Gavin Newsom releases ad that highlights his push to allow same-sex couples to marry

A new ad from Democratic gubernatorial candidate Gavin Newsom features Phyllis Lyon, who with her partner, Del Martin, received the first marriage license after Newsom vowed to allow same-sex couples to marry when he was mayor of San Francisco in 2004.

The current lieutenant governor’s push for marriage equality thrust him into the national spotlight and he has emphasized that effort to portray himself as a bold, progressive leader.

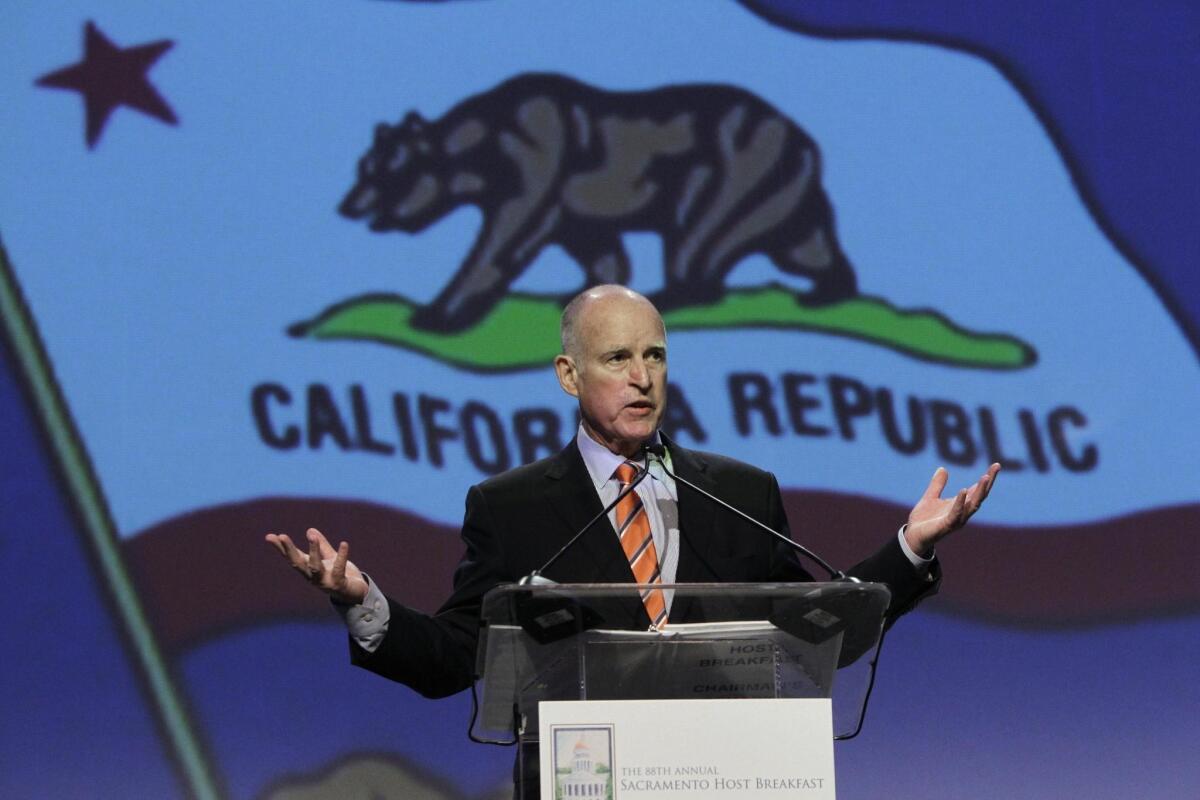

Failed California housing bill was ‘not a bad idea,’ Gov. Jerry Brown says

Earlier this month, high-profile housing legislation that would have allowed for four- to five-story apartments and condominiums near transit stops failed to advance in the state Legislature. But had it reached his desk, would Gov. Jerry Brown have signed it? Maybe.

“I think that was not a bad idea,” Brown said of Senate Bill 827 at a meeting with business leaders from the Bay Area Council on Monday afternoon.

The bill, written by Sen. Scott Wiener (D-San Francisco), attracted national attention and a maelstrom of opposition in part because it would have eliminated single-family zoning near transit stops in favor of apartments or condominiums. Brown said that a relative of his who lives in West Portal, a low-density neighborhood in San Francisco, told the governor he was “horrified” by the bill.

Brown also lamented dramatically rising housing costs. He said he bought his first house in Los Angeles in 1973 for $75,000 at a time when his salary as secretary of state was $35,000. Now, he said, buying a house for a little over twice one’s annual salary is virtually impossible anywhere in the state.

FOR THE RECORD

May 1, 9:32 a.m.: This post originally misstated the year Brown purchased his house as 1970. It was 1973.

John Cox begins California barnstorm with the delivery of gas tax repeal signatures

GOP gubernatorial candidate John Cox strolled up to the stack of 12 boxes in front of the Los Angeles County registrar-recorder’s offices in Norwalk on Monday and placed his hands on top of his party’s hope for success in 2018.

The boxes, stacked four across and three high, contained 211,000 signatures for an initiative to repeal recent increases in California’s gas tax and vehicle fees.

Cox says the effort has gathered more than 940,000 signatures from registered voters to put the measure on the ballot — far more than the 585,407 signatures that are required.

The aim: to bring out the party’s base to the polls this November and help candidates in tough congressional and legislative races down the ticket.

A USC Dornsife/Los Angeles Times poll in November found 54.2% of registered voters surveyed said they would repeal the tax and fee hike, but a survey a month earlier by another group said a majority would vote to keep the higher taxes.

Cox was flanked by Bill Essayli, a former federal prosecutor who is challenging Democratic Assemblywoman Sabrina Cervantes of Riverside in the June primary.

Cervantes voted for the gas tax and Essayli plans to use that vote against her. He even launched his campaign at a 76 gas station in Norco.

“This is a central issue in my campaign,” he said.

Cox also submitted signatures in San Diego on Monday and is headed to Bakersfield, Fresno and Sacramento, as well as Shasta and Butte counties in coming days.

“We are going all across the state,” Cox said. “The whole state is paying this tax and the whole state wants it gone.”

All Californians would be able to serve on state boards — even people in the U.S. illegally — under new bill

State lawmakers on Monday introduced legislation that would allow all Californians to serve on state boards and commissions regardless of immigration status.

Senate Bill 174, by Sen. Ricardo Lara (D-Bell Gardens) and Assemblywoman Wendy Carrillo (D-Los Angeles), comes as the state is locked in a broader legal battle with the Trump administration over state immigration laws and his call for mass deportations. Lawmakers point to what they say is the state’s own discriminatory history as their basis for introducing the legislation.

The proposal would amend an 1872 provision that was first adopted to exclude Chinese immigrants and other “transient aliens” from holding appointed civil positions. At the time, antipathy toward the Chinese had been building in California, though, Chinese immigrants opened hundreds of businesses across the state and would play a critical role in building the transcontinental railroad.

The Senate bill would delete the phrase “transient aliens” from the government code and make clear that any person, regardless of citizenship or immigration status, can hold an appointed civil office if they are at least 18 years old and a resident of the state. That would allow any Californian to serve on hundreds of boards and commissions that advice in an array of policy areas, including farm labor, history and employment development.

“California’s two million undocumented immigrants are a source of energy for our state,” Lara said in a statement. “It is shocking to read the words of fear and exclusion that are still in California law but belong in history’s trash can.”

Tony Mendoza’s fundraising dries up after resignation amid harassment inquiry

Political contributions to Tony Mendoza, who resigned from the state Senate under pressure amid sexual harassment allegations, have nearly dried up. New documents he filed with the state in his bid to reclaim the seat he once held show that his support has eroded.

As a result, five other candidates for the 32nd District senate seat in the June 5 election have raised more than Mendoza so far this year. With the June 5 election approaching, Mendoza has reported raising just $7,750 in cash from six supporters during the nearly four-month period from Jan. 1 to April 21.

Mendoza, a Democrat from Artesia, went on a leave of absence from the Senate Jan. 3 and resigned a month later under the threat of expulsion from colleagues. An investigation ordered by the Senate found a pattern of “unwanted flirtatious or sexually suggestive behavior” based on testimony from six women. Mendoza has denied wrongdoing.

Last year, Mendoza’s reelection campaign raised $412,600, or an average of about $34,000 per month, from more than 350 supporters.

Most of Mendoza’s 2018 total was contributed by the political arm of the Southern California Pipe Trades District Council 16 on Jan. 22, a month before Mendoza resigned. Mendoza also reported that his campaign loaned $125,000 this year to his legal defense fund. That left him with $446,600 in his campaign account at the end of April.

Mendoza is running against eight Democrats and two Republicans. Democrat Bob J. Archuleta, a Pico Rivera city councilman, raised the most, $210,000, during the period.

On Monday, Mendoza suffered another setback when the State Legislative Women’s Caucus endorsed Democrat Vicky Santana, a member of the Rio Hondo College Board.

Newsom and Villaraigosa affairs coming to TV ads in California

An independent political committee backing Republican John Cox for governor released an ad blasting both Lt. Gov. Gavin Newsom and former Los Angeles Mayor Antonio Villaraigosa for their past sexual affairs.

The “California Deserves Better” ad, which was first reported by Politico, criticizes Newsom for having an affair with a woman on his staff in 2005 while he served as mayor of San Francisco. It also goes after Villaraigosa for having an extramarital affair with a television reporter in 2007 while he was mayor of Los Angeles.

The ad, which begins airing on Fox stations in the state’s top media markets Monday, links Newsom and Villaraigosa to the men accused of sexual impropriety in the #MeToo movement, including movie mogul Harvey Weinstein and disgraced “Today” show veteran Matt Lauer.

“Powerful men are finally being held to account, punished for inappropriate sexual conduct with women over whom they exercise power,” the ad begins. “…Newsom and Villaraigosa think the rules shouldn’t apply to them.”

The independent campaign committee, called Restore Our Values, already has raised more than $100,000, said Leigh Teece of Emeryville in Northern California, co-founder of the group.

Teece, the CEO of a nonprofit that helps line up students with professional mentors, said the campaign will actively support Cox. She called him a “true conservative” and noted that he supports cutting taxes and opposes California’s sanctuary state policy.

“John is a business person who has demonstrated integrity,” Teece said.

Was that Cisneros in the voicemail? Dispute is latest espisode of Democratic infighting in crowded primary races

With less than five weeks to go before California’s primary, insults and accusations are flying with abandon in the most crowded races Democrats hope to ultimately win.

The latest example of this is in the 39th Congressional District, where a half dozen Democrats are vying for a chance to replace Rep. Ed Royce, who’s retiring.

It’s one of several California contests where Democratic leaders are already worried that divisions could ultimately split votes and shut Democrats out of key pickup opportunities.

In that race, millionaires Gil Cisneros and Andy Thorburn are going negative … about going negative. Cisneros was recently elevated to the Democratic Congressional Campaign Committee’s “Red to Blue” program in hopes it would serve as a signal to Democratic activists and donors that his campaign was the most viable. But both Cisneros and Thorburn have poured millions into the race, which promises to be a knock down, drag out fight through June 5.

At the center of the latest controversy is a voicemail, allegedly left by Cisneros on Thorburn’s home answering machine earlier this month.

The recording, which the Thorburn campaign turned over to media outlet The Intercept, lasts less than 10 seconds. “Hi Andy, it’s Gil Cisneros. I’m gonna go negative on you,” a man’s voice is heard saying.

Cisneros’ campaign manager Orrin Evans denied the candidate made the call, posting a cease and desist letter to The Intercept on Twitter. The letter, sent by a Cisneros campaign attorney, called the voicemail “fabricated” and demanded that the story be taken down, calling it “defamatory.” It gave the publication until 3 p.m. Friday to take down the story before they “pursue all legal rights and remedies.”

An attorney for The Intercept, in a letter to Cisneros, said the publication confirmed with “multiple sources familiar with Mr. Cisneros” that his voice was on the recording, and that it stands by its reporting.

Thorburn’s camp says it “flatly rejects” Cisneros’ denial, and that the timing of a negative website filled with unflattering background on Thorburn, released three days later, suggests it was him.

Track the California races that could flip the House

According to The Intercept’s report, Cisneros’ campaign manager did not respond to initial inquiries about the voicemail, calling its questions “ridiculous.” In a follow-up statement Friday, Evans said called the episode a “dirty, desperate trick” by the Thorburn campaign and said they are “readying to pursue legal action for defamation and false light” against both him and the publication.

“It sounded like him to me!” said Thorburn’s wife, Karen, in a statement released by the campaign. She was the one who first heard the voicemail, they said.

Thorburn campaign manager Nancy Leeds called Cisneros’ threats “Trump-like tactics” and accused the candidate of trying to “harass and intimidate anyone who stands in his way.”

It’s not the first time candidates from the same party have clashed in the lead-up to the June 5 primary, and it’s all but certain to not be the last. Cisneros sued two of his opponents, Thorburn and Sam Jammal, over their ballot descriptions until they had to change them.

Earlier this month, Democrat Bryan Caforio asked his opponent, Katie Hill, to sign a pledge rejecting the use of independent expenditure committees, entities that neither of them can legally coordinate with, in the race to unseat Rep. Steve Knight (R-Lancaster). Hill refused and called the attempt “hollow” and likened it to “political theater,” while Caforio accused her of “empty campaign promises.”

California Politics Podcast: The money raised in the race for governor hints at a race that’s now red hot

With less than six weeks before election day, the cash raised in the California governor’s race mirrors the overall dynamics: one major front-runner and a heated race for second place.

This week’s podcast episode offers a glimpse into those cash reports and how the Republican field seems more settled in a new statewide poll than the battle between Democrats.

We also examine the reasons why a nationally talked-about housing bill in Sacramento was killed by the Democratic author’s own allies.

I’m joined by Times staff writers Melanie Mason and Liam Dillon. You can subscribe to the podcast on iTunes, SoundCloud and Stitcher.

L.A. County politician sexually assaulted woman when she was 16, lawsuit claims

A woman sued an unnamed politician in Los Angeles County on Friday, alleging the man sexually assaulted her when she was a teenager after he gave her an unusual-tasting drink.

The politician, identified as John Doe, was in his early 40s and a “public figure” at the time of the 2007 assault, according to the lawsuit filed in Los Angeles Superior Court.

The man is an elected official today and lives in Los Angeles, said attorney Lisa Bloom, who is representing the woman identified in the lawsuit as Jane Doe. Bloom declined to say what branch of government the man represents.

Villaraigosa touts his working-class upbringing, accomplishments as mayor in first TV ad

Democrat Antonio Villaraigosa released his first TV ad in the governor’s race Friday, touting his record and accomplishments as mayor of Los Angeles when up against the economic downturn during the recession.

The 30-second television spot opens with a sweeping shot of Los Angeles and cuts to Villaraigosa sitting on a bus.

“In kindergarten, my sister and I took three buses to get to school. As mayor, I remembered that,” Villaraigosa says into the camera. “And despite the recession, we built more new schools and rail lines than any city in America, added 200,000 living wage jobs, built 20,000 units of affordable housing and nearly doubled graduation rates.”

Campaign spokesman Luis Vizcaino said the ad will air statewide over the next week at a cost of approximately $1 million. The commercial will being airing Saturday.

Two Democratic rivals in California’s race for governor, Lt. Gov. Gavin Newsom and state Treasurer John Chiang, also launched ads this week, signaling the biggest ramp-up of the campaign as the June 5 primary approaches.

Newsom is the front-runner, while Villaraigosa is battling for second place with Republican John Cox. One recent poll has Villaraigosa trailing both Cox and Republican Assemblyman Travis Allen of Huntington Beach. Chiang has been stuck in the single digits in almost all polling in the race.

Last week, an independent expenditure group called Families and Teachers for Antonio Villaraigosa for Governor, funded largely by a trio of wealthy charter school backers, launched a spot in support of the former mayor of Los Angeles. That ad campaign is focused on increasing Villaraigosa’s chances of coming in second in the June 5 primary and moving on to the general election.

Villaraigosa’s ad, titled “Three Buses,” emphasizes the struggles he faced growing up in East Los Angeles and addresses one of his central campaign themes — that he’s the candidate best suited to help working-class Californians.

“I know how far a bus can take you,” Villaraigosa says in the ad.

California lawmakers shelve proposal to ban tackle football for children under 12

Faced with a lobbying blitz by youth football fans, state lawmakers have sidelined a proposal that would have made California the first state to prohibit minors from playing organized tackle football before age 12, representatives said Friday.

The measure had been proposed after consultation with medical professionals who believe limiting tackle football would help prevent young athletes from sustaining long-term brain damage caused by repetitive tackling, hitting and blocking.

Assemblyman Kevin McCarty (D-Sacramento) confirmed Friday that he has cancelled a committee hearing scheduled for next week on the Safe Youth Football Act, signaling his decision that AB 2108 will not advance to a vote this year.

“We’re taking a time out,” McCarty said Friday.

Multiple studies are expected in the coming months on the health impacts of football on the brains of children and they could inform a future debate, said Terry Schanz, the assemblyman’s chief of staff.

“It’s an important issue that he is going to continue to look at,” Schanz said.

The bill, which originally banned tackle football for minors before high school, was amended but still faced a lack of support in the Legislature after youth football backers launched a social media drive under the banner of a new Save California Football Coalition. They collected more than 45,000 signatures opposing the legislation.

Pop Warner spokesman Brian Heffron said Friday the decision to shelve the bill “is welcome news for the 100,000 kids who play youth football in California. We’re grateful to those in the Assembly who recognize that tackle football has never been safer, thanks to our many rule changes, improved coaching education and commitment to player safety.”

Assemblywoman Lorena Gonzalez Fletcher (D-San Diego), a co-author of the measure, said the bill may not get a vote this year but the issue is not going away.

“I’m going to continue to talk about the dangers of youth tackle football whether there’s a bill or not,” she said. “I’m confident that one day in California, kids under 12 will be playing only flag football.”

Supporters of the bill had cited studies that show chronic traumatic encephalopathy is caused by repetitive impacts to the head sustained over a period of time. Gonzalez Fletcher said children who play contact sports during critical years of brain development are at a significantly greater risk for neurological impairments and CTE later in life.

However, Pop Warner officials said they have taken steps to make the sport safer for young kids, including “a series of dramatic rule changes and safety protocols” implemented since 2010 with guidance from an independent medical advisory committee of neurologists, sports medicine professionals and medical researchers.

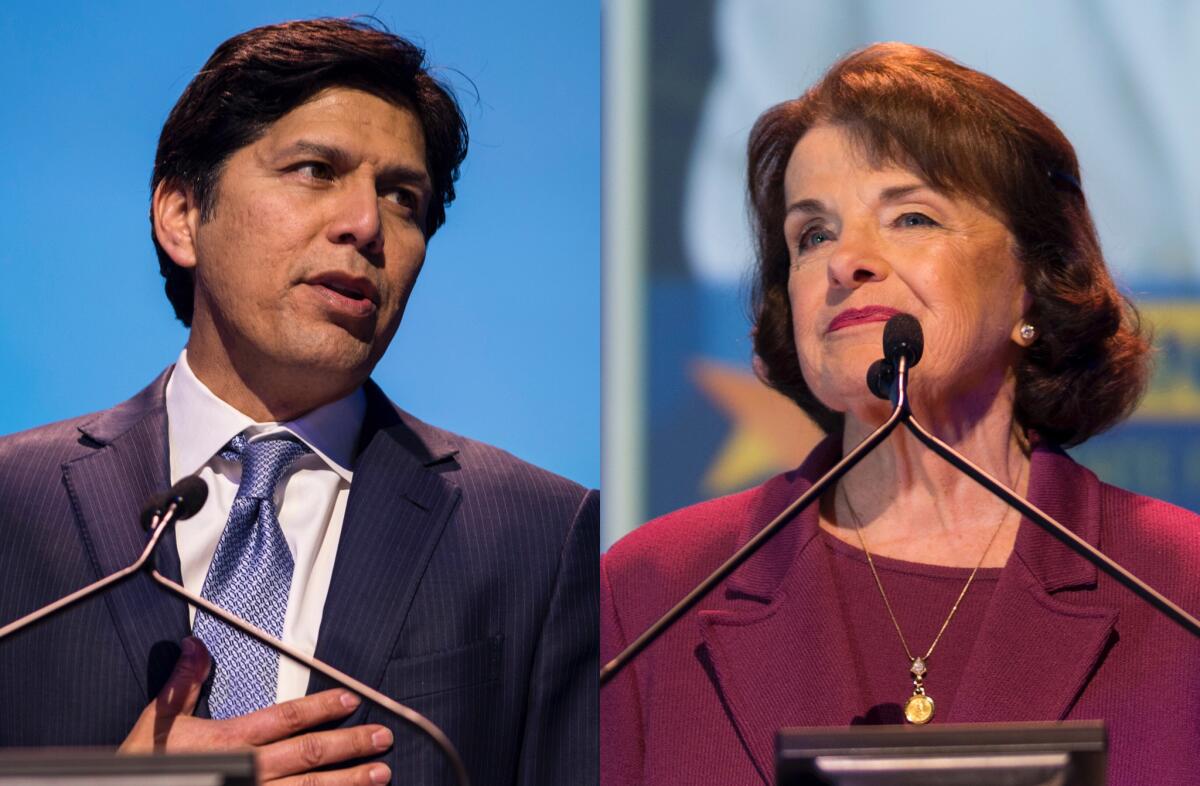

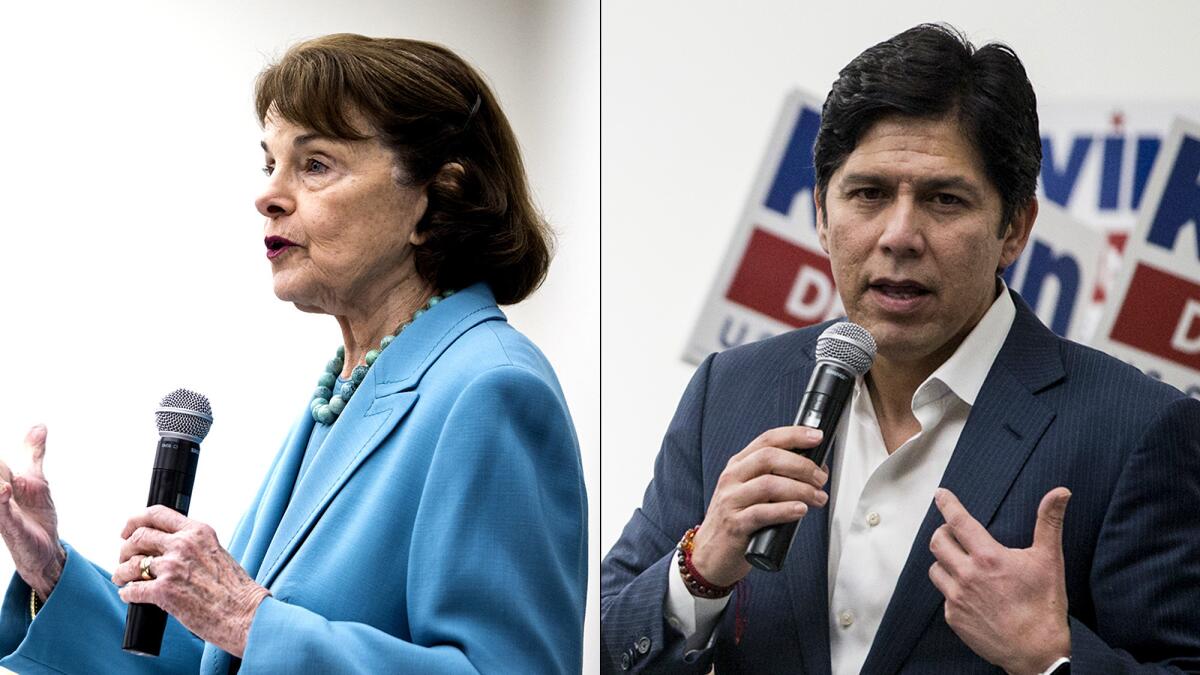

Sen. Dianne Feinstein won’t participate in pre-primary debate

California Sen. Dianne Feinstein will not participate in a proposed pre-primary debate because there are too many candidates in the race, her campaign spokesman said Thursday.

Political activists with the group Indivisible Los Angeles said they had a venue and date — May 5 — reserved for a debate with four of the Senate candidates. But they said if Feinstein does not participate, it will be canceled.

Feinstein faces 31 primary opponents in her bid for a fifth full term representing California in the Senate.

Feinstein staffers initially said she had a prior commitment on May 5 in San Francisco. When organizers offered to let her campaign pick another date, her campaign said it wasn’t fair for the group to invite only some of the candidates when there is such a big field, said Tudor Popescu, volunteer community organizer with Indivisible Los Angeles.

The invited candidates, all Democrats, were Feinstein, state Sen. Kevin de León, political action committee director Alison Hartson and lawyer Pat Harris. They were selected based on fundraising and poll numbers. There are 11 Republicans, 10 Democrats, nine independents and 2 third-party candidates running for Senate on the June ballot.

Indivisible Los Angeles is still hoping Feinstein will pick another date, Popescu said.

Feinstein spokesman Jeff Millman pointed to a San Francisco Chronicle endorsement of Feinstein, which indicates that she told the editorial board she would be willing to have a debate ahead of November’s general election.

“Senator Feinstein looks forward to debating her opponent in the general election,” Millman said in an email.

Feinstein holds a substantial lead in both fundraising and in the polls. Front-runners in statewide races have routinely declined to debate their challengers, knowing that it’s free publicity for candidates who don’t have the cash to increase their name recognition on their own.

De León spokesman Jonathan Underland said the state senator has done candidate forums before, but planned to attend the May 5 debate only if Feinstein did.

“We basically said we’ll clear his calendar 100%, we’ll clear his calendar if Feinstein shows up,” Underland said. “We‘d love to make it happen, but we want her to be there.”

NRA, Olympic shooter sue California over its restrictions on ammunition sales

The National Rifle Assn. and its state affiliate have filed a fourth lawsuit against California over its gun control laws, this time challenging new restrictions on the sale and transfer of ammunition.

The NRA and the California Rifle and Pistol Assn. filed a challenge in federal court to a requirement that ammunition sales and transfers be conducted “face to face” with California firearms dealers or licensed vendors, ending purchases made directly from out-of-state sellers on the internet. The lawsuit in the United States District Court for the Southern District of California also challenged a requirement starting next year for background checks for people buying ammunition.

The lawsuit was filed in the name of Kim Rhode, a six-time Olympic medal-winning shooter, and others. It challenges California’s new ammunition sales restrictions as a violation of the 2nd Amendment and the commerce clause of the United States Constitution.

Restrictions on ammunition purchases were included in Proposition 63, approved by voters in 2016, and in bills approved by the Legislature.

“As a result of these laws, millions of constitutionally protected ammunition transfers are banned in California,” Chris W. Cox, executive director of the NRA’s Institute for Legislative Action, said in a statement. “California’s law-abiding gun owners are sick of being treated like criminals and the NRA is proud to assist in this fight.”

Lt. Gov. Gavin Newsom, who is running for governor, defended his initiative and vowed to fight the NRA lawsuit.

“We wrote Proposition 63 on solid legal ground and principle: If you’re a felon banned from possessing guns in California, then you should not be able to purchase the ammunition that makes a firearm deadly,” Newsom said in a statement. “California voters said loudly and clearly that guns and ammunition do not belong in the hands of dangerous individuals — but once again, the NRA has prioritized gun industry profits over the lives of law-abiding Californians.”

Nunes, McClintock races downgraded from ‘safe’ to ‘likely’ Republican by one election handicapper

Reps. Devin Nunes (R-Tulare) and Tom McClintock (R-Elk Grove) fell behind in one election handicapper’s ratings on Thursday, giving more optimism to Democrats who hope to regain control of the House in November.

Nunes’ and McClintock’s districts were downgraded to “likely Republican” from “safe Republican” by analysts at Larry J. Sabato’s Crystal Ball at the University of Virginia Center for Politics on Thursday.

Nunes has made a name for himself as a Trump defender and as chairman of the House Intelligence Committee, a newfound notoriety that the analysts said could both hurt and help him. He raised more than $1 million in the first quarter of 2018, but so did his Democratic opponent, Andrew Janz, a Fresno County deputy district attorney.

McClintock, who only scraped out a close victory in 2008, a strong Democratic year, sits in a suburban Sacramento district Trump won, but it’s likely he will have a credible Democratic challenger in November.

See how Times politics editors rank the toughness of those races.

Republicans hope to ride a gas-tax repeal to victory

In a Central Valley barn decked out in red, white and blue, dairyman and state Senate candidate Johnny Tacherra drew cheers from a crowd of fellow farmers when he said he opposes the California Legislature’s hike on gas taxes and vehicle fees.

“I would not have voted for that. It is not the time to be voting on (raising) the gas tax,” said Tacherra, a Republican running against Democratic Assemblywoman Anna Caballero, who voted for the tax increase last year.

Three hundred miles away the same week, a campaign mailer arrived at homes in Orange County from an Assembly candidate with a message blaring from the cover in bold type: “Republican Greg Haskin — tough enough to stand up to Jerry Brown and repeal the gas tax.”

Treasurer John Chiang launches ad in governor’s race touting his record as a fiscal steward

In his first television ad in the governor’s race, state Treasurer John Chiang touts his record on fiscal issues as California faced the recession.

“Some thought we were done,” Chiang says in a voiceover in the 30-second spot he released Thursday, with images of him standing seriously at a lectern and complimentary headlines about his work as controller and treasurer. “But I knew better. I made the tough calls. And brought California back from the brink of financial disaster because you trusted me to manage our economy.”

Chiang’s campaign is spending about $500,000 to air the ad in Los Angeles and San Diego in coming days.

That buy is dwarfed by seven-figure purchases for ads supporting Lt. Gov. Gavin Newsom and former Los Angeles Mayor Antonio Villaraigosa. Newsom is the front-runner, while Villaraigosa is battling for second place with Republican businessman John Cox. Chiang has been mired in the single digits in almost all polling in the race.

His ad, called “Quiet Storm,” tries to portray Chiang as a progressive who is effective and can move policy in Sacramento.

Chiang points to his work challenging Wells Fargo before arguing that he could accomplish what “doubters” say is impossible to improve the state’s healthcare, housing and schools.

“I say, we got this,” Chiang concludes.

Been ignoring the race for California governor? That’s OK, in some ways it’s just starting

On a recent trip to Iowa, Eric Garcetti — the mayor of Los Angeles and a possible 2020 White House contestant — raised eyebrows with a bit of exuberant outreach.

Los Angeles and Iowa, Garcetti insisted, “have a ton in common,” and he didn’t simply mean both are inhabited by carbon-based life forms needing oxygen to survive.

Urban or rural, farmer or fashion plate, all of us harbor the same hopes and dreams, the mayor suggested, and if it wasn’t a terribly original thought it also wasn’t the most egregious sort of political pandering — like, say, ordering that every home in Los Angeles be powered by Iowa-produced ethanol.

California voters should expect to decide on an $8.9-billion water bond in November

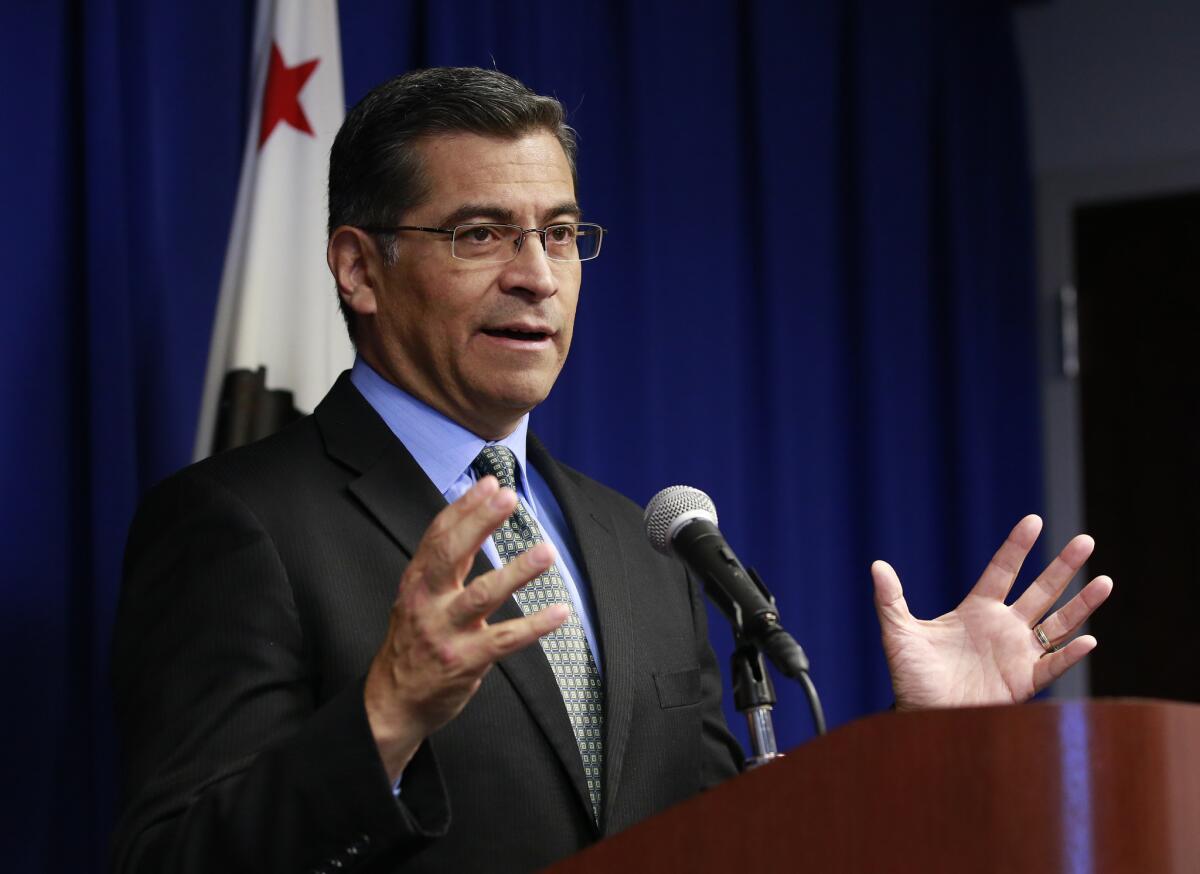

A proposal to borrow $8.9 billion for improvements to California’s water quality systems and watersheds and protection of natural habitats is eligible for the statewide ballot in November, Secretary of State Alex Padilla announced in a press release Wednesday.

Padilla said the measure, which is backed by agricultural interests, had exceeded the 365,800 valid signatures it needed to qualify for the general election ballot.

The bond measure will appear on the ballot unless proponents withdraw it by June 28, the release said.

The bond is one of many voters could decide on in 2018. A $4-billion bond for parks and water infrastructure improvements will appear on the June 5 ballot. State lawmakers approved it last year.

They came for Darrell Issa. They stayed with their inflatable chicken, blue wall and signs for political therapy

A mother of two turned ringleader of “the resistance” and more than a hundred of her faithful followers gathered on Tuesday morning outside Rep. Darrell Issa’s office in a northern San Diego County suburb. Across the street was her foil, a wedding DJ in a red “Make American Great Again” cap, setting up hefty speakers for an upcoming war of words.

For about 65 weeks the deep divide in America played out along this 100-yard stretch of road in Vista. Here, at 10 a.m. every Tuesday, passersby found signs, chants, songs and, if they were lucky, sometimes a 20-foot-tall inflatable chicken with a Trump-esque coif.

They’d also glimpse the state of the body politic in 2018, a time when shock has turned to anger and post-2016 calls for reconciliation have morphed into grudging acceptance that each side might be better off in their respective corners. Or in this case, their sides of the street.

On Tuesday, the anti-Issa, anti-Trump contingent fought this particular battle for the last time, declaring it their final protest at the congressman’s office. They said they planned to use their energy to knock on doors and get out the vote, with an occasional protest on the side. Their pro-Trump rivals vowed to show up wherever they do.

Efforts to regulate bail companies have some unlikely allies: bail agents

In recent years, the seriousness and number of official complaints related to the bail industry in California have significantly increased while bail agents and bounty hunters face limited oversight, putting vulnerable communities at risk of fraud, embezzlement and other forms of victimization.

This year, as Gov. Jerry Brown has pledged to work with lawmakers in a push to overhaul how courts assign defendants bail and to better regulate bail agencies, even some who profit from the court practice admit it’s time for regulation. These bail and bail-recovery agents could become unlikely allies, saying they advocate for change because they’ve seen the system abuse the poor.

California voters: Get ready for an onslaught of television ads

After a sleepy campaign, California voters are now being bombarded with television advertisements in the governor’s race, an onslaught that is expected to ramp up in coming weeks.

The ads most frequently seen on television are those promoting Lt. Gov. Gavin Newsom, the front-runner in the race, and former Los Angeles Mayor Antonio Villaraigosa, who is trying to secure the second spot in the June primary.

Newsom’s campaign and an outside group backing Villaraigosa are spending seven figures weekly on these efforts, according to filings with the California secretary of state’s office and a media buyer who asked not to be identified in order to freely discuss the ads.

Other gubernatorial candidates are expected to hit the airwaves soon, the media buyer said. State Treasurer John Chiang has reserved a half-million dollars in the coming days in the Los Angeles and San Diego markets, and Villaraigosa’s campaign has requested availability in at least five of the state’s biggest TV markets.

The GOP candidates in the race, who will be seeking the state Republican Party’s endorsement at its convention next weekend, have been much less active.

Businessman John Cox in recent weeks has been spending about $90,000 per week, but doubled that this week in Los Angeles and added small buys on KFI-AM radio and cable in markets including Fresno, Bakersfield and Salinas.

State Assemblyman Travis Allen of Huntington Beach, who has been scooping up Republican Party endorsements across the state, has yet to make a notable television or radio buy, though he and Cox have received some attention as commentators on Fox News.

Republicans ready to turn in signatures for ballot measure to repeal California gas-tax increase

Republican activists said Tuesday that they have collected at least 830,000 signatures for an initiative to repeal recent increases in California’s gas tax and vehicle fees, more than enough to qualify the measure for the November ballot.

The activists need 585,407 signatures of registered voters to qualify the ballot measure.

Because signatures are still being processed and counted by the campaign, backers hope to have 900,000 by the time they begin turning them in to the counties on Friday, according to Carl DeMaio, a former San Diego City Council member and organizer of the drive.

“The breadth and depth of voter anger over the car and gas tax hikes is just amazing,” said DeMaio, who hosts a radio talk show. “We are seeing Democrats, independents and Republicans sign the petition and volunteering to carry the petition, people from all walks of life.”

The initiative targets a law approved in April 2017 by the Legislature and Gov. Jerry Brown that is expected to raise $5.4 billion annually for road and bridge repairs and improvements to mass transit.

The money comes from a recent 12-cents-per-gallon increase in the gas tax, a 20-cent increase in the diesel fuel excise tax and a new annual vehicle fee ranging from $25 for cars valued at under $5,000, to $175 for cars worth $60,000 or more.

The petition drive raised more than $2 million with significant contributions from the California Republican Party and Republican members of Congress from California, including House Majority Leader Kevin McCarthy of Bakersfield and Reps. Ken Calvert of Corona and Mimi Walters of Irvine.

Republicans hope the issue will help their candidates for office in this year’s election and hurt Democrats who support the higher taxes.

“I think this is going to put Democrats in real bad spot,” DeMaio said.

A spokesman for Brown declined to comment until the signatures are filed.

DeMaio said there were approximately 20,000 volunteer petition circulators who brought in more than 250,000 signatures, with the rest collected by paid circulators who received $1 to $2.50 per signature.

“It’s a pretty comfortable margin [of signatures] that we have been able to hit here,” DeMaio said.

Opposition will grow, he said, as more Californians get their annual vehicle registration notice.

The repeal campaign hopes to raise $5 million for the campaign to pass the constitutional amendment, which would not only repeal the increase in the gas tax and vehicle fees but require future increases to be submitted to voters.

“We know that Gov. Brown and his cohorts are going to spend an amazing amount of money to mislead voters,” DeMaio said. “But I feel pretty confident that we will repeal the gas tax.”

Rep. Duncan Hunter sets up trust to raise money for legal expenses amid ongoing criminal investigation

Rep. Duncan Hunter, R-Alpine, has filed paperwork to establish a legal expense fund amid an ongoing federal criminal investigation into misused campaign cash.

Hunter filed the required paperwork March 27, seeking a rarely granted “Legal Expense Fund” through which members of Congress under investigation or being sued in connection with doing their jobs or running for office can raise money for their legal expenses.

Such funds are administered by an independent trustee and allow donors to give above the maximum amount they can contribute a candidate’s campaign. Hunter has spent more than $600,000 of campaign money on lawyers.

Kamala Harris says she won’t take corporate donations anymore

California Sen. Kamala Harris says she will no longer accept money from corporate political action committees.

In an interview with WWPM-FM’s “The Breakfast Club,” in New York that aired Monday, the senator said she wasn’t expecting a question at a town hall this month about whether she would accept money for corporations or corporate lobbyists.

At the time, Harris said “it depends,” but she said on Monday that she had reflected on the matter and changed her mind.

“Money has had such an outside influence on politics, and especially with the Supreme Court determining Citizens United, which basically means that big corporations can spend unlimited amounts of money influencing a campaign, right?” Harris said. “We’re all supposed to have an equal vote, but money has now really tipped the balance between an individual having equal power in an election to a corporation. So I’ve actually made a decision since I had that conversation that I’m not going to accept corporate PAC checks. I just — I’m not.”

You can watch the video of the interview here. (Harris’ corporate money comments come about 30 minutes in.)

Harris wouldn’t be on the ballot for a second Senate term until 2022, though it’s widely believed that she is planning a presidential bid in 2020. Other potential 2020 presidential candidates, including Sens. Bernie Sanders (I-Vt.), Cory Booker (D-N.J.) and Elizabeth Warren (D-Mass.), have also ruled out taking corporate PAC money.

Soon after Monday’s show aired, Harris’ campaign sent out a fundraising request noting her new stance.

“As corporate PACs continue to corrupt our politics and twist Congress’ priorities at your expense, we’re going to focus on raising money from small-dollar, individual donors like you,” the email says.

With money tied up in court, California lawmakers try again with new plan to spend $2 billion on homeless housing

A measure to spend $2 billion on housing homeless Californians could be on the November statewide ballot.

State Sen. Kevin de León (D-Los Angeles) is pushing the idea to deal with what he said was a “burgeoning humanitarian crisis whose epicenter is here in California.”

De León’s new measure is a do-over for a 2016 plan passed by the Legislature to redirect $2 billion toward building homeless housing from a voter-approved 1% income tax surcharge on millionaires that funds mental health services. A Sacramento attorney sued over that decision, arguing that the move violated constitutional rules on approving loans without a public vote and that lawmakers shouldn’t take money away from mental health treatment. The case remains active in Sacramento Superior Court and it’s unclear when, or if, the state will be able to spend the $2 billion.

De León’s Senate Bill 1206 would put the $2-billion loan on the ballot in November, freeing up the money if voters approve the measure. De León said had he been able to predict the 2016 plan would end up in court, he would have sought a ballot measure at the time.

“We thought this was like apple pie and baseball and puppies,” De León said. “Who would oppose the idea of repurposing the dollars to build immediate housing as a permanent solution for homelessness? Obviously with a crystal ball, had I anticipated the litigation, I would have worked to place it on the ballot.”

De León noted that the 2016 plan had bipartisan supermajority support in the Legislature, something his new bill also will need to get on the ballot. Sen. John Moorlach (R-Costa Mesa) is a coauthor of the plan.

SB 1206 is scheduled for its first hearing in the Legislature on Wednesday.

Should De León’s measure be approved, it will join a crowded list of housing issues before voters in November. Californians will decide on a separate $4-billion bond to help finance new low-income housing and home loans for veterans. De León said he’s not worried those two measures will compete against each other because voters are aware of the scale of the state’s housing problems and the proposed homeless housing bond redirects existing dollars instead of raising taxes.

“Once [voters] know that the impact on their pocketbook is not existent, I’m confident that they’ll join me and my colleague John Moorlach in support of this measure,” De León said.

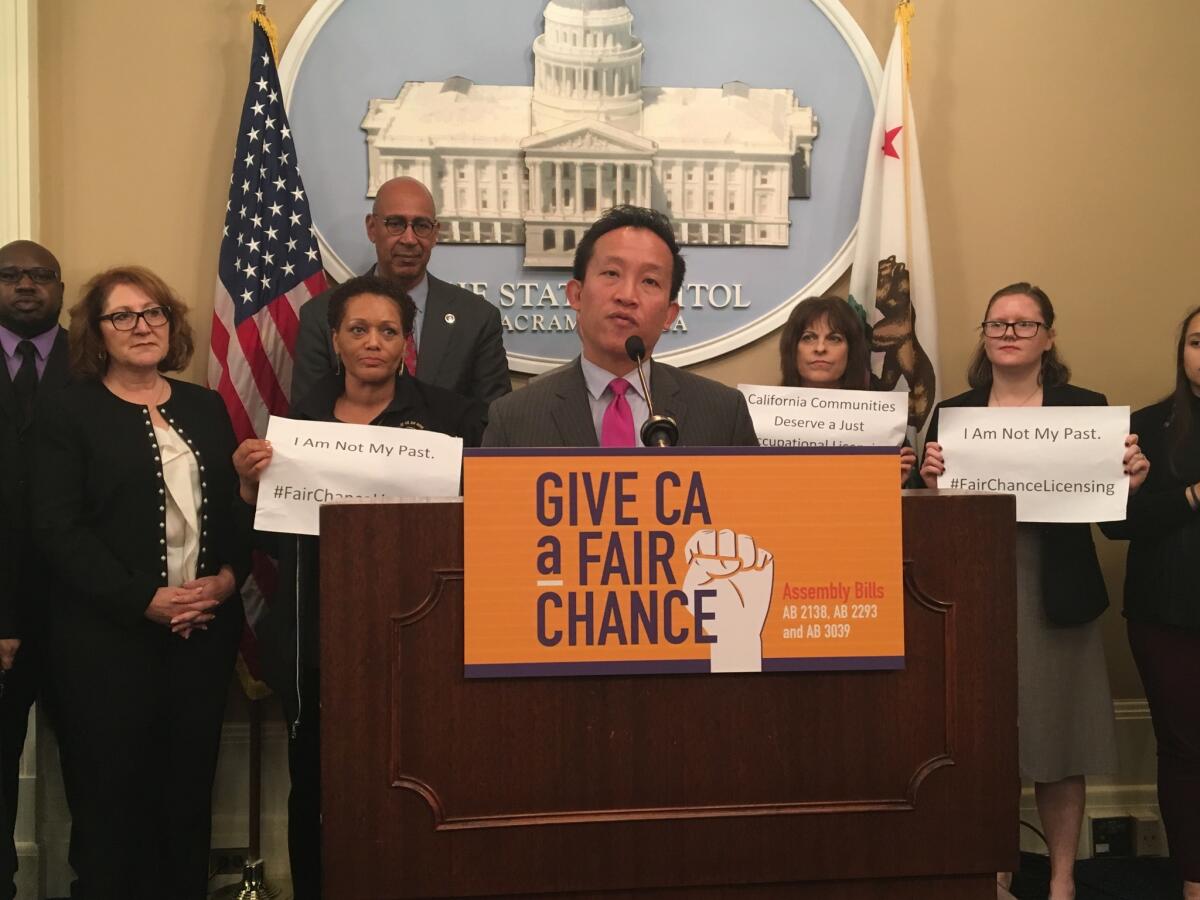

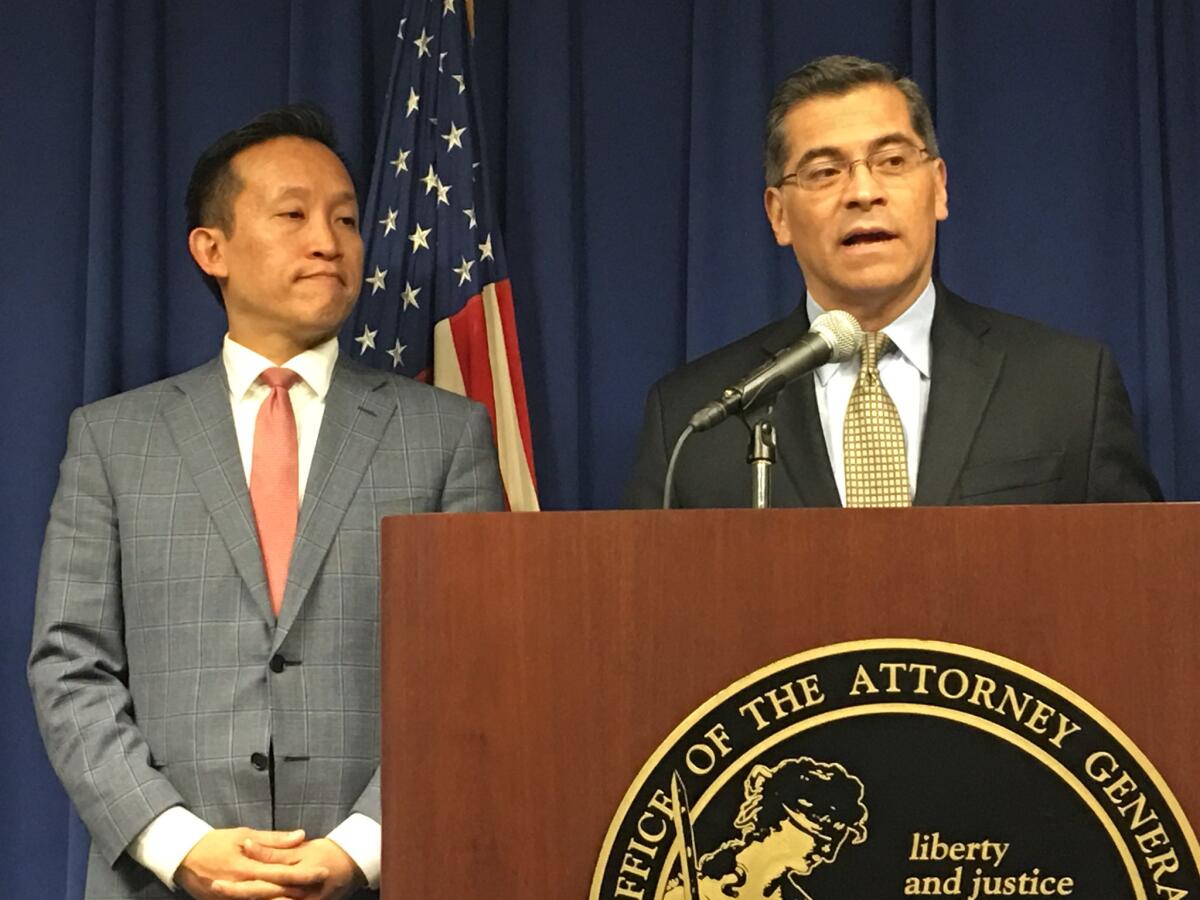

California lawmakers say too many former felons are being denied professional licenses

A trio of California Assembly members urged colleagues on Monday to pass legislation that would prohibit state commissions and agencies from rejecting a professional license for those who were once convicted of less serious crimes.

“We can’t say we want to rehabilitate people, and then block them from getting the jobs that they need when they’re released,” said Assemblyman David Chiu (D-San Francisco). “That leads to more recidivism and to more crime.”

The bills, scheduled to be heard in Assembly committees Tuesday, would ban the use of arrest or conviction records as the reason for denying a professional license. The bill would not apply to Californians who served time for any of the offenses on the state’s list of “violent crimes.”

The authors, all Democrats, said that a government-issued professional license is required for some 30% of all jobs in the state. Their bills would change the licensing process at the California departments of Consumer Affairs and Social Services and agencies that certify emergency medical technicians.

The bills would block prior convictions from leading to the delay or denial of a license unless that crime is “directly related” to the profession the person intends to pursue. Two of the bills also specifically say convictions less than 5 years old could continue to play a role in licensing decisions.

Last year, Gov. Jerry Brown signed a law that keeps private sector employers from inquiring about a job applicant’s conviction history prior to an offer of employment.

Advocates joined the lawmakers at a press conference in Sacramento to point out that limits on awarding licenses should focus only on those whose prior criminal activity could pose a threat to consumers.

“Continuing to hold people back for crimes that are 6, 7, 8, 10, 20 years old does not actually make sense if you’re looking at public safety,” said Jael Myrick of the East Bay Community Law Center.

One of the proposals, Assembly Bill 2293, seeks to make it easier for ex-felons to get a license allowing a job with the California Department of Forestry and Fire Protection — the same agency that often uses prison inmates to battle blazes around the state.

“If a person is good enough to risk their life fighting fires for the state of California as an inmate,” said Assemblywoman Eloise Gomez Reyes (D-Grand Terrace), “their previous actions should not prevent from having a job utilizing the skill set that they learned.”

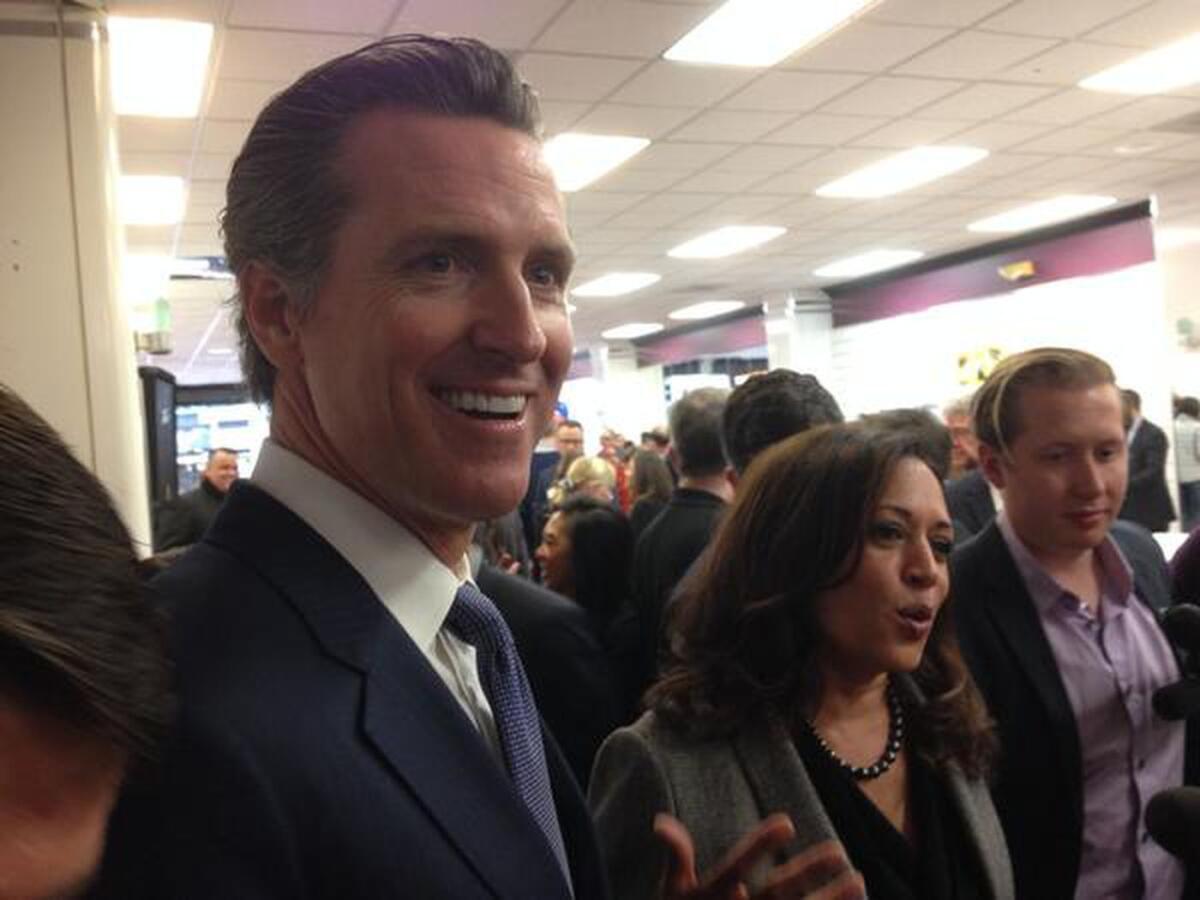

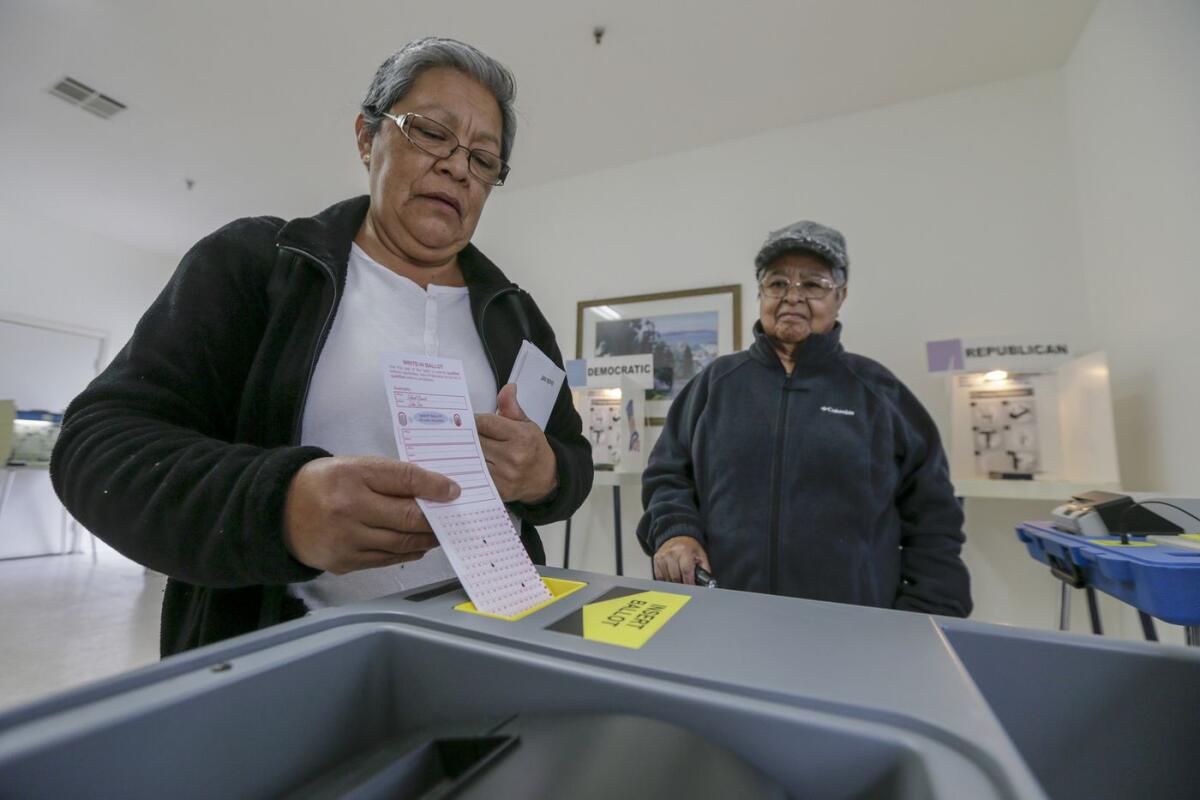

Newsom highlights liberal bona fides in his first ad in the governor’s race

Gubernatorial front-runner Gavin Newsom released his first television ad of the race on Monday, days after a well-funded effort to boost fellow Democratic candidate Antonio Villaraigosa went on the air with its own spot.

The 30-second ad, being aired statewide on broadcast and cable, highlights Newsom’s record on same-sex marriage, universal healthcare and gun control.

“The one candidate with the record of bold leadership and bold results,” a narrator says over images of Newsom looking serious and making a speech. It also mentioned endorsements he has received from Sen. Kamala Harris and various unions, and included the slogan, “Courage for a change.”

Newsom’s campaign declined to say how much it was spending to air the spot, which appears designed to appeal to Democratic-base voters.

The lieutenant governor and former mayor of San Francisco is dominating fundraising and polls in the race. Last week, an independent expenditure group called Families & Teachers for Antonio Villaraigosa for Governor launched a spot in support of the former mayor of Los Angeles. The group is funded by a trio of wealthy charter school backers, and by law cannot coordinate with a candidate.

Its ad is aimed at boosting Villaraigosa’s chances of coming in second in the June 5 primary and moving onto the general election. In recent polling, Villaraigosa has placed third, behind Republican businessman John Cox.

The group released the ad on Thursday. The following day, the Newsom campaign’s attorney demanded that California television stations stop airing it, arguing that it violated elections law because it used snippets of video from the Villaraigosa campaign. The independent expenditure committee’s attorney responded by saying the allegations have “no merit” and are misleading.

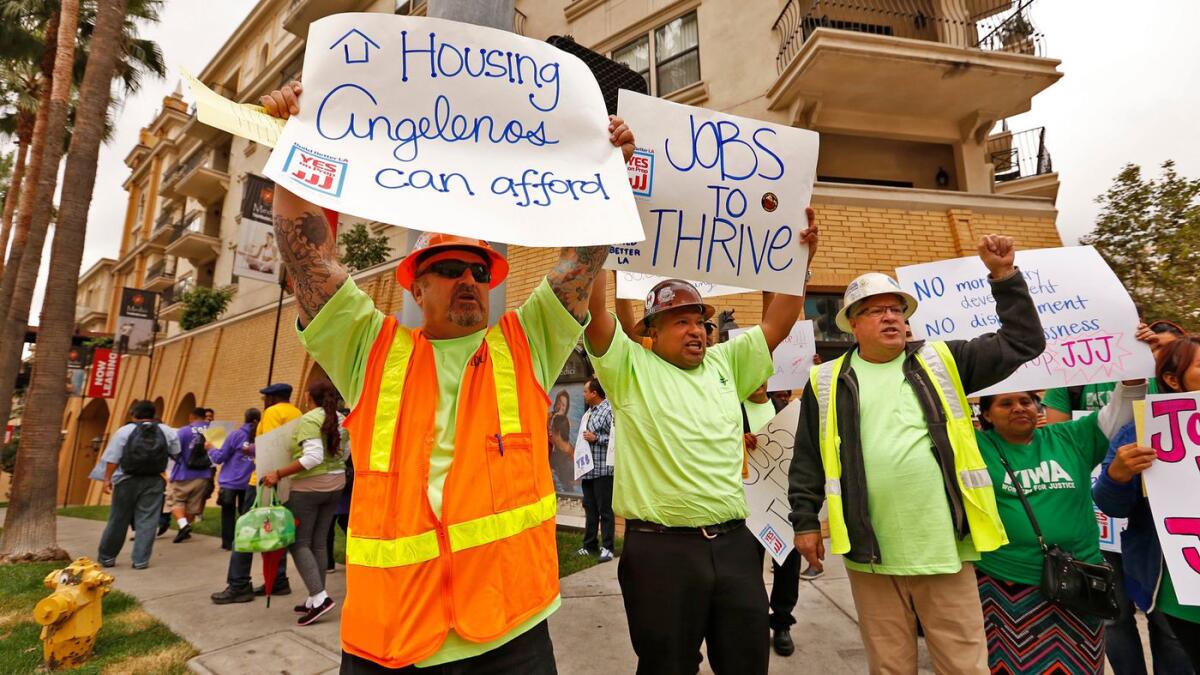

Assembly speaker rebukes building trades union after it targets Assemblywoman Cristina Garcia

The decision by a politically powerful labor group to openly campaign against an embattled Los Angeles-area lawmaker drew a sharp rebuke on Friday from Assembly Speaker Anthony Rendon.

The Lakewood Democrat lashed out hours after the State Building and Construction Trades Council of California filed paperwork for a political action committee to defeat Assemblywoman Cristina Garcia (D-Bell Gardens). Garcia, who’s seeking her fourth term, took an unpaid leave of absence in February following allegations of sexual misconduct. She has denied the reports and an Assembly investigation remains underway.

Rendon didn’t criticize the labor group by name, insisting instead that the decision was driven by oil and gas industry interests.

“This is a thinly veiled attempt by Big Oil and polluters to intimidate me and my members. It is an affront to my speakership,” Rendon said in a statement. “We are proud of the work that the Assembly has done to increase jobs and wages while defending our environment. We will vigorously defend the members of our caucus from any ill-advised political attack.”

A statement from the labor group, which sparred with Garcia last year on her effort to link new climate change policies with a crackdown on air pollution, said it had decided to “reverse” past support for her.

“The Trades have thousands of hard working members in Garcia’s district, and we look forward to lifting up another Democrat in the 58th Assembly to better represent them and their families,” said the statement.

The political action committee’s campaign finance filing on Friday listed nonmonetary “in kind” contributions from Erin Lehane, a public affairs consultant aligned with the building labor group. Lehane said she had begun “researching” Garcia in November. In January, a former legislative staffer accused her of groping him in 2014.

Lehane, who identified herself as a spokesperson for the labor group’s political action committee, said on Friday that she believed Garcia’s “hypocrisy threatened a movement that will dictate how much harassment and abuse my daughter will face in her work life.”

Garcia, who has been an outspoken advocate for women in the #MeToo movement, has complained that her political opponents helped fan the flames of the accusations. Through a campaign consultant, she declined to comment on Friday.

Rendon’s critique came on the heels of a full-page ad in The Times on Friday, partly paid for by the Trades Council, that criticized “well-funded ivory tower elites” who push proposals that hurt the oil and gas industry.

“We are the real jobs that fuel the real California economy,” read the advertisement.

See Team Politics at the Festival of Books this weekend

For anyone interested in politics, this weekend’s L.A. Times Festival of Books at USC will be the place for you.

It’s a great event — the biggest book festival in the country and a showcase for ideas and literature in California.

Members of the Times’ California politics team and the Washington bureau will be there in force. We’ll talk about the contest for governor and the midterm elections on Sunday at 1:20 p.m. There also are a number of panels on the Trump administration and politics, moderated by Times journalists.

Here’s the full schedule. To see where we’ll be, filter the list by Politics & History. Also, don’t miss the Ask a Reporter booth on campus.

Legal tiff breaks out over independent committee’s ad backing Antonio Villaraigosa for governor

An attorney representing Gavin Newsom’s campaign for governor is demanding that California television stations cease airing an ad by an independent political committee supporting his Democratic rival Antonio Villaraigosa.

Attorney Thomas A. Willis, in a letter to the stations, said the ad is “false and misleading and violates California law” because it uses snippets of video footage from Villaraigosa’s own campaign ads. Willis called that illegal coordination between the campaign and PAC.

“Under California law, advertisements made by entities other than a candidate are presumed to be ‘coordinated’ — and thus not independent expenditures — when the advertisement replicates, reproduces or disseminates substantial parts of a communication, including video footage, created and paid for by the candidate,” the letter states.

A representative for the independent expenditure committee — Families & Teachers for Antonio Villaraigosa for Governor — fired back. Attorney Brian T. Hildreth says those allegations have “no merit” and accused the Newsom campaign of being misleading.

Hildreth sent a letter to the television stations in response, urging them to ignore the Newsom campaign’s accusations.

He said the Newsom camp “appears to intentionally misrepresent the law” and that the video use was permissible. He said only six seconds of video from Villaraigosa’s campaign ads was used, which is well within the legal limits.

The independent committee is sponsored by the group California Charter Schools Assn. Advocates, according to the California secretary of state’s office. The ad is airing on broadcast and cable stations statewide.

The committee’s ad is focused on Villaraigosa’s record as Assembly speaker and as mayor of Los Angeles when there was a drop in crime.

Governor’s race snapshot: Californians are generally upbeat but not focused on the campaign

As California chooses a new governor — one of just a handful in the last 40 years not named Jerry Brown — the state seems to be enjoying something unusual in these tumultuous political times: a feeling of relative contentment.

Not to say things are perfect.

Still, more than 100 random interviews conducted over the length and breadth of the state — from Redding in the north to Santee in the south, from the Pacific coastline to the edge of the Sierra Nevada — found most saying things are looking up, at least so far as California’s direction is concerned.

California housing crisis podcast: One of the nation’s biggest housing bills meets its demise

Earlier this week, state senators killed legislation that would have boosted the number of homes that could be built near transit stops across Los Angeles and the rest of the California.

The measure, SB 827, attracted national attention because it aimed to address both California’s housing shortage and environmental goals. But SB 827’s author, Sen. Scott Wiener (D-San Francisco), failed to garner enough support from his colleagues at the bill’s initial committee hearing.

On this episode of Gimme Shelter: The California Housing Crisis Pod, we break down why the bill failed and explain what might come next.

“Gimme Shelter,” a biweekly podcast that looks at why it’s so expensive to live in California and what the state can do about it, features Liam Dillon, who covers housing affordability issues for the Los Angeles Times’ Sacramento bureau, and Matt Levin, data reporter for CALmatters.

You can subscribe to “Gimme Shelter” on iTunes, Stitcher, Soundcloud, Google Play and Overcast.

Sierra Club backs Gavin Newsom for California governor

The Sierra Club endorsed Lt. Gov. Gavin Newsom in the race for California governor, with officials in the established environmental group praising the Democrat’s record on climate change and clean energy.

“He has a proven record for leading on environmental protection, public health and clean energy,” Kathryn Phillips, director of Sierra Club California, said in a statement released by the Newsom campaign. “He understands that we are feeling the effects of climate change and that California must reduce carbon emissions and reach 100% renewable energy to achieve our climate goals.”

Phillips said the Sierra Club’s extensive network of volunteers will campaign for Newsom as the June 5 primary approaches. Sierra Club executive director Michael Brune also praised the Democrat, saying he will protect California from “Donald Trump’s attacks on our clean air and water.”

The Sierra Club joins a series of other influential groups in California that have backed Newsom.

The California Medical Assn., the powerful state doctors lobby, announced its endorsement of Newsom on Thursday. The California Nurses Assn. and the Service Employees International Union, one of the most powerful labor unions in the state, also support Newsom.

Newsom is the race’s front-runner in polls and fundraising.

A poll released earlier this month by the nonpartisan Public Policy Institute of California found that 26% of likely voters backed Newsom. John Cox, a Republican from Rancho Santa Fe, was favored by 15% of likely voters and former Los Angeles Mayor Antonio Villaraigosa, a Democrat, by 13%.

California’s GOP House members are taking their challengers more seriously and the numbers show it

For much of last year, consultants and campaign managers for some of California’s most vulnerable Republican incumbents maintained a bullish tone on the prospect that the GOP would hold the House in this year’s midterms.

The National Republican Congressional Committee insisted that longtime Republican incumbents in California had built up reputations as effective champions of local issues that would help them weather a flood of Democratic enthusiasm.

Since then Rep. Ed Royce (R-Fullerton) and Rep. Darrell Issa (R-Vista) have decided not to seek reelection and the NRCC has opened a West Coast headquarters in Orange County.

GOP challenger to Rep. Dana Rohrabacher drops out, endorses another Republican opponent

California officials say Pentagon has confirmed National Guard funding despite Trump threat

The awkward dance between Gov. Jerry Brown and the federal government over the National Guard jerked back toward discord on Thursday, when Trump said he would refuse to pay for a new deployment of troops — just hours after his administration said otherwise.

And a few hours later, California officials said they had received written confirmation from the Pentagon that the mission would indeed be funded.

Trump had earlier called Brown’s decision to approve 400 troops for a mission focused on combating transnational crime and drug smuggling a “charade” in a tweet. “We need border security and action, not words!” the president wrote.

A spokesman for Brown pointed to a tweet written Wednesday night by Homeland Security Secretary Kirstjen Nielsen, thanking the California governor for his efforts. Trump was meeting on Thursday with Nielsen at his Mar-a-Lago estate not long after his tweet was posted.

A tweet later posted by the California National Guard said that almost three hours after Trump’s comment, the state received “written confirmation from the Pentagon” to fund the mission as outlined by Brown the day before.

“In short, nothing has changed today,” said a subsequent Guard tweet.

Brown was the last of the nation’s border governors to respond to Trump’s insistence earlier this month that National Guard troops were needed to assist with immigration-related duties at the U.S.-Mexico border. And he has consistently refused to allow California troops to engage in any mission related to federal immigration law.

“This will not be a mission to build a new wall,” Brown wrote last week to Nielsen and Defense Secretary James N. Mattis. “It will not be a mission to round up women and children or detain people escaping violence and seeking a better life.”

Exactly what the California operations will cost remains unclear, as state officials have said it will depend on decisions made once the mission begins. The funds would not be transferred to the state, but instead would be paid directly by the Department of Defense.

Trump has critiqued California several times over the past few days, often writing tweets that embrace the actions by some cities and counties to join his administration’s lawsuit against the state’s sanctuary immigration law. He made similar comments to reporters on Thursday afternoon.

“If you look at what’s happening in California with sanctuary cities — people are really going the opposite way,” Trump said. “They don’t want sanctuary cities. There’s a little bit of a revolution going on in California.”

2:26 p.m.:This article was updated with additional information from the California National Guard and with remarks from Trump.

This article was originally published at 9:51 a.m.

Gay ‘conversion therapy’ services would be banned under measure advancing in California

The California Assembly voted Thursday to add gay “conversion therapy” to the state’s list of deceptive business practices, following a debate that focused on the personal experiences of several lawmakers and hinted at potential lawsuits to come.

“It is harmful and it is unnecessary,” Assemblyman Evan Low (D-Campbell), the bill’s author and one of the Legislature’s most vocal LGBTQ members, said of the practice.

Low, who told Assembly members that he explored conversion therapy as a teenager and suffered depression over his sexual orientation, insisted that the bill would be limited to efforts that involve the exchange of money.

“There’s nothing wrong with me,” he said in an emotional speech on the Assembly floor. “There’s nothing that needs to be changed.”

The bill, which now heads to the Senate, has become the focal point of intense debate on social media. Some religious groups have said that such a law would be a violation of their constitutional rights, while advocates insist the provisions are narrow and there’s no credible evidence that the services work.

One key part of the debate centers on whether Assembly Bill 2943 would stretch beyond businesses that charge for these programs and extend to printed documents, even Bibles. An analysis by the Assembly Judiciary Committee says the bill would apply only to services that purport to change a person’s sexual orientation and offered “on a commercial basis, as well as the advertising and offering of such services.”

Lawmakers who spoke in support of AB 2943 also made clear that they believe those kinds of services have been discredited. “This is fraudulent, it should not be occurring,” said Assemblywoman Susan Eggman (D-Stockton). “But you can still try to pray the gay away, if you like.”

Assemblyman James Gallagher (R-Yuba City), who said the bill addresses a difficult issue, nonetheless said that it’s important to ensure laws don’t tamper with religious freedom.

“We have to think about the legitimate experience of people who have gone through conversion therapy and said this was a good thing for them,” Gallagher told his colleagues.

California law already bans the use of conversion therapy by mental health professionals on those under age 18. Low’s bill would expand the state’s efforts beyond minors. It would join a list of commercial activities deemed “unfair or deceptive acts or practices” and therefore banned under state law.

Gavin Newsom gets backing from doctors group, despite differences over single-payer healthcare

California’s doctors are siding with Gavin Newsom in the governor’s race, even though they don’t see eye-to-eye on a defining issue of the campaign: single-payer healthcare.

The California Medical Assn., the state doctors lobby and a political heavyweight, announced its endorsement of the lieutenant governor on Thursday.

“Gavin is a lifelong champion for health care in California, and we know he will continue to fight for pragmatic solutions to our most crucial health care challenges, including working to achieve universal access and tackling our state’s physician shortage,” CMA President Theodore M. Mazer said in a statement.

Newsom has made his support for state-financed healthcare a centerpiece of his campaign, and he earned the early backing of the most ardent single-payer supporters, the state nurses union.

The doctors, meanwhile, oppose the nurses’ bill, SB 562, which emerged as a flashpoint in the healthcare debate last year. The CMA said the bill “would dismantle the healthcare marketplace and destabilize California’s economy.”

Newsom has said SB 562 should advance in the Legislature, but also said it has “open-ended” issues that still need to be addressed.

The doctors group is also battling with another prominent Newsom endorser, the Service Employees International Union, over a new measure that would impose price caps on an array of medical services paid for by commercial health insurers in the state. The SEIU is a leading sponsor of the proposal; the doctors fiercely oppose it.

Newsom and the physicians group have a history of political alignment. Newsom was the first statewide official to support Proposition 56, a 2016 tobacco tax pushed by the CMA that raised revenue in part to increase money for doctors who saw Medi-Cal patients. That year, the association also endorsed two initiatives championed by Newsom: Proposition 63, which imposed new gun control measures, and Proposition 64, which legalized recreational marijuana.

Independent committee backing Antonio Villaraigosa for governor hits the airwaves with first ad

A well-financed independent committee backing Antonio Villaraigosa’s bid to be California’s next governor released its first television ad Thursday, praising his record for working with Republicans and as a candidate for “all of California.”

The ad, which is to air statewide on broadcast and cable stations, is focused on Villaraigosa’s record as Assembly speaker and mayor of Los Angeles, including on education and a drop in crime while he was at City Hall.

“To move California forward, we need to help more Californians get ahead,” the ad says. “That’s why Antonio Villaraigosa brought both parties together to balance the state budget with record investments in public schools and new career training programs.”

The independent expenditure committee behind the ad campaign, Families & Teachers for Antonio Villaraigosa for Governor 2018, is sponsored by the California Charter Schools Assn. Advocates, according to the California secretary of state’s office.

The committee is spending “seven figures” per week on the ad buy, said Josh Pulliam, a political consultant for the committee.

As mayor of Los Angeles, Villaraigosa clashed with teachers unions, starting with his failed attempt to take political control of the Los Angeles Unified School District. His fight with those unions continued after he left office in 2013.

Money has poured into the committee this month from wealthy charter schools supporters: Reed Hastings, chief executive of Netflix, donated $7 million, and Los Angeles billionaire and philanthropist Eli Broad donated $1.5 million. On Wednesday, former Los Angeles Mayor Richard Riordan donated $1 million.

The independent expenditure committee is expected to provide a boost to Villaraigosa’s campaign. Democratic front-runner Lt. Gov. Gavin Newsom has a major advantage in fundraising over all other candidates in the race and has received the backing of the California Teachers Assn. and other education unions.

A recent Public Policy Institute of California poll also showed Villaraigosa lagging in third place in the race, trailing Newsom and Republican businessman John Cox. The candidates who finish in the top two in the June 5 primary will advance to the November general election, regardless of their party affiliation.

Gov. Jerry Brown says Trump administration will fund his National Guard mission — without immigration duties

Gov. Jerry Brown formally mobilized 400 California National Guard members Wednesday for transnational crime-fighting duties, thus preventing any effort by President Trump to have the troops focus on immigration enforcement on the Mexican border.

The governor announced that federal officials have agreed to fund the plan he announced last week — a mission to “combat criminal gangs, human traffickers and illegal firearm and drug smugglers” in locations around California, including near the border. The order Brown signed makes clear that the troops will not be allowed to perform a broader set of duties as envisioned by Trump’s recent comments.

“California National Guard service members shall not engage in any direct law enforcement role nor enforce immigration laws, arrest people for immigration law violations, guard people taken into custody for alleged immigration violations, or support immigration law enforcement activities,” the order read.

The cost of the mission, a spokesman for Brown said, will be paid directly by the federal government. No initial estimate has been made, as the exact amount will depend on exactly how the troops will be used.

Though the duties of California Guard members were outlined last week, the state had been waiting for an agreement by federal officials to pay for the operations. Since that time, the president has taken Brown and the state to task over its decision to avoid any immigration-related duties at the border. On Wednesday morning, Trump tweeted, “Jerry Brown is trying to back out of the National Guard at the Border, but the people of the State are not happy. Want Security & Safety NOW!”

“Looks like Jerry Brown and California are not looking for safety and security along their very porous Border. He cannot come to terms for the National Guard to patrol and protect the Border,” Trump tweeted Tuesday.

There was no immediate reaction from the White House to Brown’s announcement.

On Tuesday, Brown told reporters in Washington that his plan was consistent with a safer border. “That sounds to me like fighting crime,” the governor said. “Trying to catch some desperate mothers and children, or unaccompanied minors coming from Central America, that sounds like something else.”

The order Brown issued Wednesday after returning from a brief trip to talk climate change in Toronto and to speak to a national trade union and visit with reporters in Washington is set to expire at the end of September. It specifically says no Guard service member may participate in a mission that would “exceed the mission scope and limitations” related to transnational crime activity. It also says troops cannot help build “any new border barrier.”

5:27 p.m.: This article was updated with information related to the cost of the Guard mission and Brown’s trip to Washington.

This article was originally published at 5:13 p.m.

California bill aims to end practice that keeps workplace misconduct cases out of court

A California bill would prohibit employers from requiring workers to use private arbitration to settle disputes, a practice that critics say shields improper workplace conduct from public view.

The bill by Assemblywoman Lorena Gonzalez Fletcher (D-San Diego) would bar businesses from making employees, when they are hired, waive their future rights to take any harassment, discrimination or other claims to court.

“Arbitration can be a highly effective dispute resolution method when both parties can choose it freely, when both parties are equal,” Gonzalez Fletcher said at a news conference on Wednesday. “It is far less successful when the more powerful party forces the other to accept those terms, especially as a condition of employment.”

Forced arbitration has come under increasing scrutiny since the #MeToo movement, with high-profile figures such as former Fox News anchor Gretchen Carlson pointing to the practice as shielding workplace abusers from public disclosure because arbitration resolutions often include nondisclosure agreements. Last year, a bipartisan bill was introduced in Congress to end mandatory arbitration in employment agreements.

Gonzalez Fletcher said she was pursuing an unusual tool to draw attention to the issue — a subpoena issued by the Legislature to compel testimony from a worker bound by a nondisclosure agreement as a result of arbitration. The Legislature has subpoena power but it is rarely used. The bill’s sponsors believe lawmakers last issued a subpoena in 2001 while investigating price manipulation by Enron.

Gonzalez Fletcher said she has requested Assembly Speaker Anthony Rendon (D-Lakewood) to issue the subpoena to require Tara Zoumer, who sued the company WeWork in 2016 for overtime pay, to testify before the Assembly Judiciary Committee next week.

Zoumer’s suit was moved to arbitration and resolved. She is now subject to a nondisclosure agreement and could face a financial penalty for speaking publicly about her case.

A spokesman for Rendon said the subpoena request is under consideration.

Business groups oppose the bill, AB 3080. The California Chamber of Commerce has dubbed it a “job biller,” claiming it would dramatically increase legal costs for businesses.

“Banning such agreements benefits the trial attorneys, not the employer or employee,” the group said.

The bill must first advance from the Assembly Labor Committee on Wednesday.

At least 240 House lawmakers want a vote on immigration. California supporters say they aren’t ready to force one

Rep. Jeff Denham says at least 240 of the 430 current House members have signed onto his resolution to hold votes on four immigration bills, and he hopes House Speaker Paul D. Ryan (R-Wis.) and President Trump are paying attention to the show of support.

But, the Republican from Turlock and his allies said Wednesday that they are not yet willing to commit to forcing Ryan’s hand through a little-used procedural move called a discharge petition; they acknowledged there’s no guarantee that all of 47 Republicans and 193 Democrats House co-signers will back them up if they try to force the issue.

“I’m sure that it is something that will be discussed in the coming weeks. You should not need a discharge petition. When you can show the overwhelming majority of the House, the support of it, you should not need a discharge petition, but it is something we would talk about in the future,” Denham said. “It is far too early to talk about next steps.”

Ryan said last week that he opposes Denham’s effort, saying it’s a waste of time for the House to vote on bills the president might veto.

Denham’s resolution would prompt debate and votes on four very different immigration bills: one favored by the Trump administration, one preferred by Democrats, one bipartisan proposal and another immigration bill of Ryan’s choice. Whichever got the most votes would move forward to the Senate.

All four bills would help Dreamers to differing degrees and include varying levels of border security or immigration enforcement. For example, the Trump-backed bill would also dramatically reduce legal immigration, while the Democrats’ would only deal with legal status for Dreamers.

Democrats say they don’t expect the show of support will sway Ryan. Congressional Hispanic Caucus Chairwoman Rep. Michelle Lujan Grisham (D-N.M.) said Tuesday night she expects Ryan will have to be forced into allowing a vote.

“It doesn’t matter how many signatures we get. We could have every signature, technically, except his, on the floor of the House and... if he doesn’t want to, it doesn’t happen,” Lujan Grisham (D-N.M.) said.

Rep. Pete Aguilar (D-Redlands), who gathered the Democratic co-sponsors for Denham, also wouldn’t give a deadline for House leaders to act, but said the co-sponsors are only willing to wait “weeks not months.”

“We do want to give them an opportunity to bring up the rule and to use whatever process they want,” Aguilar said. “They do have options, but I think they need to understand that we have options too.”

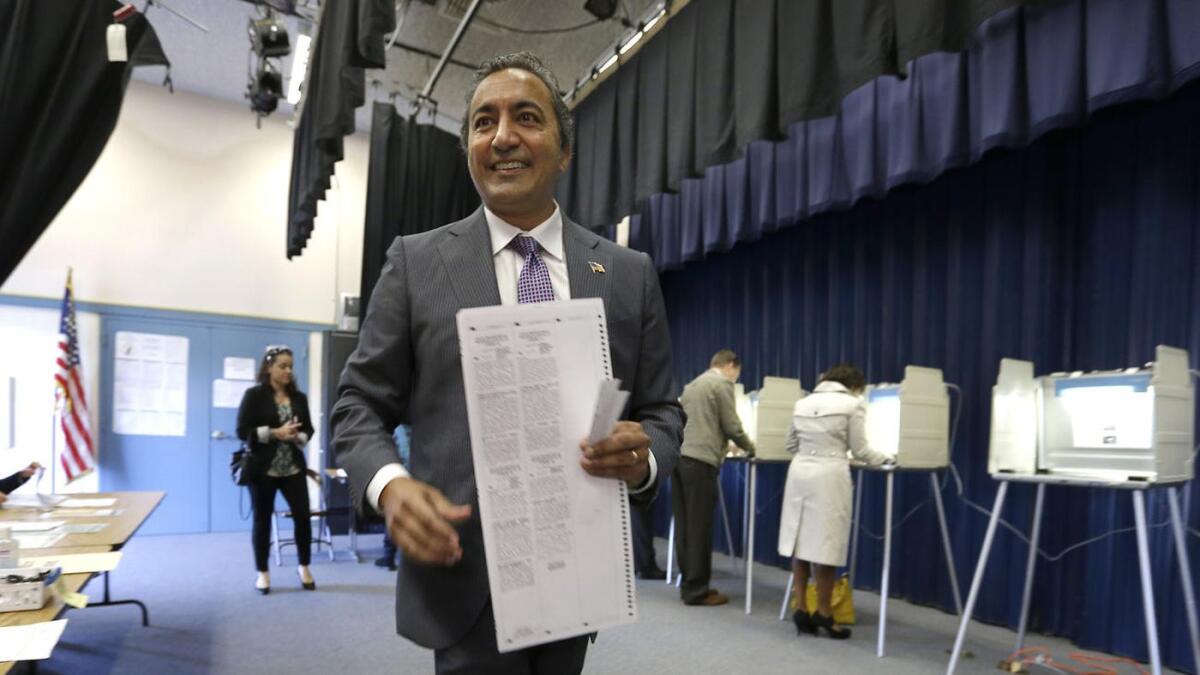

DCCC elevates Democrat Gil Cisneros in hopes of uniting Democrats to flip Rep. Ed Royce’s seat

National Democrats are inching closer to weighing in on the race to replace retiring Rep. Ed Royce (R-Fullerton).

The Democratic Congressional Campaign Committee on Wednesday added Gil Cisneros, a Democrat running for the Orange County seat, to its national “Red to Blue” program, which highlights particularly strong campaigns in crucial districts.

The only other California Democrat on the Red to Blue list is T.J. Cox, running against Rep. David Valadao (R-Hanford).

DCCC chairman New Mexico Rep. Ben Ray Lujan lauded Cisneros’ status as a Navy veteran who is involved in education policy and called his campaign “formidable.”

The move is the latest signal that national Democrats are trying to get activists on the ground to pick a single candidate who can get through California’s tricky top-two primary, which advances the top two vote-getters, regardless of party. With six Democrats and seven Republicans on the ballot in June, national Democrats have long feared conditions will be so unpredictable they could be shut out of a crucial pickup opportunity.

This led national and state party leaders to privately pressure some of the Democrats to drop out of the race ahead of the candidate filing deadline last month.

A Democratic insider said Cisneros has consistently led in several private polls taken in the district.

The announcement does not amount to an official endorsement but could give Cisneros access to the organizational and fundraising support from the committee. It also opens up the possibility that the DCCC could spend funds before the primary to support Cisneros or attack one of his fellow Democrats, a tactic that was met with fierce criticism when the party used it in a Texas Democratic primary.

The contest in Royce’s district is ranked No. 1 on The Times’ list of the most competitive California House races.

Billionaire Democratic activist Tom Steyer endorses Kevin de León in his insurgent bid against Sen. Dianne Feinstein

Billionaire Democratic activist Tom Steyer is endorsing state Sen. Kevin de León in his insurgent challenge to Sen. Dianne Feinstein, and did not rule out funding an outside effort to boost De León’s chances.

“I think he’s the kind of young progressive that reflects California and would be a very strong advocate for our state nationally,” Steyer said in an interview on Tuesday, pointing to De León’s efforts on issues such as immigration, climate change and gun control while he was the state Senate leader. “I know him well and he’s a friend. We share a lot of values.”

Steyer, who flirted with running for the Senate seat, did not criticize Feinstein as he has in the past.

“Sen. Feinstein has been an outstanding public servant who has dedicated the bulk of her adult life to the service of our state and the country,” he said. “These are two strong, very good Democrats. I just believe Kevin is the true progressive and he reflects something we need representing California going forward. I have nothing bad to say about Dianne Feinstein. I have a lot of good to say about Kevin de León.”

De León faces enormous odds as he tries to oust Feinstein, who has served in the Senate for a quarter-century, is well known to the state’s voters and has daunting leads in polls and fundraising.

But De León has gained notable endorsements, most recently from the 2.1-million-member California Labor Federation last week.

Campaign finance reports released this week show that Feinstein has more than $10 million in the bank, while De León has just more than $670,000.

Feinstein, a multimillionaire and one of the wealthiest members of the Senate, has already lent her campaign $5 million and could easily write another check.

But Steyer, a billionaire former hedge fund manager, could write a larger one.

He is among the largest Democratic donors in the nation and has already committed more than $50 million to push for the impeachment of President Trump and to register young voters.

He was noncommittal when asked if he would fund an independent expenditure group on behalf of De León.

“I don’t have any concrete plans for that,” he said.

California’s largest pension fund sends next year’s invoice to state government: $6.3 billion

As part of a shift toward less optimistic expectations for investment returns to pay for government worker pensions, board members of the California Public Employees Retirement System voted Tuesday to require an almost $6.3-billion payment from the state budget in the fiscal year that begins on July 1.

The action, which could receive final approval on Wednesday, reflects a gradually higher annual contribution to public employee pensions by the state and from local governments across California. In 2016, CalPERS approved a half-percentage point decrease in its official estimate of the long-term investment return on its $353.3-billion portfolio. That shift was designed to happen over several years, in hopes it would lessen the financial shock of shifting more of the costs onto government employers. The highest costs are also, in part, a reflection of increases in the size of the state’s payroll.

The state’s CalPERS payment will be about $450 million more than the total paid in the current fiscal year and more than double what it was only a decade ago.

CalPERS board members voted on Tuesday’s staff proposal with little discussion, save for a question about the increase in contributions also required from workers hired after a pension overhaul that took effect in June.

“It seems like it will be a ding on people’s salaries,” said Theresa Taylor, the chairwoman of CalPERS’ finance committee and a member of SEIU Local 1000, the union that represents some 96,000 state employees.

The $6.299-billion payment required from California’s state government must now be factored into the budget crafted by the Legislature and signed into law by Gov. Jerry Brown in late June. Brown had already assumed a similarly sized payment in his budget proposal unveiled in January.

In February, a coalition representing city governments warned about the effects of rising pension costs under the expectations of less money from Wall Street investments. The report issued by the League of California Cities projected an average increase of more than 50% in annual pension payments made by the state’s largest cities over the next seven years.