Gov. Jerry Brown doubles down on California measure changing recall process, calling it ‘eminently reasonable’

The partisan volleys have continued this week in the effort to recall state Sen. Josh Newman (D-Fullerton) over his vote to pass an increase in the gas tax. Those seeking to recall Newman submitted more than enough signatures needed to qualify the measure for the ballot, if they’re all deemed valid.

Newman supporters looking to halt the recall filed a lawsuit Thursday, claiming signature gatherers had misled voters. And Gov. Jerry Brown signed a bill that makes changes to long-standing recall rules, an effort that Republicans have decried as an attempt by Democrats to “rig the system” to protect one of their own.

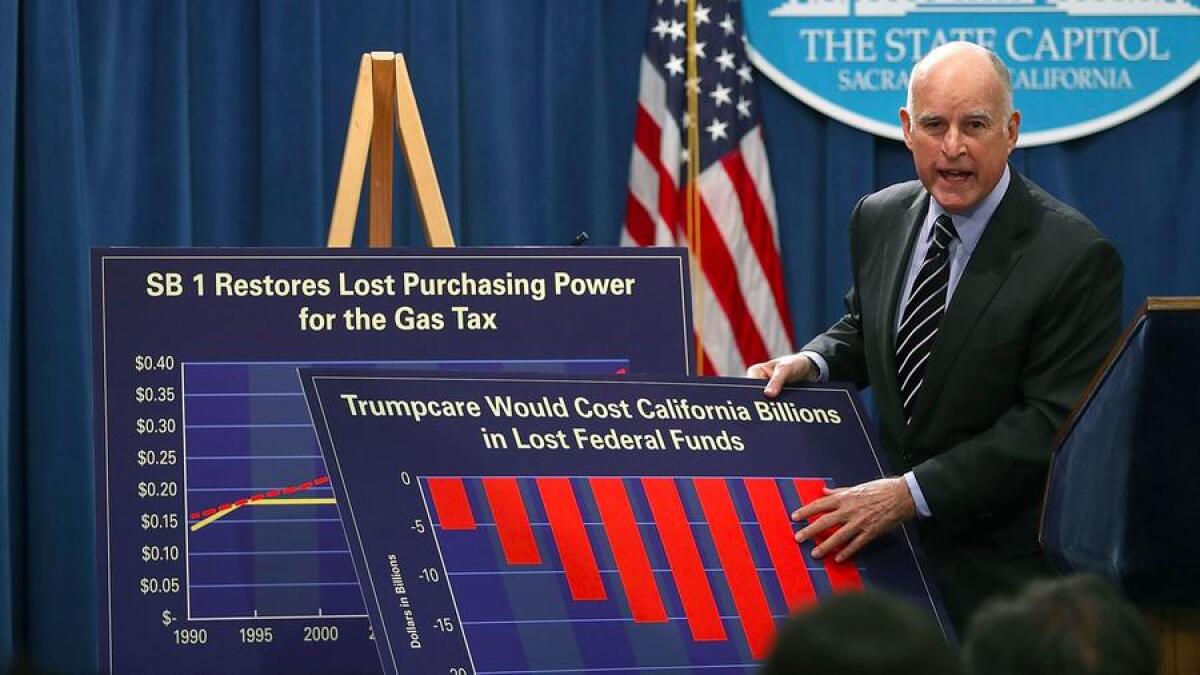

Brown seemed to double down on that measure Friday at a press conference at Cal State Dominguez Hills, where he discussed the new gas tax, calling the new recall process “eminently reasonable.”

The measure allows voters up to 30 days to remove their signature from a recall petition and creates a new process to review costs associated with a recall election. Brown said the bill provides an opportunity for “people who have been hoodwinked” to change their mind.

“It’s all about truth and giving people the opportunity to make sure that their vote and their signature is knowingly given,” Brown. “The only people who would be against that are people who wanted to fool people and don’t want to test it in court or in the light of day.”

Brown’s comments came after a roundtable discussion in which he and state Sen. Steven Bradford (D-Compton) spoke about the importance of directing transportation dollars raised by the gas tax increase to businesses owned by women, minorities and people who are disabled. Brown cast it as part of a larger question of equality and opportunity in America.

But the discussion took place even as Brown mused about efforts to repeal the controversial tax package, which is expected to raise $52 billion over 10 years for road repairs and other transportation projects.

“If people want to not fund the roads, then they can put something on the ballot and maybe change things,” Brown said. “But I think most people in California want to fix the roads.”

Assemblyman Travis Allen (R-Huntington Beach), who is running for governor, has filed a ballot measure to repeal the gas tax.

Brown dismissed a recent poll by the Institute of Governmental Studies at UC Berkeley, which said that a majority of registered voters oppose the gas tax increases Brown and legislators recently approved.

“That was a poll that said, ‘Do you want to raise a tax?’” Brown said. “Of course people are going to say no.”

Brown added that when voters are given “concrete situations” like education and roads, they’re more likely to support tax increases.

“I think Californians are always leery of taxes. I’m leery of taxes,” Brown said. “You want to drive around on gravel roads? I’ve got a gravel road out in front of my house in the country. It’s not bad. But I don’t think that’s what people want. I think they want real, paved roads — and to have paved roads you’ve got to spend real money.”

Times staff writer Patrick McGreevy contributed to this report.

San Diego Mayor Kevin Faulconer says he won’t run for governor, dashing hopes of GOP leaders

Republican San Diego Mayor Kevin Faulconer, who has been lobbied intensely by GOP leaders to run for California governor, on Friday rejected the idea and vowed to serve out his second term at city hall.

Both House Majority Leader Kevin McCarthy (R-Bakersfield) and state Republican Party Chairman Jim Brulte had urged Faulconer to run.

A fiscal conservative and social moderate who has demonstrated crossover appeal by winning over Democrats, Faulconer has been seen as the GOP’s strongest potential gubernatorial candidate, and one who could help Republicans in down-ballot races if he was at the top of the ticket in 2018. But Falconer nixed the idea of a gubernatorial bid in a Facebook post Friday afternoon, saying he was “deeply honored” by “so many” encouraging him to run.

“It’s a testament to the people of San Diego, and the progress we’ve made to create a fiscally responsible, prosperous city that is moving in the right direction. I made a pledge last year to serve out my second term as mayor, and that’s exactly what I’m going to do,” Faulconer said in the post.

He was facing pressure to enter the race and GOP insiders who were familiar with his thinking believed he was leaning toward running.

Faulconer ultimately decided not to run because he did not see a certain path to victory, according to a top state party official who did not want to be identified because they were not authorized to speak for the San Diego mayor.

The last time a GOP candidate won a statewide race was in 2006.

The governor’s race already has attracted a handful of Republican candidates, but none with Faulconer’s political stature. They include conservative Orange County Assemblyman Travis Allen and Rancho Santa Fe venture capitalist John Cox. Speculation is mounting that former state Assemblyman David Hadley plans to announce a run.

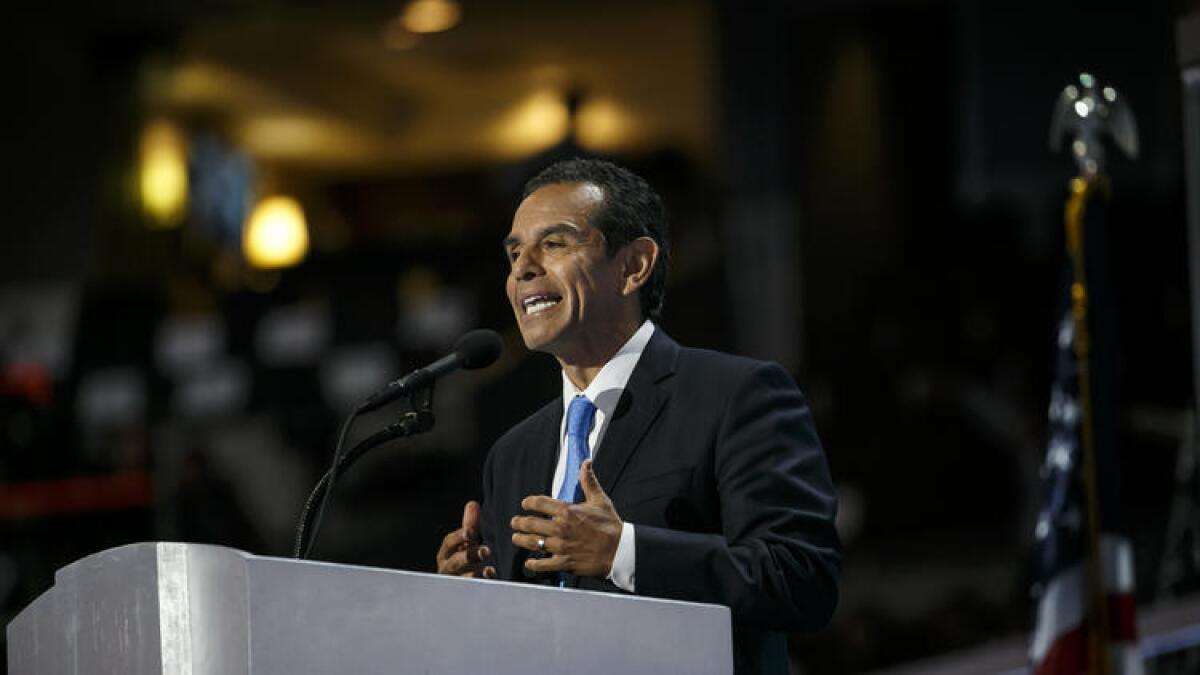

The Democratic heavyweights in the race include Lt. Gov. Gavin Newsom, former Los Angeles Mayor Antonio Villaraigosa and state Treasurer John Chiang.

A strong GOP top-of-the-ticket candidate would be expected to increase Republican turnout next fall. Faulconer’s decision not to run could impact some hotly contested congressional races in California, and potentially affect Republican efforts to retain control of the House of Representatives.

If a Republican gubernatorial candidate fails to make the general election, creating a Democrat-on-Democrat race in November 2018, that could depress GOP turnout and affect those targeted congressional races.

“It leaves the Republicans without an obvious front-runner that the donors would have confidence in,” said GOP strategist Rob Stutzman, who previously advised former Gov. Arnold Schwarzenegger and 2010 GOP nominee Meg Whitman. But “it still depends on the nature of the race next November. It’s too early to say.”

Update 4:21 p.m.: This story was updated with reaction about Faulconer’s decision and more information about the 2018 election.

This story was originally published at 3:30 p.m.

Assembly Democrats denounce threats made after single-payer healthcare bill was sidelined

Lt. Gov. Gavin Newsom blasts National Rifle Assn. recruitment video, saying it could lead to violence

Gubernatorial candidate Gavin Newsom called on the National Rifle Assn. to take down a controversial new video that he argued villanizes political rivals and could lead to violence.

“Come after politicians. Come after policy makers. Come after ME,” Newsom wrote on his Facebook page Thursday. But “do not implicitly call for demonstrations of force against your fellow Americans in a country that is already reeling. You are powerful. People are listening to you. And your message could lead to tragedy.”

The NRA video, which urges people to join the organization, was posted earlier this month and features conservative commentator Dana Loesch talking about political rivals who she argues use the media, schools and Hollywood for sinister purposes.

The video features footage of police clashing with protesters and a bloodied Trump supporter, and flashes images such as the Hollywood sign, Disney Hall and the Los Angeles Times building as Loesch repeatedly invokes an unnamed opponent she refers to as “they.”

Loesch’s concluding remarks in the minute-long video have drawn the most ire.

“The only way we stop this, the only way we save our country and our freedom, is to fight this violence of lies with the clenched fist of truth,” Loesch said. “I’m the National Rifle Assn. of America, and I’m freedom’s safest place.”

Newsom is a longtime foe of the NRA. He was a primary sponsor of Proposition 63, a ballot measure voters approved in November that requires background checks to purchase ammunition, bans possession of high-capacity magazines and other gun-safety efforts.

On Thursday, the NRA claimed victory when a federal judge, at their attorney’s request, granted a preliminary injunction blocking a related law that would have required Californians to get rid of large-capacity magazines by Saturday or face fines and potential jail time.

Newsom, the state’s lieutenant governor, wrote that he felt a “chill down my spine” when he watched the video.

He said while he and the NRA have long disagreed, the video crosses the line of appropriate political debate. He described it as “dangerous” because it tells viewers “that our fellow Americans are to be feared … and even worse.”

“How does this video advance debate? How does it bring people together for common ideals? How does it do anything but cast Americans as ‘enemies’ to be defeated in a cynical ploy to sell as many weapons as possible?” he wrote.

Tired of exporting campaign cash, these politicos are putting California first

California feeds the world with its bounty, fuels the economy with its innovation, fires the imagination with its creativity.

There is one export, though, that is far less celebrated: the unceasing torrent of outbound campaign cash.

For political fundraisers, California has long been the Big Rock Candy Mountain, excavated, mined and, ultimately, shafted by candidates of both parties who use the boodle to run for president in Iowa or New Hampshire, or Congress in East Podunk.

Now, Democratic efforts are underway to put California first, directing more campaign cash from whence it came by focusing on seven targeted House districts in the Central Valley and southern part of the state.

Federal judge blocks California gun law

A federal judge Thursday granted a request by attorneys for the National Rifle Assn. to block a law that requires Californians to dispose of large-capacity ammunition magazines by Saturday or face fines and possible jail time.

U.S. District Judge Roger T. Benitez wrote in San Diego that the rights of voters who approved Proposition 63 in November have to be balanced against the rights of gun owners.

“If this injunction does not issue, hundreds of thousands, if not millions, of otherwise law-abiding citizens will have an untenable choice: become an outlaw or dispossess one’s self of lawfully acquired property,” Benitez wrote. “That is a choice they should not have to make.”

C.D. Michel, an attorney for the NRA and state gun owners, welcomed the decision, which allows a lawsuit to be decided on its merits before the law takes effect.

“My clients are pleased the Court affirmed that the Second Amendment is not a second class right, and that law abiding gun owners have a right to choose to have these magazines to help them defend themselves and their families,” Michel said in a statement.

Two California Democrats join with House Republicans to vote for ‘Kate’s Law’

There would be tougher penalties for people repeatedly caught crossing the border illegally, and millions of dollars less in federal funds for so-called sanctuary jurisdictions such as Los Angeles under two House immigration bills approved Thursday.

Both bills would fulfill President Trump’s campaign promises if they became law, but the Senate has killed similar legislation and is unlikely to be able to reach the 60-vote requirement to pass the bills.

The House voted 257 to 167, with 24 Democrats crossing party lines, to pass “Kate’s Law,” which would create harsher mandatory minimum prison sentences for people who repeatedly enter the U.S. illegally.

It is named after Kathryn Steinle, who allegedly was shot and killed in San Francisco in 2015 by Juan Francisco Lopez-Sanchez, a Mexican immigrant who had repeatedly entered the country illegally and was released from jail by sheriff’s officials despite a request by immigration officials to keep him behind bars.

Two California Democrats, Reps. Jackie Speier of Hillsborough and Eric Swalwell of Dublin, joined Republicans in voting for the bill.

Swalwell grew up with Steinle and is still in touch with her family, he said.

“This bill is not perfect, and it’s shameful that the Republicans did not allow any debate…. But it does improve our ability to punish individuals who repeatedly break the law and to deter those who may do so,” he Swalwell said in a statement.

Volkswagen submits revised plan for installing charging stations as part of emission-cheating settlement

Volkswagen would build more electric vehicle charging stations in disadvantaged communities under an updated plan being submitted to state regulators on Thursday.

The company’s subsidiary, Electrify America, revised its proposal after an earlier version was rejected as inadequate by the California Air Resources Board.

The proposal is the first phase of an $800-million investment in the state, one piece of a much larger settlement over Volkswagen’s cheating on vehicle emission rules.

Although the money is expected to yield hundreds of new charging stations and boost California’s efforts to foster the market for electric cars, it’s also been a source of controversy.

State regulators want 35% of the money to be spent in disadvantaged communities, a target endorsed by the Legislature as well. Electrify America CEO Mark McNabb said, “We will strive hard to hit it.”

The updated plan adds Fresno to the list of metropolitan areas, which already included Los Angeles and Sacramento, where charging stations would be installed.

“It made sense to get out into the Central Valley,” McNabb said. “We thought that was an improvement we could make to the plan.”

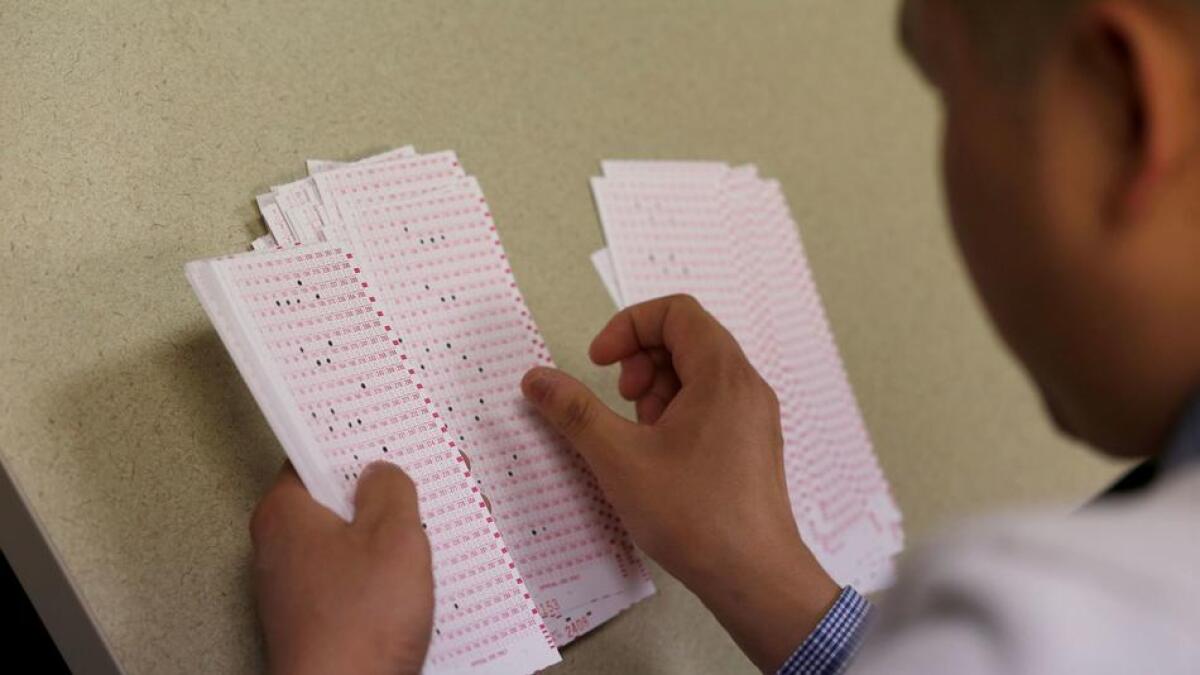

California’s top elections officer to Trump’s voting fraud panel: No

President Trump’s voter fraud commission will not be getting the names and addresses of California’s registered voters. The panel’s request was denied on Thursday by Secretary of State Alex Padilla, who said it would only “legitimize” false claims of massive election cheating last fall.

Padilla refused to hand over data, including the names, addresses, political party and voting history of California’s 19.4 million voters. Kris Kobach, the secretary of state of Kansas who serves as vice chairman of the Presidential Advisory Commission on Election Integrity, sent letters to all 50 states on Wednesday for information he said would help the group examine rules that either “enhance or undermine the American people’s confidence in the integrity of federal elections processes.”

Padilla, though, suggested the effort is little more than a ruse.

“I will not provide sensitive voter information to a commission that has already inaccurately passed judgment that millions of Californians voted illegally,” he said in a written statement. “California’s participation would only serve to legitimize the false and already debunked claims of massive voter fraud made by the President, the Vice President, and Mr. Kobach.”

Last November, Trump tweeted that California was one of three states where “serious voter fraud” took place in the general election. No state or local elections official has found any evidence to back up the president’s assertion.

Kobach’s request says the panel seeks only “publicly available” information. Basic information about California voters is routinely shared with journalists, political campaigns and researchers after a written request and payment of a fee.

The letter asks for data including “information regarding any felony convictions, information regarding voter registration in another state, information regarding military status, and overseas citizen information.”

Padilla also criticized the selection of Kobach to help lead Trump’s commission, accusing the Kansas official of past efforts at racial profiling and suppressing voter turnout.

“His role as vice chair is proof that the ultimate goal of the commission is to enact policies that will result in the disenfranchisement of American citizens,” Padilla said.

The presidential commission’s first meeting is scheduled for July 19.

Supporters of state Sen. Josh Newman sue to stop effort to recall him, alleging voters have been misled

Supporters of state Sen. Josh Newman filed a lawsuit Thursday seeking to stop a recall campaign against the lawmaker, alleging that signature gatherers have misled voters and the petition contains false information.

The Democratic legislator from Fullerton faces a recall funded by the California Republican Party for voting with other lawmakers to increase the state’s gas tax and vehicle fees to raise $5.2 billion annually for road repairs.

On Tuesday, the state party announced it had submitted 84,988 signatures to election officials, some 20,000 more signatures than would be needed if officials determine they are valid.

The lawsuit against Secretary of State Alex Padilla was filed in Sacramento Superior Court by three residents of Newman’s Senate district and paid for by the campaign against the recall. It alleges that signature gatherers misled voters to sign the petitions by saying they would repeal the car tax.

The “petition gathering campaign has misrepresented the nature of the petition by informing voters that it will ‘Stop the Gas Tax’ when it will not,” the lawsuit says. “These statements are intentionally misleading statements of fact that are false beyond dispute and mislead voters…”

The legal complaint, which also names several signature gatherers, alleges that the notice of intent to file the petition is inaccurate in saying that the tax bill provides billions of dollars for mass transit in Northern California without Newman’s district benefiting from the revenue. The bill itself does not earmark where money will go, but the intent of lawmakers was that Newman’s district would benefit, the lawsuit says.

The lawsuit asks that the circulation of the petition be stopped and the recall effort, using the petition as drafted, be halted.

“This suit is about nothing less than the integrity of our election process; a recall election simply should not be certified when signatures were gathered based on lies to voters,” said James Harrison, an attorney who filed the lawsuit.

Former San Diego City Councilman Carl DeMaio, an organizer of the recall, said the lawsuit is without merit.

“Josh Newman refuses to accept accountability for his disastrous vote to raise the car and gas tax and instead has chosen to blame others for the recall against him with lies and frivolous lawsuits,” DeMaio said.

State to pay $2.9 million to three men wrongfully convicted in Los Angeles cases

The state Senate has approved payment of $2.96 million to settle three claims by men who were wrongly convicted for crimes in Los Angeles and served time in prison before they were exonerated.

The approval of the payments, amounting to $140 for each day served behind bars, next goes to Gov. Jerry Brown.

The largest payment — $1.7 million — goes to Kash Delano Register, who said he was wrongfully convicted of a 1979 murder because of a flawed LAPD investigation.

He served 34 years in prison. In 2013, the Los Angeles County Superior Court ordered that Register be released from prison after it found he had been denied due process of law and a fair trial because material exculpatory information and evidence was not disclosed.

The court acted after lawyers and students from Loyola Law School cast doubt on the testimony of a key prosecution witness.

The Los Angeles County district attorney’s office later dismissed the charges, and Register was found by the court to be factually innocent.

The Senate payment for 12,427 days served in custody is in addition to a $16.7-million settlement paid to Register by the city of Los Angeles.

The Senate also voted Thursday to pay $886,760 to Luis Vargas, who spent more than 17 years in custody before a court ruled him factually innocent of a 1998 rape.

In 2012, DNA evidence from one of the victims showed that a suspect known as the “Teardrop Rapist,” not Vargas, was the perpetrator of the rape.

The third payment, $340,620, goes to Reggie Cole, who was found factually innocent after serving time in prison for the shooting death of a man outside a South Los Angeles house of prostitution in 1995.

Public affairs strategist Fiona Hutton hosts fundraiser for Antonio Villaraigosa

Los Angeles public affairs strategist Fiona Hutton is hosting a San Fernando Valley fundraiser for Democratic gubernatorial candidate Antonio Villaraigosa in July.

Hutton, who has worked on a number of statewide campaigns, also raised money for Villaraigosa during his successful campaign for mayor of Los Angeles in 2005.

The July 25 fundraiser is being held at Hutton’s office in Studio City. Tickets run $1,000 apiece. To be a “co-host,” it’ll cost $10,000.

Along with serving as president of her company, Fiona Hutton & Associates, Hutton sits on the board of directors of the Los Angeles Area Chamber of Commerce.

California joins other states asking the Trump administration for information on how it’s enforcing immigration law

A group of nine state attorneys general, including California Atty. Gen. Xavier Becerra, filed a Freedom of Information Act request with the Department of Homeland Security on Thursday seeking records that would clarify how the Trump administration is enforcing federal immigration law.

The request seeks the number of immigration detentions, deportations and detainer requests, and the rationale for each, as well as clarifying information on whether Trump is following through on comments that he will not target young people who were brought to the country illegally by their parents.

The attorneys general also want to know whether immigrants in the country illegally have been detained at schools, hospitals and places of worship, which the state officials feel should be off-limits for enforcement.

“Mixed messages from the Trump Administration on immigration enforcement are sowing confusion and increasing anxiety among immigrants,” Becerra said in a statement. “Today we ask the Administration to tell us what it is doing in this area.”

The data could be used in a barrage of legal challenges the states have filed against federal immigration policies.

Becerra noted that immigration-related arrests have increased nearly 40% since Trump became president, and there is concern that some of the arrests have included young people who were given a deferral from deportation under the Obama administration.

“The President’s Executive Orders, and the steps taken by the Department of Homeland Security to implement those orders, have generated new fears and uncertainties in immigrant communities across the country,” the attorneys general wrote in the request for information.

The other states represented in the request are New York, Illinois, Washington, Massachusetts, Iowa, Maryland, Oregon and Hawaii.

This is why California’s Legislature can’t fix the state’s housing problems

For 50 years, California has had a law that aims to encourage developers to build housing.

But the law has failed at helping stem the statewide shortage of homes that drives California’s affordability problems. The reason? The law requires cities and counties to produce prodigious reports to plan for housing — but it doesn’t hold them accountable for any resulting home building.

Cities and counties resent the law. To avoid complying, they’ve asked the state to let prison beds count toward their low-income housing goals, among other things. And despite knowing about the law’s weaknesses for decades, state lawmakers have provided no incentive, such as a greater share of tax dollars, for cities and counties to meet their housing goals.

California’s attorney general joins the fight against President Trump’s ‘sanctuary city’ order

Atty. Gen. Xavier Becerra led a group of 10 states Wednesday in filing an court brief supporting San Francisco and other California communities that challenged President Trump’s executive order to withhold federal funds from “sanctuary jurisdictions.”

After the local governments won a preliminary injunction against the order, the Trump administration asked the courts to dismiss the cities’ lawsuit.

The brief filed by Becerra argues that public safety is improved when local law enforcement agencies focus on crime prevention instead of helping federal authorities enforce immigration laws.

“The Trump Administration does not have the right to coerce states, counties or municipalities to do the federal government’s job,” Becerra said in a statement. “California’s state and local law enforcement officials are in the business of public safety, not of deportation. Threatening public safety funding to compel localities to do immigration work is a dangerous game that undermines public safety.”

California Supreme Court leaves in place decision upholding cap-and-trade system

After more than four years, a legal challenge to California’s cap-and-trade program has reached an unsuccessful conclusion.

The end came on Wednesday when the California Supreme Court declined to consider an appeal from business groups who consider the program to be an unconstitutional tax.

The program requires companies to buy permits to release greenhouse gases, a system intended to provide a financial incentive to reduce emissions.

The law that provided the program’s foundation was not passed with a two-thirds vote in the Legislature, the legal threshold for new taxes, sparking lawsuits from the California Chamber of Commerce and the Pacific Legal Foundation.

A state appeals court rejected their arguments in April, but they appealed. Business groups were also concerned the decision was too broad and could open the door to additional taxes.

Despite the state’s victory in court, there are other legal questions around cap and trade. Gov. Jerry Brown is pushing lawmakers to extend the program past 2020 with new legislation.

“With this Supreme Court victory, now it’s up to us to take action extending California’s cap-and-trade system on a more permanent basis,” Brown said in a statement.

This story has been updated with a statement from the governor.

Rohrabacher on meeting with Manafort while he was a foreign agent: ‘It was a nice little dinner’

When former Trump campaign manager Paul Manafort belatedly filed as a foreign agent on behalf of a pro-Russian Ukrainian political party this week, he listed a meeting with just one U.S. politician — Rep. Dana Rohrabacher of Huntington Beach.

Manafort’s years-late filing with the Justice Department details $17 million in political consulting work he did between 2012 and 2014 for the Party of Regions, a Ukrainian party considered friendly with the Kremlin.

Rohrabacher told the Los Angeles Times on Wednesday that the March 2013 meeting happened over dinner at the Capitol Hill Club, a popular Washington Republican social club. He said Manafort billed it as a chance to get reacquainted decades after they worked together in the 1970s on President Reagan’s campaign. Still, he assumed Manafort had an agenda.

“I assume when old friends call me up and are wanting to get reacquainted and stuff I always assume they are in some way under contract with somebody,” Rohrabacher said.

Rohrabacher, chairman of the House Foreign Affairs Subcommittee on Europe, Eurasia, and Emerging Threats, has long been known for encouraging improved relations with Russia, something that’s made him an outlier in the Republican Party.

He said Russia and the Baltic states probably came up during dinner, but it wasn’t the focus of their conversation.

“We discussed a myriad of things, a lot of personal stuff, a lot of different analysis of the politics of the day,” Rohrabacher said. “It was a nice little dinner.”

Three days later, Manafort contributed $1,000 to Rohrabacher’s reelection campaign. Manafort’s “modest” donation didn’t stand out, Rohrabacher said.

Ongoing FBI and congressional investigations into Russian attempts to interfere in the 2016 election, and how the Trump campaign may have been involved, have heightened interest in any connections American politicians may have had with the Russian government or its proxies.

Rohrabacher’s opponents immediately began fundraising off the revelation that Manafort met with the congressman while serving as a foreign agent. Democrat Harley Rouda, who’s running for Rohrabacher’s seat in 2018, called it “embarrassing” in a solicitation email Tuesday.

“We need someone who cares more about Orange County and America than supporting Russia and Putin,” Rouda’s email stated.

Democrats block Republican legislator’s proposal for forensic audit of UC Office of President

Two months after a state audit found mismanagement at the University of California, Democratic state lawmakers on Wednesday blocked a Republican legislator’s proposal to have auditors go back in and look deeper at spending, this time with an eye for possible criminal activity.

Assemblyman Dante Acosta (R-Santa Clarita) said the follow-up examination was justified after an audit in April found the UC Office of the President had failed to disclose a $175-million budget surplus to the Board of Regents and the public, was paying excessive salaries and expenses and had inadequate financial safeguards in place to prevent abuse.

The lack of controls, the audit concluded, was “putting millions of dollars at risk of abuse.”

“I am fighting to return trust in the institution of the UC Office of the President for students, parents, faculty and staff,” Acosta said. “Only complete transparency can accomplish that goal.”

However, no Democratic lawmakers on the Joint Legislative Audit Committee voted to authorize a new audit, so the motion failed. Assemblyman Al Muratsuchi (D-Torrance) said the university administration should be given time to address the recommendations of its recent audit.

“I believe this request is premature,” he said.

State Auditor Elaine Howle said Wednesday in response to a legislator’s question that she did not find any evidence of misuse of funds. “We didn’t see anything nefarious,” Howle told the panel.

UC President Janet Napolitano said funds were not hidden, but she has agreed to adopt policies to make the budget process more transparent. Monica Lozano, chairwoman of the UC Board of Regents, told the legislative committee Wednesday that a new audit is “unnecessary” and may interfere with the system’s implementation of recommendations from the last audit, including the hiring of an accountant to look at UC spending.

Single-payer healthcare advocates protest at Capitol with a message for California’s Assembly speaker: ‘Shame on you!’

Backers of a measure to establish a single-payer healthcare system in California rallied at the Capitol on Wednesday to renounce Assembly Speaker Anthony Rendon (D-Paramount), who shelved the bill last week.

Several hundred demonstrators, many affiliated with the California Nurses Assn., the legislation’s sponsor, convened in the Capitol rotunda, where they unfurled a banner that blared “Inaction = Death,” before handing off signs with written complaints to a member of Rendon’s staff.

The rally, on the heels of a smaller demonstration at Rendon’s district office on Tuesday, is a sign of how single-payer backers continue to seethe after the bill, SB 562, stalled on Friday.

Patty Estefes, a retired nurse from San Jose, said the campaign for single-payer heathcare, in which the government would cover all residents’ healthcare costs, was her passion.

“Rendon sabotaged SB 562 and we want to take the knife out,” said Estefes, explaining her sign, which had an image of the California grizzly bear stabbed in the back with a blade labeled “Rendon.”

The image has become popular among supporters of the bill, although other Democrats have said the violence of the image makes them uneasy.

Meanwhile, another union leader, Robbie Hunter of the powerful State Building and Construction Trades Council of California, chimed in Wednesday with support for the state Assembly speaker.

“Working people have real fights, and they are not with a labor champion like Anthony Rendon,” said Hunter, who denounced the criticism from single-payer advocates as “unfair and unwarranted attacks.”

Garcetti and Schwarzenegger urge cities and states to lead fight against climate change in Trump era

Former Gov. Arnold Schwarzenegger and Los Angeles Mayor Eric Garcetti on Wednesday called on cities and states to lead the nation’s fight against global warming as the federal government begins to reverse its climate change policies.

The Republican former film star — who signed a landmark 2006 law to reduce California’s carbon emissions — and the Democratic mayor spoke out against President Trump’s denial of climate science at a forum at Creative Artists Agency in Century City.

Both argued that steps taken by cities and states to promote renewable energy could largely make up for the Trump administration’s withdrawal from the worldwide Paris agreement to cut greenhouse gas emissions.

California voters could decide in 2020 whether to remove mandatory punishment for falsifying U.S. citizenship records

A proposed California law would let state voters decide in November 2020 whether to remove the mandatory punishment for a person who falsifies citizenship documents.

The legislation by Assemblyman Raul Bocanegra (D-Pacoima) would make the crime a “wobbler,” meaning prosecutors would have the discretion to charge suspects in such cases with either felony offenses or lower-level misdemeanors. That, supporters say, would bring the penalties in line with those for similar crimes committed by legal residents who falsify government records, such as driver’s licenses.

Assembly Bill 222 moved out of the Senate Public Safety Committee on Tuesday with a 5-2 vote along party lines. An amendment added Tuesday places the issue on the ballot in November 2020.

Bocangera said the measure was introduced as a response to President Trump’s hard-line stance on immigration and would reverse part of Proposition 187, a 1994 California ballot measure to deny public services to immigrants in the country illegally.

The bill would repeal provisions in the penal code that require a person to serve an automatic five-year mandatory prison sentence or pay a $75,000 fine if they are convicted on charges of manufacturing, distributing or selling false documents to conceal someone else’s citizenship or residency status.

It has the support of the Los Angeles County district attorney’s office, which says there are far more serious crimes that carry substantially lower penalties.

“Today, if an underage college student uses a fake ID to purchase a six-pack of beer, he or she can be charged with a misdemeanor,” Bocanegra said in a statement. “However, if an immigrant is caught using that same fake ID, he or she is automatically charged with a felony and is subject to five years in prison.”

It’s all good: Gov. Jerry Brown (again) signs a budget without any vetoed spending

Gov. Jerry Brown holds two unique records when it comes to state budgets. No governor has signed more of them, and none in modern times have been as hesitant to veto items they don’t like.

In the budget he signed on Monday, Brown made no changes. It’s not the first time. This was Brown’s second consecutive budget in which he took no veto actions, and his third veto-free budget since 1982.

Governors have line-item veto power to erase budget expenditures, decisions that aren’t subject to review by the Legislature. Previous chief executives have used their unilateral power far more often, a way to trim spending from a variety of state budget-related programs.

State documents show former Gov. George Deukmejian holds the modern record for the most budget changes, issuing 367 line-item vetoes on July 21, 1983. In total amount of spending, the record belongs to former Gov. Pete Wilson, whose budget vetoes in 1998 added up to more than $1.9 million.

Brown also has the distinction of issuing fewer vetoes of stand-alone legislation of any governor in the last half-century, suggesting it’s a sign of “respect” for the legislative branch of government.

The governor’s signature on the latest state budget sets in place $183.2-billion in spending, covering a wide range of programs and services while setting aside more in cash reserves than ever before.

Jimmy Gomez scheduled to be sworn in more than a month after he was elected to Congress

Rep.-elect Jimmy Gomez is scheduled to be sworn into Congress on July 11, the day the House returns from its July Fourth recess, according to a senior Democratic aide.

House Majority Leader Kevin McCarthy (R-Bakersfield) complained about the 34th Congressional District’s “elongated vacancy” in a letter Tuesday, calling the three-week span since the June 6 Los Angeles special election “an abdication” of Gomez’ responsibilities.

Gomez, a current Democratic state assemblyman, told The Times after the election he would try to delay his Assembly resignation to vote on extending the state’s cap-and-trade program, which requires companies to buy permits to release greenhouse gas. He’s since said he could not be sworn in with other new members of Congress this week because of a family conflict.

Discussions on cap-and-trade have dragged on in Sacramento, and it appeared Democrats were delaying Gomez’ swearing in, and Assembly resignation, to help Gov. Jerry Brown pass the bill with a two-thirds majority before the Legislature leaves on July 21.

The office of House Minority Leader Nancy Pelosi (D-San Francisco) pushed back on McCarthy on Wednesday, saying Republicans should worry about getting their own house in order.

“As the majority leader well knows, the Republican majority has canceled votes the last two Fridays because there is nothing to vote on. While we appreciate his interest in having a full complement of Democrats in Congress, perhaps his time would be better spent identifying exactly what and where the Republican agenda is,” said Pelosi spokeswoman Caroline Behringer.

It is unusual for so much time to pass between a special election and the winner taking office. In the last several congresses, the time between a special election and its winner taking the oath averaged one week.

L.A.’s newest congressman still hasn’t taken his oath. Majority Leader Kevin McCarthy wants to know why

House Majority Leader Kevin McCarthy (R-Bakersfield) wants to know why Rep.-elect Jimmy Gomez hasn’t been sworn in, saying the seat’s “elongated vacancy” is “an abdication” of his responsibilities.

Twenty one days have passed since Gomez won a special election to replace now-California Atty. Gen. Xavier Becerra, who resigned Los Angeles’ 34th Congressional District last January.

Gomez, a current Democratic state assemblyman, told The Times after the election he would try to delay his Assembly resignation to vote on extending the state’s cap-and-trade program, which requires companies to buy permits to release greenhouse gas.

Negotiations on cap and trade are escalating in Sacramento, and there are rumblings Gov. Jerry Brown would like to be able to count on Gomez’ vote to pass the bill with a two-thirds majority before the Legislature leaves on July 21. McCarthy took issue with that in a letter to Gomez, House Minority Leader Nancy Pelosi (D-San Francisco) and California Secretary of State Alex Padilla.

“If this delay persists due to his prioritization of state legislative matters, Congressman-elect Gomez should be honest with the constituents of California’s 34th congressional district who he was elected to serve and resign from his newly-elected seat so they can elect someone ready to serve on Day One,” McCarthy wrote.

Brown wants the deal to pass with a two-thirds majority to help insulate it from legal challenges, and Gomez could be an important vote if legislative leaders can’t get some moderate Democrats on board.

Gomez said Monday he only offered to be available for a cap and trade vote until June 15, and had a family conflict this week, but has been willing to be sworn in at any other time.

Because Congress leaves Friday for the July Fourth recess, the soonest Gomez can take office is July 10, but no date for the ceremony has been set. A spokeswoman for Gomez did not return a call Tuesday afternoon.

McCarthy also questioned why Gomez has not been sworn in even though two members who were elected after Gomez have already taken office.

It is unusual for so much time to pass between a special election and the winner taking office. In the last several congresses, there was an average of one week between a special election and the winner taking the oath.

Campaign to recall freshman state senator submits more than enough signatures to qualify for the ballot

The campaign against state Sen. Josh Newman has turned in more than enough signatures to force the freshman Democrat from Fullerton into a recall election.

Republican Carl DeMaio, a lead organizer of the effort, said the group submitted 84,988 signatures on Tuesday.

More signatures are being collected but only 63,500 registered voters in the 29th Senate District are needed to put the recall question on the ballot.

“It shows that there is an unbelievable grass roots movement to fire Josh Newman for his disasterous vote to support an increase in the gas tax,” said DeMaio, a conservative radio talk show host from San Diego.

The recall drive was complicated by recently enacted legislation that allows voters to ask that their signatures not be included in the recall petitions if they felt they were misled.

Elections officials in Los Angeles, Orange and San Bernardino counties must now determine whether there are sufficient valid signatures to qualify the recall.

Mike Roth, a spokesman for the campaign against the recall, said special interests including Chevron have helped fuel a misleading petition drive.

“The recall petition is a costly power grab by out-of-district special interests that won’t save taxpayers a dime and won’t solve any problem voters care about,” Roth said. “What it will do is cost up to $3 million in tax dollars that would be better spent on our schools and public safety.”

In massive shake-up, Gov. Jerry Brown breaks up California’s scandal-plagued tax collection agency

In a move that triggers the most dramatic shake-up of the California Board of Equalization in its 138-year history, Gov. Jerry Brown signed legislation Tuesday that strips the embattled state tax collection agency of most of its powers and duties as officials scramble to create an entirely new department by July 1.

The board is the target of an investigation by the state Department of Justice, and its employees and members have been accused by auditors of mismanagement, including putting $350 million in sales taxes in the wrong accounts and improperly interfering with decisions to open field offices and transfer staff.

The governor signed a bill that pares the state board from an agency with 4,800 workers to one of 400 employees, shifting the other staff engaged in the collection of sales and excise taxes to a new California Department of Tax and Fee Administration.

The elected, five-member Board of Equalization will also give up its role hearing taxpayer appeals to a new Office of Tax Appeals, leaving the board to advocate for taxpayers and continue setting rates for gas taxes and pipeline levies, and making sure counties fairly assess property taxes.

Anticipating the governor’s action, officials had already started work to create a new state department by July 1.

“It’s a short period,” acknowledged Marybel Batjer, secretary of the California Government Operations Agency, who is coordinating the changes.

The new department will be headed by a director appointed by the governor and requiring state Senate approval. Brown will also appoint a chief deputy and chief counsel.

“The recruitment is underway” for those positions, Batjer said, adding that “the transition will continue after July 1, obviously. Not every ‘i’ will be dotted and ‘t’ crossed between now and July 1. We will do our mighty best to do the most important things before July 1.”

Learn more on the history of the state board and what’s next.

Gov. Jerry Brown approves a $183-billion state budget, though a few details are unfinished

Gov. Jerry Brown on Tuesday signed into law a $183.2-billion budget, a spending plan with significant boosts for public schools and a variety of programs to help California’s most needy residents.

While the blueprint depends on a series of other related bills that haven’t reached his desk, Brown’s action largely ratifies the plan approved by the Legislature and ensures the state will have a budget in place for the new fiscal year that begins Saturday.

“This budget provides money to repair our roads and bridges, pay down debt, invest in schools, fund the earned income tax credit and provide Medi-Cal health care for millions of Californians,” Brown said in a written statement released by his office.

The budget boosts total state and local spending on K-12 education and community colleges to $74.5 billion, roughly $11,000 per pupil in the coming school year. It also increases funding for the University of California and Cal State University systems, and provides additional money for preschool and child care programs.

Brown and lawmakers agreed to devote a portion of new tobacco tax dollars to higher payments for doctors and dentists that treat patients in Medi-Cal, the state’s healthcare program for the poor. Divvying up the dollars generated by last fall’s Proposition 56 was among one of the most contentious issues during spring budget negotiations.

The budget sets aside additional money in the state’s rainy-day reserve fund, growing the contingency account to $8.5 billion.

Brown, who rarely uses his line-item veto power in trimming budgets, left entirely intact the plan ratified by the Legislature on June 15.

While the governor signed 15 budget-related bills Tuesday, a handful of other related bills have yet to make their way to his desk. Those include a plan to make an extra $6-billion payment to the California Public Employees’ Retirement System, or CalPERS, borrowing the money from surplus state revenues. The plan was approved by the state Senate on Monday.

Gov. Jerry Brown says GOP healthcare bill cuts ‘right into the heart of what is already a divided nation’

One in three California residents are covered by Medicaid, and California is thought to have the most to lose if Republicans gather enough votes to roll back major aspects of the Affordable Care Act.

California would see the nation’s biggest increase in uninsured people by next year and face a $24-billion budget shortfall by 2026 because of reduced Medicaid funding, California’s Democratic senators and Gov. Jerry Brown warned during a call with reporters on Tuesday.

The Californians’ call was just one of dozens of events House and Senate Democrats held Tuesday to try to stir up anger over the bill.

Brown called the bill divisive, saying it puts tax cuts for the wealthy above healthcare for the poor.

“This is such a political bill,” he said. “This bill will be the most divisive maneuver, cutting right into the heart of what is already a divided nation.”

The bill would increase the number of people without health coverage by 22 million and push up medical costs for millions of other poor and sick Americans, according to an analysis by the nonpartisan Congressional Budget Office.

After pledging to pass the bill this week, Senate Republicans abruptly delayed a vote until after the July Fourth recess. A handful of Republicans have announced they are leery of the bill, saying it either goes too far or doesn’t go far enough, and the White House is lobbying them to get on board.

Every major medical association has come out against the bill, which was written by a small group of senators behind closed doors. Sen. Kamala Harris said the bill is being rushed to the Senate floor without hearings, debate or much time for senators to review it.

“It’s absolutely wrong, it is harmful and it is unconscionable. The bill would restructure our nation’s entire health care system,” she said.

Sen. Dianne Feinstein said it’s not enough to amend the existing GOP bill, and Congress needs to start over instead. She said 10 or 12 Republican senators need to defect so the bill is not revived after a few changes, as a similar bill was in the House.

“I am optimistic that it is doable to kill it,” Feinstein said. “It’s the most indefensible bill I’ve actually seen in 24 years in the Senate.”

National Republicans target California water needs in new ads against House Democrats

The National Republican Congressional Committee is going after five California Democrats for votes on a water issue.

The online ads are identical except for one line tailored to target each Democrat: Reps. John Garamendi of Walnut Grove, Ami Bera of Elk Grove, Salud Carbajal of Santa Barbara, Raul Ruiz of Palm Desert and Scott Peters of San Diego. They specifically are about the Democrats voting against a bill to funnel dam permits through a single federal agency in an effort to speed up new water storage projects.

“Tell Congressman Garamendi to stop letting politics get in the way of our water,” one ad says.

Sponsored by Rep. Tom McClintock (R-Elk Grove), the bill passed the House last week, with a 233-180 largely partisan vote.

Democrats need 24 seats to regain control of the House, and are expected to focus their attention in the midterms on tying Republicans to President Trump. Their list of seats they need to flip includes 9 of the 14 California seats held by Republicans.

The ads, which will run online for the next week, could be the first glimpse of an NRCC strategy of trying to keep the focus on local issues in the 2018 election.

“California Democrats want to help radical environmentalists more than their drought-stricken constituents. If Democrats continue to sit on their hands and let this chance to capture much-needed water float on by, the NRCC will hold them accountable,” said spokesman Jack Pandol.

Only a few California counties may use the new state law for sending every voter a ballot in the mail

A broad effort to close thousands of California neighborhood polling places in favor of absentee ballots and multi-purpose “vote centers” has yet to find traction beyond a handful of counties.

Data collected by Secretary of State Alex Padilla’s office concludes only two counties have a plan in place to implement the sweeping change in state election law enacted last year. As many as 14 counties can do so in 2018, with Los Angeles County and others able to switch to the system in 2020.

“Change is hard,” said Jill LaVine, registrar of voters in Sacramento County, one of the counties that has already approved adoption of the system to swap polling places for a limited number of “vote centers” offering several different election services.

Meanwhile, leaders in the county that has done the most planning to move toward changing its election system -- Orange County -- have rejected the new law for 2018.

Nurses union uses the image of a California bear stabbed in the back after single-payer bill is blocked

As cap-and-trade deal lingers, Jimmy Gomez has still not been sworn in to Congress

Rep.-elect Jimmy Gomez will probably not be sworn in as downtown Los Angeles’ newest member of Congress until at least July 10, more than a month after he was elected to fill the empty seat in the 34th Congressional District.

Gomez, a current state assemblyman, told The Times after the election he would try to delay his Assembly resignation to help Democrats reach a two-thirds vote on extending the state’s cap-and-trade program, which requires companies to buy permits to release greenhouse gas.

Democrats hold 55 of 80 Assembly seats, more than needed for a two-thirds vote, but Gomez could be an important vote if legislative leaders can’t get some moderate Democrats on board. The high vote threshold is intended to insulate the program from future legal challenges.

After a cap-and-trade deal wasn’t included as part of the state budget vote this month, Gomez told The Times that his congressional swearing-in date would be up to House leadership. He repeated that Monday.

“I gave a commitment to be available for cap and trade until June 15 ... and I notified [Minority] Leader [Nancy] Pelosi’s office that anytime after the 15th I would be ready to be sworn-in, except the week of June 26th because [of] a family scheduling conflict,” Gomez said by text message Monday.

Because of the House’s weeklong July Fourth holiday, Gomez isn’t likely to be sworn in until at least July 10.

Discussions on the cap-and-trade program escalated between Gov. Jerry Brown and legislative leaders in Sacramento late last week, but they have yet to unite on a single bill.

Brown would like to strike a deal in July, and state lawmakers leave Sacramento for a monthlong break on July 21.

Residents of the 34th District have been without a congressman since late January, when Xavier Becerra resigned to become California’s attorney general.

House Speaker Paul Ryan (R-Wis.) on Monday will swear in Reps.-elect Karen Handel (R-Ga.) and Ralph Norman (R-S.C.), who were both elected last week. The speaker’s spokeswoman said Friday that Ryan wanted to do all three ceremonies at once, but House Minority Leader Nancy Pelosi (D-San Francisco) had not signed off on Gomez’s swearing-in. (Her staff pointed to his family scheduling conflict as the reason.)

If Gomez stays in the Assembly for the cap-and-trade vote, it could be his last vote as a member of the majority party for some time.

Rep. Grace Napolitano to miss House votes for several weeks while husband receives cancer treatment

Rep. Grace Napolitano (D-Norwalk) will miss House votes while her husband, Frank Napolitano, undergoes chemotherapy and radiation to treat esophageal cancer, her spokesman said.

The congresswoman, 80, easily beat out former Democratic state Assemblyman Roger Hernandez of West Covina in the November election. She said in April that she would seek reelection in 2018, and her husband’s health does not change her plan to seek an 11th term, spokesman Jerry O’Donnell said.

Napolitano has missed the last two weeks of House votes, though she’s working some from the district, and is expected to remain in California for several more weeks to care for her husband during the treatment, O’Donnell said. He did not know for sure how long Napolitano would be gone, but it is possible she might make it back for some votes during the seven-week-long treatment, he said.

Napolitano said by phone she will try to return if the House votes again on the GOP health care bill.

“I intend to be back at work soon,” Napolitano said.

The House leaves Friday for a one-week break and leaves again at the end of July for the August recess.

Napolitano suffered a minor stroke in 2016 that affected her ability to write and slightly slowed her walk.

For the record, 8:47 a.m.: An earlier version of this post identified the type of cancer Napolitano’s husband has as lung cancer. It is esophageal cancer.

8:47 a.m., June 27: This post has been updated with a quote from Napolitano.

2:45 p.m. This post has been updated to correct how many terms the congresswoman has served.

2:26 p.m. This post has been updated with more details about when Napolitano might return.

This post was originally published at 2:06 p.m.

Sen. Kamala Harris makes her pick in California’s lieutenant governor’s race

After a career in the majority, Jimmy Gomez prepares for life in the minority in Washington

Congressman-elect Jimmy Gomez has spent his entire political career as a member of the majority party. When he’s sworn in as central and northeast Los Angeles’ newest member of Congress in the coming weeks, he’ll be the most junior Democrat — 194th out of 194 — in Congress.

He’ll have to find a path forward in a Congress dominated by the opposing party. Even if Democrats win back control, he’ll have hundreds of more senior and just as eager colleagues ahead of him in line.

Rep. Maxine Waters focuses on GOP healthcare bill at packed town hall

Rep. Maxine Waters, who spoke Saturday at a packed town hall meeting in Gardena, said she worries some Americans will be forced to do what her family did if the Republican healthcare bill passes.

Senate Republicans have pledged to pass a bill before the July Fourth holiday.

To illustrate why she believes everyone should have access to comprehensive healthcare, the Los Angeles Democrat said she and her 12 siblings never saw a physician or a dentist their entire childhood.

“I was born at home in St. Louis back in the day when it was hard for minorities to get into hospitals,” she said.

This former Jeff Denham challenger won’t run again, but he’s launching a committee to elect Democrats

Two-time congressional challenger Michael Eggman says he won’t try for a third campaign against Republican Rep. Jeff Denham (Turlock), but he’s hoping to help Democrats running against the him.

Eggman, a beekeeper and farmer, announced Monday that he’s starting a political action committee to help oust Republicans in seven seats, including Denham’s in the Central Valley, which Democrats have targeted for 2018.

The committee, Red to Blue California, filed papers with the Federal Election Commission in March but so far hasn’t reported raising any money. Andrew Feldman, a spokesman for the PAC, said the group has taken in about $50,000 and its goal is to raise at least $7 million in the 2018 cycle. Eggman will serve as chair of the committee.

In a statement, Eggman said that while he lost last year, “I learned a heck of a lot on the way. Now as Donald Trump threatens to upend the very fabric of what makes our country great, I’m doing my part to join the resistance.”

In addition to Denham’s seat, the committee will target Republican Reps. Steve Knight (Palmdale), David Valadao (Hanford), Ed Royce (Fullerton), Mimi Walters (Irvine), Dana Rohrabacher (Huntington Beach) and Darrell Issa (Vista). All seven were reelected in districts won by Hillary Clinton in the presidential election.

The committee also plans to use some of the money to promote down-ballot candidates in each of the districts as a way of building a base of Democratic candidates.

Eggman, a beekeeper and farmer who received a rare endorsement from Barack Obama in the Democrats’ unsuccessful quest to take back the House last year, lost to Denham by 5% in November. Spending in that race topped $14 million.

Six Democrats have already filed to run in Denham’s 10th Congressional District, including Josh Harder, a venture capital executive whose campaign manager worked for Eggman in 2016.

California Politics Podcast: There’s a powerful new ally of those who support a sanctuary state

Supporters of an ambitious California effort to limit law enforcement cooperation with federal immigration authorities begin the week with a prominent new ally.

On this week’s California Politics Podcast, we take a look at the impact of Los Angeles Police Chief Charlie Beck endorsing the “sanctuary state” bill that’s now under consideration in Sacramento.

We also discuss the decision by Assemblyman Travis Allen (R-Huntington Beach) to run for governor, and how his conservative politics could have a big effect on how Republican voters view their choices in 2018.

I’m joined by Times staff writer Melanie Mason and Marisa Lagos of KQED News.

California won’t be passing a single-payer healthcare system any time soon — the plan is dead for this year

A high-profile effort to establish a single-payer healthcare system in California sputtered on Friday when Assembly Speaker Anthony Rendon (D-Paramount) decided to shelve the proposal.

Rendon announced late Friday afternoon that the bill, SB 562 by state Sens. Ricardo Lara (D-Bell Gardens) and Toni Atkins (D-San Diego), would not advance to a policy hearing in his house, dampening the measure’s prospect for swift passage this year.

“SB 562 was sent to the Assembly woefully incomplete,” Rendon said in a statement. “Even senators who voted for SB 562 noted there are potentially fatal flaws in the bill, including the fact it does not address many serious issues, such as financing, delivery of care, cost controls, or the realities of needed action by the Trump Administration and voters to make SB 562 a genuine piece of legislation.”

Rendon took pains to note that his action does not kill the bill entirely — because it is the first year of a two-year session, it could be revived next year.

But the move is nonetheless a major setback for legislation that has electrified the Democratic party’s progressive flank.

The California Nurses Assn., the bill’s sponsors and the state’s most vocal advocates for single-payer, blasted Rendon’s decision as “cowardly.”

“Acting in secret in the interests of the profiteering insurance companies late Friday afternoon abandons all those people already threatened by Congress and the Trump administration,” Deborah Burger, the union’s co-president, said in a statement.

Burger continued: “The people of California are counting on the Legislature to protect them now, not sometime next year, and as polls have shown Californians support this proposal by a wide majority. A solution to this health care emergency could be at hand; Speaker Rendon is standing in opposition.”

In a joint statement, Lara and Atkins, the measure’s authors, said they were “disappointed the robust debate about healthcare for all that started in the California Senate will not continue in the Assembly this year.”

“This issue is not going away,” they added.

Gov. Jerry Brown, who had signaled wariness about the proposal’s costs, said in a statement that Rendon “made the case that there’s clearly more work to do before anyone is in a position to vote on revamping California’s healthcare system.”

“I recognize the tremendous excitement behind the measure, but basic and fundamental questions remain unanswered,” Brown said.

Updated at 6:44 p.m.: This article was updated with a comment from Gov. Jerry Brown.

Updated at 5:38 p.m.: This article was updated to include comments from the California Nurses Assn. and the measure’s authors.

This article was originally published at 4:38 p.m.

Times staff writer Patrick McGreevy contributed to this report.

California politicians are in Dallas despite new ban on state employees traveling to Texas

A day after California banned state employees from going to Texas on official business, a group of politicians from the Golden State was in Dallas on Friday for a major conference.

California Atty. Gen. Xavier Becerra on Thursday announced he was prohibiting state employees from traveling at state expense to Texas and three other states that he determined have approved laws that discriminate against gay and transgender people.

Sen. Ricardo Lara (D-Bell Gardens), who is openly gay, is among those attending the annual gathering of the National Assn. of Latino Elected and Appointed Officials (NALEO). A spokesman said he is using his own money, not taxpayer funds. Lara voted for the bill that enacted the travel ban.

Lara felt participating in a panel discussion on immigration was important amid debate over Gov. Greg Abbott’s signage of a controversial immigration law that bans “sanctuary cities” for immigrants in the country illegally, spokesman Michael Soller said.

“Texas just passed one of the nation’s most anti-immigrant laws with Senate Bill 4, and California went down this road with Proposition 187 more than 20 years ago,” Lara said in a statement. “With LGBT and immigrant rights under assault across the country, I thought it was important to join other Latino leaders and show California’s example.”

Like Lara, West Hollywood Mayor Pro Tem John Duran made plans to attend the Dallas convention well before Becerra announced the travel ban, which does not apply to non-state employees.

Duran is the national chairman of NALEO and said the conference was scheduled for Dallas three years ago.

“I don’t know about the LGBT laws in Texas or AG Becerra’s call for a boycott -- I am not only LGBT but also Latino,” Duran said in an email, adding he is “very angry” over Texas’ SB 4, which requires law enforcement to cooperate with federal immigration officials in enforcing immigration laws.

“I am here supporting my elected official colleagues in Texas from Austin, Houston, San Antonio and Dallas who are joining together to sue the state of Texas,” Duran said. “Being a Californian who worked against Gov. Pete Wilson’s Prop 187 -- I have experiences and strategies to share with them.”

Texas responds to California LGBT travel ban, saying Golden State firms ‘fleeing over taxation and regulation’

A day after California officials said they are banning state workers from traveling to Texas on official business, an aide to Republican Texas Gov. Greg Abbott returned a verbal volley claiming mistreatment of businesses.

On Thursday, California Atty. Gen. Xavier Becerra said Texas and three other states were being put on a list of states that had adopted laws seen by Becerra as discriminatory to the LGBT community and therefore were off-limits for state-sponsored travel.

That drew a response Friday from John Wittman, Abbott’s press secretary.

“California may be able to stop their state employees, but they can’t stop all the businesses that are fleeing over taxation and regulation and relocating to Texas,” Wittman said.

Becerra put Texas on the travel-ban list after the governor signed HB 3859 last week. The new law allows foster care agencies to deny adoptions and services to children and parents based on “sincerely held religious beliefs.” Becerra said the measure allows agencies to discriminate against children in foster care and potentially disqualify LGBT families from the state’s foster and adoption system.

A spokesman for Kentucky Gov. Matt Bevin also criticized California officials.

“It is fascinating that the very same West Coast liberals who rail against the President’s executive order, that protects our nation from foreign terrorists, have now contrived their own travel ban aimed at punishing states who don’t fall in lockstep with their far-left political ideology,” said Woody Maglinger, Bevin’s press secretary.

Updated at 1:35 pm to include comment from Woody Maglinger.

Rep. Tom McClintock’s bill to streamline dam permits passes House largely on party lines

Dam permits would be funneled through a single federal agency in an effort to speed up new water storage projects under a bill that passed the House on Thursday.

Sponsored by Rep. Tom McClintock (R-Elk Grove), the 233-180 vote was largely along partisan lines. Reps. Jim Costa (D-Fresno), Lou Correa (D-Santa Ana) and six other Democrats joined with Republicans to pass the bill.

McClintock said the various local, state and federal agencies that must sign off on new projects don’t have to communicate or set deadlines, and often require redundant information from permit applicants, which can make the application process drag on for years and drive up costs.

“Dam applications can go on endlessly,” McClintock said after the vote. “A lot of these projects become cost prohibitive.”

He pointed to a dam project proposed by the town of Foresthill in his district as an example. Conflicting demands from several federal agencies about a plan to install a spillway gate on the dam at the Sugar Pine Reservoir have driven up the cost, he said. The project application is still under review.

“So a $2-million project that was a heavy lift for a little community, but within reach, becomes an $11-million cost-prohibitive boondoggle,” McClintock said.

Under the bill, the Bureau of Reclamation would coordinate with other federal agencies on all aspects of a dam application and set deadlines for deciding whether to approve a project.

Democrats who voted against the bill said the bureau would be able to set arbitrary deadlines for the at-times lengthy environmental reviews required for water projects, which could undermine reviews required by laws like the Endangered Species Act and the Clean Water Act.

“Fixing the process isn’t just about saving some headaches or a few hours of time. This is about making sure millions of people in California and across America have the water they need and deserve,” said Majority Leader Kevin McCarthy (R-Bakersfield).

Sen. John Barrasso (R-Wyo.) has filed similar legislation in the Senate, and McClintock said he is cautiously optimistic it will pass.

California Atty. Gen. Xavier Becerra expands ban on government-sponsored travel to ‘discriminatory’ states

California Atty. Gen. Xavier Becerra said Thursday that state employees will be prohibited from official travel to four additional states — Alabama, Kentucky, South Dakota and Texas — based on his determination that they have enacted laws that are discriminatory toward sexual orientation and gender identification.

“Each of those states in the recent weeks have enacted legislation that may deprive some of the individuals of those states and individuals who visit those states of their constitutional rights,” Becerra said during a news conference in San Francisco.

The state Legislature approved a bill last year that prohibits state-sanctioned travel to North Carolina, Mississippi, Kansas, Tennessee and other states that have laws that discriminate based on sexual orientation or gender identity.

The measure was in response to a North Carolina bill that overturned an ordinance in the city of Charlotte that allowed transgender people to use public restrooms based on the gender with which they most identify.

“There are consequences to discrimination,” Becerra said. “Restricting state-sponsored travel is a consequence.”

Gov. Jerry Brown says Senate healthcare bill has ‘same stench’ as House version

California’s doctors in Congress don their white coats to criticize GOP healthcare bill

Travis Allen, a conservative and controversial Orange County lawmaker, jumps into California governor’s race

Conservative Orange County Assemblyman Travis Allen (R-Huntington Beach) is jumping into California’s 2018 race for governor, a move that could splinter the GOP vote in what promises to be a crowded and competitive race.

Travis, elected to the Legislature in 2012, said he decided to run because of the years of “wasteful spending and dictatorial policies pushed by Jerry Brown and the Sacramento Democrats.”

“I am running to be the next governor of California to take back our state for the forgotten ordinary citizens of California, who will no longer tolerate the squandering of our incredible natural abundance of people, economy, and resources by limousine liberals beholden to ravenous public sector union bosses and extremist environmentalists,” Travis said in a statement announcing his campaign.

Outspoken and controversial, Travis has filed a ballot measure to repeal the recently approved gas tax and sponsored legislation requiring voters to show photo ID.

Allen has faced criticism for claiming that a new law that barred police from arresting people under 18 for soliciting sex or loitering with intent to commit prostitution was an effort to “legalize” child prostitution. The purpose of the law was to treat minors as victims of sex trafficking rather than offenders.

Allen, 43, worked as a certified financial planner before he ran for the Legislature. His Assembly district includes all or portions of Seal Beach, Huntington Beach, Fountain Valley and Garden Grove.

Allen will face stiff competition from fellow Republican John Cox, a Rancho Santa Fe venture capitalist who already has put $3 million of his own money into his campaign. Former GOP Assemblyman David Hadley of Manhattan Beach also is exploring a run, and former Los Angeles Rams football player Rosey Grier announced plans to jump into the race but thus far has not established an official campaign.

The race also has attracted a cadre of Democratic heavyweights, including Lt. Gov. Gavin Newsom, former Los Angeles Mayor Antonio Villaraigosa and state Treasurer John Chiang. Delaine Eastin, a former state legislator and state schools’ chief, is also running.

In California, Democrats hold a 19-percentage point advantage over Republicans in voter registration, a strong head wind against GOP candidates running for statewide office.

Because of the large field of Democrats in the race, a Republican could have a good shot of finishing in the top two in the June 2018 primary if they can put together GOP support. But Allen’s entry into the race could divide Republican voters, reducing the odds of a GOP candidate making it to the November general election.

The first- and second-place finishers in the primary advance to the general election regardless of their party.

Pelosi on rumbles for new leadership: ‘I’m worth the trouble, quite frankly’

House Minority Leader Nancy Pelosi on Thursday dismissed calls from some in her party who say it’s time for her to step aside.

A handful of Democrats have publicly said that after losing four special elections since January, especially a race in the Atlanta suburbs earlier this week, and failing to regain the majority in the House in the last four national elections, their party needs new leadership in the House. Others have privately said Pelosi weighs down Democrats and could prevent the party from retaking the House in the upcoming midterm elections.

In her weekly news conference, the San Francisco lawmaker called herself a “master legislator” and a “strategic, politically astute leader” who can raise a lot of money and has experience winning a majority in Congress.

With Republicans controlling both chambers, and President Trump in the White House, now isn’t the right time for new leadership, she said.

“I’m worth the trouble, quite frankly,” she said. “I love the fray.”

Coastal panel spawned by 1930s oil scandal now a player in governor’s race

When John Chiang joined the State Lands Commission, it quickly became a platform to showcase his environmental record, starting with his 2007 vote to block construction of a shipping terminal for liquefied natural gas in Ventura County.

The commission has served the same purpose for Gavin Newsom, who often uses his seat on the panel to remind Californians that he opposes offshore oil drilling.

Now that both Chiang and Newsom are running for governor, they are drawing rare attention to the little-known but powerful State Lands Commission, which oversees 4 million acres of land beneath California waters.

Ballot measure to expand L.A. County Board of Supervisors advances

The Los Angeles County Board of Supervisors would be expanded from five to seven members and an elected chief executive post would be created under a measure recommended Wednesday by a state Senate panel despite opposition from the county.

Two members of the county’s 2015-16 civil grand jury testified that the group felt the current government is inadequate for a county of more than 10 million residents. They said that if the county was a state, it would be the eighth-largest state in the country based on population.

“The board is too small to adequately serve the diverse needs of county residents,” grand jury member Molly Milligan told the Senate Governance and Finance Committee, before its 5-1 vote to recommend Senate Constitutional Amendment 12. The proposed statewide ballot measure was introduced by Sen. Tony Mendoza (D-Artesia).

The proposal was opposed by Phyllis Marshall, the chief legislative representative for Los Angeles County, who noted that the proposal would allow voters statewide to decide the governance structure for one county.

“Voters in other counties do not have sufficient knowledge to vote on a constitutional amendment to change the governing structure of Los Angeles County,” Marshall told the panel before the measure was sent to another policy panel on its way to a possible full Senate vote.

Kimberly Ellis blames Democratic Party ‘hacks’ for losses in Tuesday’s congressional races

Kimberly Ellis, who has challenged the results of the California Democratic Party leadership election she lost, blamed party “establishment hacks” who are the “worst in the biz” for losses in congressional races in Georgia and South Carolina on Tuesday.

Ellis, a progressive Bay Area Democrat who tapped into a wellspring of disaffected Bernie Sanders backers, on Tuesday night sent a tweet saying that it was “time for a new coalition.”

That drew a sharp rebuke from veteran Democratic operative Bob Mulholland, who has criticized Ellis for not conceding.

Ellis blamed her narrow May loss to Eric Bauman for state Democratic Party chairperson on voting irregularities. Ellis, who lost the race by 62 votes,has called on the party to conduct an independent audit of the election.

Bauman rejected that request, saying the party already has a process in place to review contested elections. The party’s compliance review commission, made up of six members who were appointed during former chairman John Burton’s tenure, is currently reviewing the election.

On Friday, Bauman announced that the party hired the law firm of Olson Hagel & Fishburn LLC to “oversee, advise and counsel” the commission during the inquiry.

These legislators are trying to make sure Jimmy Gomez’s replacement in the Assembly is a woman

As soon as Congressman-elect Jimmy Gomez announced he was running for Congress, his Assembly colleague Cristina Garcia got to work.