hunter is not considered to be particularly vulnerable in next year’s election, but an investigation into his alleged misuse of campaign funds has caused at least one election handicapper to move his race from “solid Republican” to the “likely Republican” column.

- Share via

San Francisco is getting a new mayor and creating a political star. Who will it be?

San Francisco is the city everyone loves, even if they hate it.

The stately Victorians, like a gingerbread dream come to life. The majestic Golden Gate Bridge, standing like heaven’s portal above the fog. The plucky cable cars, scrabbling up its impossible hillsides.

It can almost make you forget the bands of ravaged homeless, the paralyzing traffic, the scent of human waste wafting from sidewalks outside the city’s posh eateries and palatial tech headquarters.

San Francisco is getting a new mayor, owing to the sudden death of incumbent Ed Lee. All of the grandeur, and all of the grit, accompany the position.

To say the race is wide open — Lee having died just about a week ago — is an understatement.

- Share via

Sen. Dianne Feinstein is under pressure over a fix for ‘Dreamers’

California Sen. Dianne Feinstein is under pressure from activists and fellow Democrats to withhold support for a spending bill that would avert a government shutdown in exchange for protections for people brought to the country illegally as children.

Feinstein said in October that protections for so-called Dreamers are “the most important thing we can get done,” but the senator known for her moderate bent said this week that she won’t try to block the end-of-the-year spending bill over it, and has not offered an explanation.

Dreamers this week flooded Feinstein’s five California offices and her office on Capitol Hill. Two UCLA students refused to leave her Capitol Hill office after three hours Tuesday and were briefly detained by police. On Wednesday, about a dozen students and parents returned and were asked to leave after about 30 minutes of shouting in her office lobby.

- Share via

Emily’s List endorses woman running against Rep. Darrell Issa

National abortion rights behemoth Emily’s List has made its next choice among California’s vast array of Democratic congressional challengers.

The group announced Thursday it’s endorsing Democrat Sara Jacobs, a former policy advisor for Hillary Clinton’s presidential campaign who most recently served as CEO of a New York nonprofit.

Jacobs, 28, is also the granddaughter of Qualcomm founder Irwin Jacobs and is the only woman so far to enter the race for Rep. Darrell Issa’s seat.

In a statement, Emily’s List president Stephanie Schriock called Jacobs a “passionate, energetic leader” who will “deliver a fresh, new approach to government that creates economic opportunity and works for Southern California families.”

Emily’s List included Issa in a list of seven GOP members in California that they’re looking to unseat next year. So far, the group has backed pro-abortion-rights female candidates in four of them.

Issa is considered by many election observers to be the most vulnerable congressional incumbent. He won his reelection campaign by just 1,621 votes last year against Democrat Doug Applegate, who is also running this year. In addition to Applegate and Issa, Jacobs will face Democrats Mike Levin and Paul Kerr.

- Share via

The GOP tax plan passed. Now Democrats have another big issue to use in the midterms

As GOP leaders in Congress met behind closed doors to hash out the details of their massive tax overhaul, a group of UC Irvine graduate students met in Rep. Mimi Walters’ district, fretting about how the plan could cost them money.

About 20 miles north, dozens of activists in top hats stood outside Rep. Ed Royce’s Brea office as they chanted, “Shame on you!”

And up in the Central Valley, protesters gathered outside Rep. Jeff Denham’s Modesto office to sing “Protest ye dreary congressman … Remember that he voted to take healthcare away. To save himself from taxes now, so you will have to pay.’

- Share via

Kevin de León to Feinstein: ‘Don’t come back’ to California without forcing a government shutdown over Dream Act

Taking direct criticism to the woman he is attempting to unseat in next year’s U.S. Senate race, California Senate leader Kevin de León on Wednesday urged Democrats to block a year-end spending bill as leverage to pass a Dream Act — “clean” of GOP demands for increased border security.

At a news conference in downtown Los Angeles, De León commended Sen. Kamala Harris for pledging to block the measure, saying he could not understand why her colleague Sen. Dianne Feinstein had failed to take a similar stance in pushing for legislation to protect the so-called Dreamers, immigrants brought to the country illegally as children.

“Dreamers make up hundreds of thousands of Sen. Feinstein’s constituents, and while talking a good game on Dreamers, when it comes to standing up and supporting them, she is AWOL,” said De León (D-Los Angeles), who has attempted to position himself to Feinstein’s left as he campaigns for her seat.

His statements follow days of demonstrations by young protesters at legislators’ offices in Washington and California. The coalitions of activists have been calling on Democrats to hold up the spending bill, a move that could force a government shutdown. They want to pass Dream Act legislation that would provide protections and a path to citizenship to young people without legal residency in the U.S.

At least two young protesters were arrested Tuesday outside of Feinstein’s Capitol Hill office, and more demonstrations took place at her offices in Washington and San Francisco on Wednesday.

Feinstein, House Minority Leader Nancy Pelosi (D-San Francisco) and Senate Minority Leader Charles E. Schumer (D-N.Y.) have sponsored Dream Act legislation but have not pledged to hold up the spending deal. A separate bipartisan group of senators is advocating punting the issue to January. President Trump has asked Congress to come up with a solution by March.

Standing next to De León and immigrant rights advocates on Wednesday, state Assemblyman Miguel Santiago (D-Los Angeles) said advocates had “to double down the shame on any Democrat” who thinks it’s time to wait on the issue.

De León said they had made that message clear to Schumer, saying, “It is time to find your spine, sir.” To Pelosi and Feinstein, he said: “Don’t come back to California if you haven’t demonstrated your leadership and your courage to stand up for these young men and women.”

“I can tell you this,” De León said. “If the Republicans were on the other side, they wouldn’t hesitate for a nanosecond to shut down the government to move forward what they believe in.”

- Share via

Rep. Zoe Lofgren loses race to lead Democrats on Judiciary Committee

Rep. Zoe Lofgren (D-San Jose) lost a vote Tuesday to become the highest-ranking Democrat on the House Judiciary Committee.

The House Democratic Caucus, by a 118-72 tally, instead picked Rep. Jerry Nadler (D-N.Y.) to replace outgoing Rep. John Conyers Jr.

Conyers (D-Mich.) recently agreed to step down amid sexual harassment allegations.

Lofgren, a former immigration lawyer serving her 12th term, was the third-most-senior Democrat on the committee. But when Conyers announced he was stepping down after 23 years as the panel’s senior Democrat, she made it clear that she didn’t intend to yield to Nadler, the second-most-senior Democrat on the committee.

Being the highest-ranking member of the minority party on a committee doesn’t hold much power. However, if Democrats win control of the House in 2018, the ranking member of the Judiciary Committee would take over leadership of the panel, which would be tasked with considering impeachment charges against President Trump if they are brought forward.

- Share via

12 California Republicans vote to support tax overhaul for a second time; Rohrabacher and Issa say no

The House gave final approval for the GOP tax bill Wednesday, with 12 Republicans in the state delegation again voting in favor of the bill.

Reps. Dana Rohrabacher of Costa Mesa and Darrell Issa of Vista voted no.

The House and Senate both passed the bill Tuesday, but, because Democrats raised procedural objections that forced the bill to be changed in the Senate, the House had to vote on the bill again Wednesday before sending it to President Trump for his signature.

Though many California taxpayers are expected to see an initial income tax cut under the plan, a significant number probably will have higher taxes because of the lost deductions. Analysts also expect the biggest cuts to flow to corporations and the state’s wealthiest residents.

Republicans are expected to head to the White House later Wednesday for a celebration with Trump.

No House Democrats, including the 39 from California, supported the bill. Rep. Grace Napolitano (D-Norwalk) was not present for the second vote, but she voted no on Tuesday.

See the Republican votes here:

- Share via

California’s Democratic senators vote no on GOP tax bill

- Share via

GOP tax overhaul passes House with help from a dozen California Republicans

Despite weeks of consternation from some California House Republicans, a dozen of them joined their colleagues to pass an overhaul of the U.S. tax code Tuesday. Two — Reps. Darrell Issa and Dana Rohrabacher — voted against the plan.

In the weeks before the vote, Republican Reps. Mimi Walters of Irvine and Steve Knight of Palmdale cited new caps on popular deductions as reasons they were uncertain about whether to vote for the bill. Both worked behind the scenes on changes and ultimately supported the bill, which passed the House on a near party line vote 227-203.

Knight said he’s satisfied the changes are enough to to turn what would have been a tax increase into a tax cut for his constituents.

- Share via

More than half of Californians oppose GOP tax bill, according to new poll

More than half of Californians oppose the GOP tax bill expected to be approved by Congress today, and just 20% believe it will have a positive affect on their families, according to a poll released Monday.

Just over half of California voters, 51%, oppose the tax bill, and 30% support it, according to the newest IGS Poll, a survey by the Institute of Governmental Studies at UC Berkeley.

And the belief falls largely along party lines, with Democrats opposing the bill by a more than 4-to-1 (67% to 15%) margin and Republicans supporting it 3 to 1 (60% to 21%).

The House and Senate are expected to vote on the tax bill Tuesday. California’s Republican members of Congress largely support the bill despite some concerns about how cuts to the state and local tax deduction and mortgage interest deduction might affect Californians. Democrats in the delegation oppose it and have said they will use the vote against vulnerable Republicans in the 2018 midterm elections.

When asked about the impact they think the bill will have on themselves and their families, just 20% of the poll’s respondents said they think it will benefit them directly, while 40% foresee a negative impact. About 27% do not expect much of an impact, and 13% said they don’t know if they’ll be affected.

The poll of a random sample of 1,000 registered voters was completed by telephone in English and Spanish from Dec. 7 to 16.

- Share via

A quick look at some of the biggest tax changes for Californians

Congressional Republicans are framing their tax cut bill as a Christmas gift that will give Americans an average tax cut of $2,059. For Californians, especially in the wealthier areas along the coast, the situation isn’t as clear-cut.

When the measure comes up for a vote in the House on Tuesday morning, it’s expected to pass along party lines. At least two Republicans say they will join Democrats in the California delegation to oppose the plan because they fear it will hurt their constituents’ bottom line.

Take a quick look at what some of the biggest changes in the tax bill might mean for average Californians.

- Share via

Lawmakers, pot growers say California’s marijuana cultivation rules favor big corporate farms

California’s new rules allowing marijuana cultivation favor large corporate farms despite a promise in Proposition 64 that small growers would be protected, according to a group of state lawmakers and marijuana industry leaders who called Monday for the policy to be changed.

The California Department of Food and Agriculture issued emergency rules last month that allow for small and medium-sized farms of up to a quarter acre and one acre, respectively, to get licenses for the first five years. That five-year head start for small farms was promised in Proposition 64, the initiative approved last year by voters that legalized growing and selling marijuana for recreational use.

Individuals and businesses can get only one license for a medium-sized farm, but the new rules do not set a limit on how many small-farm licenses can be obtained by one person or business.

That could allow a corporation to assemble a 20-acre farm by obtaining 80 licenses for a quarter-acre each, opponents worry.

Democratic state Sens. Scott Wiener of San Francisco and Mike McGuire of Healdsburg, Assemblyman Jim Wood (D-Healdsburg) and the California Growers Assn. asked for swift action by the state agricultural department to change the rule.

“This is clearly a broken promise,” McGuire said. “For two years, every discussion has included a cap on cannabis grows and the Department of Food and Agriculture needs to fix this massive loophole they have created. This last-minute revision rolls out the red carpet for large corporations to crush the livelihood of small family farmers.”

With cultivation licenses set to take effect next month, the lawmakers also promised legislative hearings on why the rules were drafted to disadvantage small, mom-and-pop farms.

“California only has one chance to get this right, and it is already on the wrong path with this last-minute change that flies in the face of what the backers of Prop. 64 promised,” said Hezekiah Allen, executive director of the California Growers Assn. “This single decision will hand over the California marketplace to multinational corporations and a wealthy few at the expense of thousands of growers who are ready to play by the rules and provide economic opportunity in communities that until recently were criminalized or — at the very least — marginalized.”

The industry estimates there are about 3,500 independent growers on track to get a state license in the first half of 2018. Allen’s group estimates that number could grow to as many as 10,000 or 15,000 by the end of 2020, but not if large corporate farms are allowed in early.

The agricultural agency issued a response later: “A one-acre canopy limit has not been in proposed regulations at any point and was not included in the emergency regulations due to the fact that Proposition 64, the law guiding the process, did not provide authority to include it. However, local jurisdictions may impose that limitation on their own if it meets the needs of their constituents.”

Updated at 5:10 pm to include comment from agricultural agency.

- Share via

Gov. Jerry Brown takes to social media to criticize Republican ‘tax monstrosity’

- Share via

Rep. Grace Napolitano’s husband, Frank Napolitano, dies after battle with cancer

Rep. Grace Napolitano’s husband, Frank Napolitano, died Friday at their home in Norwalk after a battle with cancer.

The former restaurateur was 90, and had undergone chemotherapy and radiation to treat esophageal cancer over the summer.

“The congresswoman loved Frank dearly and is immensely saddened by his passing. He was a devoted husband, father, grandfather, and great-grandfather,” her office said in a statement.

The couple was married in the early 1980s after the death of Napolitano’s first husband, with whom she had five children.

The congresswoman, a Democrat, will return to Washington for this week’s vote on a tax code overhaul.

She said in April that she planned to seek reelection next year, though her husband’s health problems prompted The Times to keep the congresswoman on its retirement watch list.

- Share via

Final tax bill dramatically softens blow to mortgage interest deductions in California

Last-minute changes to the Republican-led tax overhaul seem to be tailor-made to entice support from California GOP lawmakers, several of whom voted against a previous version passed in the House last month.

The House version, passed with the support of all but three California Republicans, had proposed capping the mortgage interest deduction at loans of $500,000 or less. Republicans in high-tax, expensive states had voiced concerns the bill would have major effects in their districts.

But the final version of the bill dramatically slashed the percentage of new mortgages that would be affected if the package becomes law.

*New mortgages over $500,000 include data through Sept. 2017. New mortgages over $750,000 include data through Oct. 2017.

Source: Times analysis of data provided by CoreLogic

The particulars of the mortgage interest provision and other popular deductions were major sticking points as House and Senate negotiators hammered out a compromise between the two versions.

A previous Times analysis showed that more than half of new mortgages this year in Rep. Dana Rohrabacher’s coastal Orange County district exceeded the $500,000 cap laid out in the House version. Text of the new bill released Friday outlined a cap of $750,000, which would apply to just under a quarter of new mortgages there through October 2017. Rohrabacher was one of three California Republicans, along with Reps. Darrell Issa (R-Vista) and Tom McClintock (R-Elk Grove) who previously voted against the measure.

Rep. Mimi Walters (R-Irvine) said she supported the House version after receiving assurances from leaders that the bill would be changed to account for the loss of deductions, The percentage of new mortgages over the cap dropped from 48% to 14%.

Rep. David Valadao (R-Hanford), whose district had 1% of mortgages exceeding the $500,000 cap proposed previously, saw that share drop almost to zero; 27 of 7,515 mortgages in his congressional district this year have been for more than $750,000.

The House is expected to vote on the final tax bill Tuesday.

- Share via

California Politics Podcast: The state Senate hires new help for sexual misconduct investigations

Leaders of the California Senate have taken the first big step in changing the way sexual misconduct investigations are handled, though few would argue the real work has yet to begin.

On this week’s California Politics Podcast episode, we discuss the decision to hire two outside law firms to handle all investigations involving staffers or members of the Senate — a decision that some of the women demanding change says still needs to lead to a single new policy embraced by both houses of the Legislature.

We also discuss the legacy of San Francisco Mayor Ed Lee, whose death last week marks the end of an important era in the city. It also means new statewide attention for the woman who’s now stepped into his role.

- Share via

A major change to Proposition 13 takes its first step toward the 2018 ballot

Proponents of making a dramatic change to California’s landmark Proposition 13 property tax restrictions took their first step to getting a measure on the November 2018 statewide ballot Friday.

The change would allow the state to receive more tax dollars from commercial and industrial properties by assessing them at their current market value, an effort known as “split roll” because existing tax protections on homes would remain in place.

Advocates of the measure, including the League of Women Voters of California and community organizing nonprofits California Calls and PICO Network said the change could raise billions of dollars that could be spent on public schools and community colleges.

“I think the cumulative effects of the unfair tax system have gotten to the point where it’s created crippling economic impacts on the state,” said Melissa Breach, executive director of the League of Women Voters of California.

Backers filed their proposed initiative Friday. The attorney general’s office will prepare an official title and summary for the measure and it will receive a financial analysis. From there, advocates will decide if they will collect signatures to put the measure on the ballot.

Proposition 13 passed in 1978 amid concerns that rising property taxes could force people out of their homes. The ballot measure limited property taxes to 1% of a property’s value at the time of purchase and ensures that the assessed value on which taxes are based can only increase by a maximum of 2% a year — no matter how much a property’s market value goes up.

Split-roll measures have been long debated in state politics, but business groups and anti-tax groups have expressed substantial opposition to the idea, arguing that it would cause major harm to the state’s business climate.

Breach said she expected “an avalanche of big money” against the measure should it go forward, but said that her organization wouldn’t get involved without believing it could raise sufficient funding.S

For the record

1 p.m., Dec. 18: An earlier version of this post said the “split roll” ballot measure would allow California to charge higher tax rates on commercial and industrial properties. It would allow the state to assess those properties at current market value, not charge higher rates.

- Share via

Three more women accuse California assemblyman of sexual misconduct

A Los Angeles woman has filed a police report alleging Democratic Assemblyman Matt Dababneh had sex with her without consent four years ago, adding new allegations of sexual misconduct to those that led the politician to announce his resignation last week. He says her claims are false.

Nancy Miret, 26, told The Times that when she was 22 and a recent college graduate, she spent time with Dababneh over two months in late 2013, primarily at his Encino apartment.

At the time, Dababneh was running for Assembly to represent the western San Fernando Valley. They had consensual sex on one occasion, but after that, Miret said she had multiple nonconsensual sexual encounters with Dababneh that left her traumatized. Miret, who now works in commercial real estate, is one of three women interviewed by The Times who have made new allegations concerning Dababneh’s behavior.

“These allegations are false and I’m confident that when all the facts are in, it will clearly show that these claims are not true,” Dababneh told The Times.

- Share via

San Diego business is first in California to be issued license to sell marijuana for recreational use

A San Diego medical marijuana business is the first firm to be issued a license by the state of California to sell marijuana for recreational use, officials said Thursday.

Torrey Holistics received two of the first 20 licenses granted by the state Bureau of Cannabis Control this week to sell or distribute marijuana, although the licenses do not take effect until Jan. 1, according to bureau chief Lori Ajax.

An additional 180 firms have applied for licenses but they are being processed.

“Last week, we officially launched our online licensing system, and today we’re pleased to issue the first group of temporary licenses to cannabis businesses that fall under the Bureau’s jurisdiction,” Ajax said in a statement. “We plan to issue many more before January 1.”

The bureau is issuing temporary, four-month licenses to firms initially, but will eventually require firms to undergo background checks and pay a $1,000 application fee for yearlong permits.

Tony Hall left a chemical distribution business two years ago to start Torrey Holistics with a friend and classmate at San Diego State. He said he was ecstatic to have the first recreational permit in California. He also obtained a new license to continue selling marijuana for medical uses.

“We feel fricking great about it,” he said Thursday. “It’s just exciting. This is a once in a multi-generational event,” he added, likening it to the end of prohibition.

Added Ruthie Edelson, the firm’s marketing director, “We will be open at 7 a.m. on Jan. 1.”

Last year, voters approved Proposition 64, which makes California one of eight states that allow the growing and sale of marijuana for recreational uses.

- Share via

Conservative activist group files a lawsuit over Los Angeles County ‘inactive voter’ list

A Washington-based conservative-leaning activist group filed a federal lawsuit Wednesday alleging Los Angeles County officials are “refusing to cancel the registrations” of voters who are ineligible to cast a ballot.

The legal action by Judicial Watch comes four months after the organization first accused elections officials across the state of maintaining registration lists that are larger than their voting-age population. The lawsuit also names Secretary of State Alex Padilla as a defendant and alleges the voter lists violate the National Voter Registration Act, or NVRA.

“They don’t care about removing ineligible registration,” said Robert Popper of Judicial Watch. “I think we have a very strong lawsuit.”

The lawsuit names four Los Angeles County voters as co-plaintiffs and asserts that a county’s two lists of voters — the file of active voters and those whose registration has been placed on “inactive” status — should be combined into a single total.

The inactive list includes people who haven’t cast ballots in recent elections and haven’t responded to inquiries from elections officials. Though the names on that list are considered voters, they are not counted in official registration reports and are not mailed election material.

Popper led an effort earlier this year to estimate the size of each county’s voting-age population using the Census Bureau’s American Community Survey. He said the survey’s five-year average of county populations was then adjusted by focusing just on the estimate of those over the age of 18, and then comparing that with the combined active and inactive voter lists.

Popper dismissed any concern that the resulting number might be skewed by the different standards used by counties for the inactive list, which could include names of voters who moved or died and thus be an imperfect guide.

“I believe that a court is going to accept our numbers,” he said.

Dean Logan, the registrar of voters in Los Angeles County, said his staff’s practices are consistent with federal law. “This lawsuit appears to fundamentally interpret the requirements of the NVRA in a manner inconsistent with ensuring voter enfranchisement and appropriate list maintenance,” he said.

The lawsuit also alleges that Los Angeles elections officials failed to provide Judicial Watch with requested data about the size of the inactive list, and accuses Padilla of failing to address the group’s concerns about California not following NVRA rules.

In a statement on Thursday, Padilla said county inactive-voter files are not out of compliance with the law. He criticized Judicial Watch for its “baseless assertions, bad math, and flawed methodology.”

Local elections officials have said very few “inactive” voters show up on election day, and that any who do would be asked to cast a provisional ballot — one that isn’t counted unless the voter’s eligibility is confirmed through additional review. Popper insisted that if the list is never used, there’s no reason to keep it.

Judicial Watch, which sued for access to Hillary Clinton’s emails in 2016, alleged that its calculations show 11 California counties with questionable voter registration totals.

- Share via

Voters in California GOP districts may get calls asking them to thank their member of Congress for tax plan

Voters in four key Republican-held congressional districts could get a robocall starting Friday urging them to call and thank their member of Congress for supporting the tax bill.

It’s a last minute effort by American Action Network, a politically active nonprofit connected with House Speaker Paul D. Ryan (R-Wis.) that has spent millions to shore up Republican support for the bill. The robocalls include the member’s office number.

The four California members being targeted are Reps. Jeff Denham of Turlock, David Valadao of Hanford, Steve Knight of Palmdale and Mimi Walters of Irvine. All four represent districts that backed Hillary Clinton for president in 2016 and are Democratic targets in 2018.

Knight and Walters had been particularly vocal about their concerns with the plan, saying it might raise taxes for their constituents. The final text of the bill is set to be released Friday, with a vote expected early next week.

In total, American Action Network plans to place 1 million robocalls in 29 districts nationwide.

- Share via

‘Merry Christmas Republicans in Congress’: Funny or Die video goes after California lawmakers over DACA

As members of Congress try to pass a controversial tax bill and a measure to keep the federal government funded, the political arm of the Congressional Hispanic Caucus is hitting Republicans hard over another unresolved issue: the legal status of hundreds of thousands of people brought to the country illegally as children who could face deportation if lawmakers don’t act.

Amid negotiations over a long-term spending bill, Democratic leaders have been pushing their GOP colleagues to include a fix for those who were granted temporary protection under President Obama’s Deferred Action for Childhood Arrivals, known as DACA. President Trump announced an end to the program earlier this year and gave Congress a March deadline to address it.

Funny or Die and BOLD PAC released a video Friday featuring comedians skewering GOP members, including two in California, for their inaction.

In the video, Oscar Nuñez, best known for his role on “The Office,” calls out Reps. Steve Knight (Palmdale), Ed Royce (Fullerton), Carlos Curbelo (Florida) and John Culberson (Texas), who “get to go ahead and celebrate as thousands of Dreamers are banished from the only country they’ve ever called home.”

“How many broken promises can fit in a stocking?” Nuñez asks later. “I’m asking for a congressman.”

The political action committee says it’s spending six figures on the weeklong buy, which will go out nationwide across Funny Or Die’s social media channels. They are known for blasting out irreverent, often viral parodies that play to young audiences.

The video will also be targeted to constituents in each of the four congressional districts. A separate video released by the ACLU last week also urged members of Congress to strike a deal on DACA.

Many California Republicans have remained mum on the issue, particularly those facing tough races in 2018. So far, only Reps. David Valadao (Hanford), Jeff Denham (Turlock) and Mimi Walters (Irvine) have pressured fellow Republicans to come up with a solution before Congress breaks for Christmas.

Following Trump’s decision, Knight said the issue should “receive attention by Congress.” Royce, who has taken hard-line stances on immigration in the past, urged his colleagues to provide a “permanent, legislative solution that gives certainty to these kids.” Neither elaborated on what that solution should be.

- Share via

For a prominent California consumer group and savvy political consultants, documents reveal a close financial relationship

If there’s a clear mantra for Consumer Watchdog, one of California’s most visible and vocal advocacy groups, it’s that hidden financial relationships shouldn’t shape politics and public policy.

The Santa Monica-based nonprofit has spent more than three decades reprimanding politicians and interest groups for doing the bidding of those who give them money. Its official motto is “expose, confront, change.”

“We are loud, and we speak more of a populist truth than the way people usually talk to each other in Sacramento,” said Jamie Court, Consumer Watchdog’s president.

- Share via

Regional director resigns from California Democratic Party amid sexual misconduct claims

A regional director with the California Democratic Party submitted his resignation on Thursday, nearly two weeks after a 23-year-old woman reported that he sexually assaulted her last year, spurring party leaders to seek his ouster.

Craig Cheslog served as Region 2 director spanning the East Bay, Napa, Sonoma and the Clearlake areas. In a statement, his lawyer, Mary P. Carey, said she and her client were “confident that a full and fair exploration of this matter, undertaken in an appropriate, fact-governed venue, would exonerate Mr. Cheslog.”

“We are prepared, if necessary, to put forward the facts of this matter in just such a venue,” she said.

Democratic Party Chairman Eric Bauman and other officials initially called for Cheslog’s removal in a Nov. 29 letter to state party secretary Jenny Bach. They said he was seen acting “in an inappropriate and sexually aggressive manner” toward a member of the party in a public area of the Westin San Francisco Airport Hotel, following a Nov. 18 executive board meeting.

“The level to which this activity advanced made a number of those in attendance uncomfortable,” the letter stated. It added that another member reported “that Mr. Cheslog raped her at a CDP executive board meeting the previous year.”

Party officers said the incident occurred during a weekend where the prevention of sexual harassment of women in politics was a dominant theme in the wake of the #metoo movement. Before the meeting’s conclusion on Sunday, the California Women’s Caucus approved a resolution making clear that sexual harassment, bullying and other forms of abuse are grounds to lose endorsements and be stripped of party membership.

Maddy Dean, who was not named in the letter, spoke at the meeting about her experiences of sexual harassment in the movie industry, and told the Times that she reported Cheslog. She said she could not provide further details about her allegation as she explores possible legal paths moving forward.

“This was about protecting other women and in particular other young women,” she said of reporting the assault.

In his own letter to Bach on Thursday, Cheslog did not acknowledge any wrongdoing. He said he was stepping down to prevent any personal misconduct allegations “from creating a distraction with the party at a critical moment in national and state politics.”

“I am confident of the results that would be forthcoming in a fair, fact-based exploration of this matter,” he said.

Since the report, Cheslog has been fired from his job at Common Sense Media, a nonprofit organization that helps families navigate media and technology. He also has stepped down from his position on the Acalanes Union High School District Board of Trustees.

“The conduct represented a serious violation of both company policy and the way in which our employees are expected to conduct themselves in the community at large,” Common Sense spokeswoman Corbie Kiernan said in a statement. “We immediately suspended Mr. Cheslog and conducted an investigation. As a result of the investigation, Mr. Cheslog’s employment with Common Sense was terminated.”

4:05 p.m.: This post was updated with Cheslog’s resignation from the school board.

- Share via

Sen. Bob Hertzberg will cooperate with investigation into unwanted hugs

State Sen. Bob Hertzberg (D-Los Angeles) said Thursday he will cooperate with a state investigation into complaints from a former legislator that she was uncomfortable with his repeated hugs after she asked him not to touch her.

Senate President Pro Tem Kevin de León said Thursday that a team of outside attorneys will investigate a complaint by former Assemblywoman Linda Halderman that Hertzberg has made her uncomfortable with hugs that were too close and lasted too long.

Hertzberg, well-known for hugging other lawmakers, said he supports having any allegations investigated by the two outside law firms.

“I just learned of the investigation, and will fully cooperate,” he said. “The use of an independent third party investigator is essential to improving transparency and trust in the system.”

Halderman said Thursday she was encouraged that her concerns will be investigated, but said it was “disturbing “ that attorneys for one of the law firms selected, Gibson, Dunn and Crutcher, contributed more than $90,000 in campaign funds to sitting legislators including Hertzberg.

Halderman, a surgeon, served in the state Assembly from 2010 through 2012 and said Hertzberg hugged her multiple times even after she asked him to stop because she was uncomfortable. The last incident occurred in a hallway of the Capitol, she claimed.

“I told him I don’t care to be hugged. ‘Don’t touch me,’ ” Halderman recalled. “He then grabbed me and pinned my arms to my side and used his hands to press my lower back into his groin and he essentially pinned me so I couldn’t push off of him to get away the way I ended previous hugs.”

“It was certainly so over the line,” she added.

Halderman said a current female senator and assemblywoman also have complained about inappropriate hugs from Hertzberg.

However,

Sen. Cathleen Galgiani (D-Stockton) defended Hertzberg, saying she has known him for many years and he has always acted as a “gentleman.”

“I have never felt uncomfortable with him, and have always felt his hugs were a display of affection - which I appreciate,” she said. “I consider him a dear friend.”

Updated at 5:30 pm to include comment from Sen. Galgiani.

- Share via

California regulators sign off on the state’s ambitious 2030 climate change plan

California climate regulators on Thursday approved a detailed plan for the state to meet its 2030 carbon reduction goals.

The effort, known formally as the “scoping plan,” details the state’s strategies for reducing greenhouse gas emissions 40% below 1990 levels over the next 13 years as a way to fight climate change.

Mary Nichols, chairwoman of the California Air Resources Board, called the plan “a visionary look at the longer term and deeper kinds of transformations that we’ll need to stabilize our climate.”

“This is a major step forward,” she said.

To meet the 2030 goals, which were approved by the state Legislature in 2016, regulators plan to rely on implementing goals set in other recently passed legislation, including:

- Generating half the state’s electricity from renewable sources by 2030.

- Cutting methane and other highly polluting emissions.

- Improving air quality.

- Reducing the amount of carbon in gasoline.

- Increasing the sustainability of trucks and other heavy-duty vehicles.

- Boosting housing development near job centers and transit to reduce driving.

- Continuing cap and trade, the market-based program requiring polluters to pay for their emissions.

- Share via

Rep. Maxine Waters asks Justice Department to investigate fake letter tweeted by Republican opponent

Rep. Maxine Waters is asking the Justice Department to look into a fake letter posted to Twitter by her Republican challenger that falsely indicated the congresswoman wants to resettle tens of thousand of refugees in her Los Angeles district.

The GOP candidate, Omar Navarro, posted the letter on what looks like official House of Representatives letterhead to Twitter on Monday. The letter, which purports to be from the congresswoman, says the congresswoman wants to bring refugees to her congressional district after the 2018 election “and perhaps even once I have secured the Speaker of the House position.”

Navarro accompanied the tweeted letter with a message: “According to this document, Maxine Waters wants more terrorists, like the one who bombed NYC, in California’s 43rd District. As Congressman of CA’s 43rd District, I will oppose such policies.”

It’s been retweeted more than 680 times. But the letter is “a forgery and a fake,” her chief of staff, Twaun Samuel, said in a news release.

The letter, dated June of this year, also contains several inaccuracies. It references multiple committees and subcommittees Waters does not serve on, and lists an address for a district office that has been closed for nearly a decade.

Waters filed a complaint about the tweeted letter with the House general counsel, who forwarded the complaint to the U.S. Attorney for the Central District of California and the fraud section of the Criminal Division for the United States Department of Justice.

The complaint states that Waters has not communicated with the letter’s purported addressee — Teri Williams, who is president and chief operating officer of the Los Angeles-based OneUnited Bank, about any refugee resettlement program.

Impersonating a federal official and misusing a federal seal are federal crimes.

Navarro, who is backed by big name far-right conservatives, said Thursday that the letter was sent to his campaign through Facebook by a person he didn’t know. He said neither the Justice Department or Waters’ staff has asked him about the letter.